Listen to our podcast 🎧

.png)

Introduction

The significance of risk scoring models is growing in fraud-heavy environments. Built for data-driven evaluation of events, these models provide proactive solutions against evolving fraud techniques.

However, with increasing operational volumes and growing expectations for instant transaction assessment from regulators, organizations worldwide struggle to maintain continuous oversight.

Several surveys indicate that continuous transaction monitoring can reduce fraud losses by up to 30%, a goal difficult to achieve through manual efforts alone.

In this context, automated systems capable of near-instant risk evaluation have become critical. Agentive AI leads the way by automating processes and decision-support steps, ensuring that high- and low-risk activities are continuously scored and filtered in real time.

Operational Risks of Non-Continuous Risk Scoring

Relying on static or manual risk scoring frameworks weakens a financial institution’s ability to react to fast-moving digital world threats. As transaction volumes and regulatory scrutiny rise, gaps in continuous monitoring expose organizations to risks, such as:

1. Missed High-Risk Events: Periodic evaluations, even weekly, leave long monitoring gaps. Fraudulent transactions or abnormal behaviours occurring between review cycles remain unnoticed, leading to avoidable financial risk.

2. Slower Risk Response: Manual or batch-based scoring introduces latency. When risk decisions depend on delayed data, responses to threats or suspicious activities become reactive instead of preventive.

3. Compliance Inconsistency: Frameworks such as PSD2 and AMLD6demand continuous monitoring. Relying on static scoring to meet these expectations only causes increasing audit exceptions and non- compliance.

4. Operational Inefficiency: Non-continuous systems limit scalability, increases workload, and forces analysts to waste time on repetitive tasks instead of investigating high-risk alerts.

5. Limited Insight into Emerging Threats: Static risk models capture only historical data. Without real-time input, institutions fail to detect evolving fraud tactics or hidden credit risks.

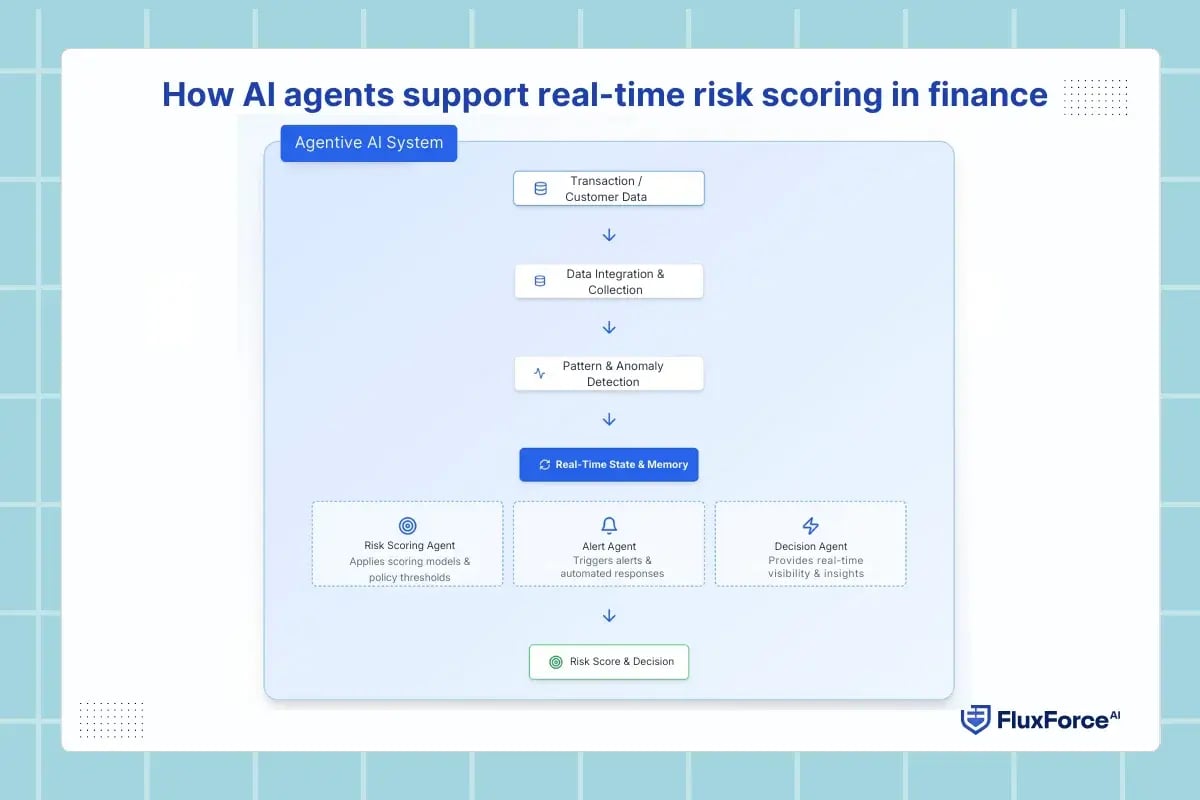

How AI agents support real-time risk scoring in finance

Agentive AI operates as a continuous intelligence layer that connects with financial data systems and 24/7 evaluates risk across every transaction and customer profile. With each step of the process, it contributes to faster and more accurate scoring decisions.

1. Comprehensive Data Integration and Analysis

Agentive AI links directly with banking cores, ERP modules, and payment gateways. It collects transaction records, loan histories, spending data, and customer behaviour patterns in real time. The system consolidates these inputs into a single stream for live evaluation, ensuring that every decision uses the most current data available.

2. Real-time Pattern and Anomaly Detection

After data is collected, the system analyses transactional trends to identify behaviours that deviate from normal patterns. It flags unusual fund transfers, abnormal repayment frequencies, or location-based anomalies that may indicate fraud, compliance violations, or credit risk.

3. Automated Risk Scoring

Agents apply risk rules, scoring models, and policy thresholds automatically. Each transaction or customer interaction receives a score based on its current and historical data. The scoring adjusts dynamically as new activity occurs, maintaining a real-time picture of exposure without manual recalculation.

4. Intelligent Alert and Response Direction

When the system detects high-risk activity, it sends immediate alerts to risk dashboards or triggers preconfigured actions. These may include holding a transaction, requesting identity verification, or escalating the event for human review. Automated flow even reduces the seconds of delay that happens between detection and response.

5. QuickDecision-Making

Through continuous analysis and scoring, Agentive AI provides risk teams with real-time visibility across operations. Loan approvals, transaction reviews, and fraud investigations are supported by continuously refreshed data, improving accuracy and response time.

6. Continuous Learning

Each processed event helps refine the AI’s understanding of evolving risk patterns. The system incorporates feedback from resolved cases, enhancing model accuracy and reducing false positives over time. This adaptive mechanism ensures that risk scoring keeps pace with changing financial behaviours and regulatory standards.

Agentic AI Risk-Scoring Applications in Finance

AI agents enable 24/7 financial risk monitoring with precision. Each application enhances risk intelligence and operational efficiency through autonomous and data-backed decision-making.

Credit Risk Assessment- Agentive AI evaluates creditworthiness through continuous data collection from payment history, spending behaviour, and account activity. Integrated real-time credit risk scoring model ensures accurate lending decisions and faster approvals.

Fraud Detection- Agents perform automated anomaly detection in banking risk systems. Continuous tracking of transfers and withdrawals allows instant identification of abnormal transactions before losses occur.

AML and Regulatory Compliance- Autonomous compliance monitoring keeps every transaction aligned with AMLD6 and BSA/AML standards. Real-time AML monitoring using agentive AI ensures proactive detection and documentation of suspicious activities.

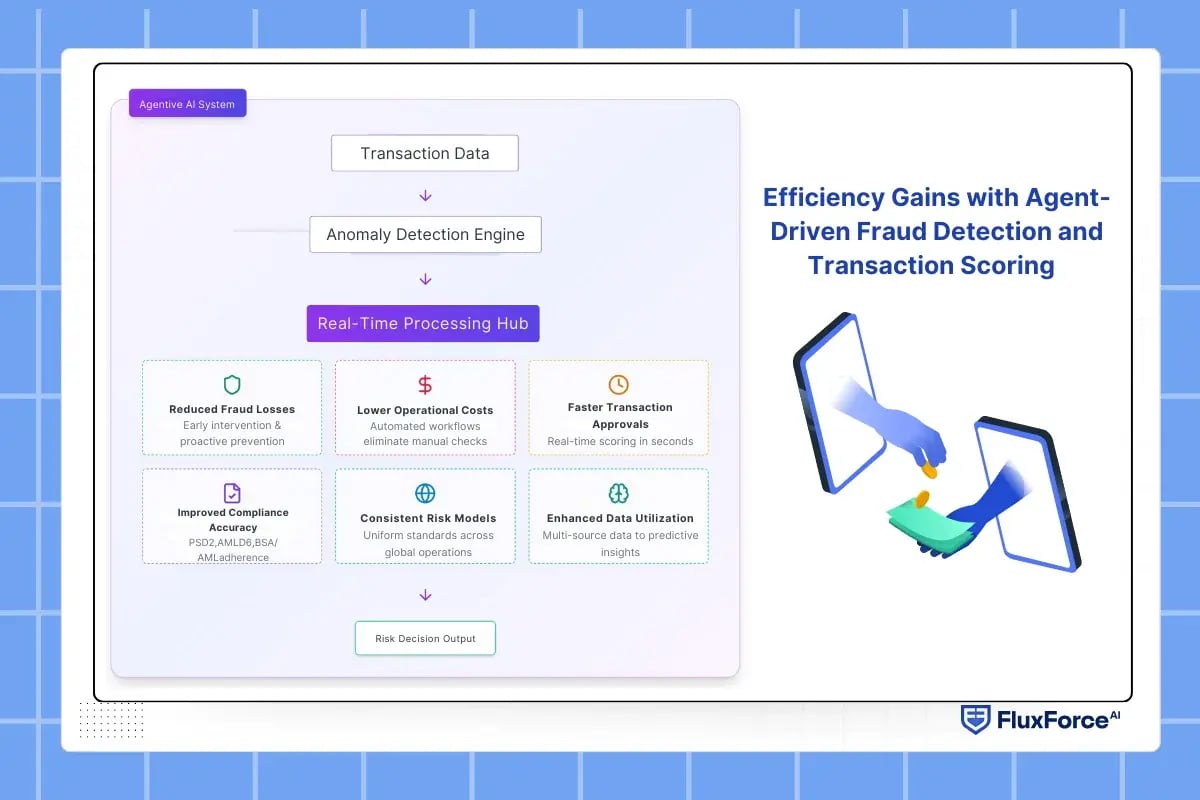

Efficiency Gains with Agent-Driven Fraud Detection and Transaction Scoring

Autonomous transaction scoring and anomaly detection engines deliver measurable efficiency gains across all operations.

Key benefits include:

1. Reduced Fraud Losses

Continuous monitoring identifies and isolates high-risk transactions before they cause financial loss. Agentive AI ensures early intervention, reducing exposure and enabling proactive fraud prevention.

2. Lower Operational Costs

Automated alerts, scoring, and decision workflowseliminate repetitive manual checks. This lowers analyst workload and operational costs while improving the precision and consistency of each review.

3. Faster Transaction Approvals

Real-time credit risk scoring completes evaluations in seconds, supporting instant approvals and seamless user experience without compromising accuracy or compliance standards.

4. Improved Compliance Accuracy

Autonomous decision intelligence for risk operationsmaintains continuous adherence to PSD2, AMLD6, and BSA/AML obligations, ensuring every transaction is verified under current regulatory frameworks.

5. Consistent Risk Models

Real-time risk assessment AImaintains uniform scoring standards across global operations, preventing regional discrepancies and enabling centralized visibility into enterprise-wide exposure.

6. Enhanced Data Utilization

AI-powered risk intelligence transforms complex, multi-source financial data into predictive insights. This strengthens digital payment security and supports advanced fraud-risk analytics across products and services.

Industry Use Cases of Agentive AI

.webp?width=1200&height=800&name=Industry%20Use%20Cases%20of%20Agentive%20AI%20(Practical%20Implementations).webp)

Agentive AI for banks supports real-time credit underwriting, continuous transaction monitoring, and predictive compliance management. Financial institutions such as JPMorgan Chase and HSBC are deploying AI-powered risk intelligence systems to manage global operations and minimize fraud exposure.

2. Insurance

Insurers use agentive AI risk scoring for claim verification and fraud-risk analytics. Companies such as AXA and Allianz employ autonomous decision models to detect false claims and evaluate customer risk profiles in real time.

3. High-Risk Trade Supply Chains

Agentive AI for fintech and trade networks supports continuous risk evaluation using autonomous AI. Platforms used by Maersk and DP World implement automated KYC/AML compliance and transaction scoring to secure global trade operations.

Conclusion

Continuous risk scoring has become a key compliance standard for acting against evolving fraud. For achieving 24/7 real-time evaluation, Agentive AI enables financial institutions to perform automated risk scoring with consistent accuracy and operational speed.

From real-time credit assessment to autonomous fraud detection, it provides forward-taking steps to organizations. Integrating agents into systems allows continuous monitoring of transactions and customer activities, ensuring that every action is recorded and evaluated against defined parameters. This approach supports ongoing compliance with regulatory requirements while maintaining transparency in decision-making.

Share this article