Fraud Detection & Anomaly Monitoring Agent

Prevent fraud before it spreads, with 89% detection accuracy and 0.1% false positives. Unlock AI-driven insights to support better business decisions and growth strategies with advanced anomaly monitoring.

for Compliance, Fraud Mitigation, and Financial Automation

YouYour teams face constant pressure — fraud spikes, audit deadlines, cross-border compliance, identity risk, API exposure. FluxForce AI Agents give you secure, explainable, and auditable automation for every critical workflow.

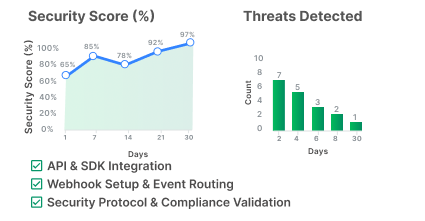

Security Anchors:

Prevent fraud before it spreads, with 89% detection accuracy and 0.1% false positives. Unlock AI-driven insights to support better business decisions and growth strategies with advanced anomaly monitoring.

One agent. 50+ global frameworks. Zero audit panic. Automate regulatory processes, AML monitoring, and audit management to drive higher efficiency and reduce risk.

Secure every session, every layer. Zero trust, zero assumptions.

Ensure system reliability with zero trust architecture, monitoring, and incident resolution.

Liveness, OCR, and KYC — in seconds, not days. Automate identity verification, biometric authentication, and employee management to improve efficiency.

PCI DSS-ready, tokenized, encrypted — enable faster secure payment processing. Enable faster, more secure payment processing with secure gateway management and critical transaction protection.

Address regulated sector challenges like secure onboarding, payment monitoring, and API integrations with prebuilt modules.

Learn MoreZero trust modules reduce attacks by 95% and automate KYC for faster onboarding.

Secure payment gateways, fraud detection, and rapid onboarding for fintech customers.

Automated claims processing and AI-powered risk analysis to reduce fraud.

End-to-end visibility and AI-driven logistics optimization for smarter delivery.

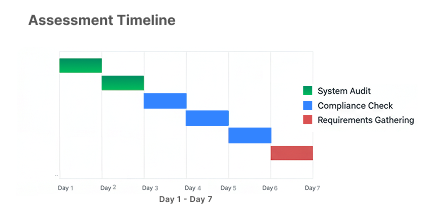

Streamlined process from assessment to optimization,

completed in 30–90 days

Days 1–7

Comprehensive evaluation of your current systems through detailed discovery calls. We analyze infrastructure and compliance requirements.

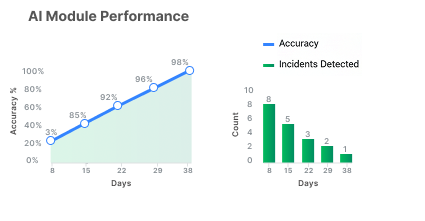

Days 8–38

30-day controlled implementation to validate AI module performance in your environment with real-world testing.

Days 39 – 75

Seamless integration using APIs, SDKs, or webhooks customized for your existing infrastructure while maintaining security.

Days 76–90+

Continuous performance monitoring with model retraining. Ongoing optimization ensures peak efficiency.

Days 10–35

Deliver end-to-end security governance through Zero Trust verification, leveraging OSINT for robust monitoring, enforcing fair AI standards, capturing comprehensive audit logs, and tracking model drift to maintain reliability and compliance.

Targeted advantages for security, compliance,

and operations in

regulated industries.

Zero trust tools reduce attack risks and enable continuous monitoring across all systems.

Automated audits, reporting, and regulatory mapping across 50 frameworks.

Secure DevSecOps pipelines accelerate builds without compromising security.

Streamlined automation for lending, payments, and claims processing.

Easily implement FluxForce AI Agents across your enterprise systems to automate audits, compliance, and financial operations with intelligence.

Keep up with the latest AI trends, insights, and conversations.

Read Insights

January 6, 2026

January 6, 2026

January 5, 2026

Take the First Step Toward Efficiency

Modernize your financial workflows with explainable, secure AI — deployed in weeks, not years.