Listen to our podcast 🎧

Introduction

Every insurance company today is trying to balance two important goals: protecting customer data and proving their systems can handle digital risks. GDPR focuses on how personal data is collected and stored, while DORA (Digital Operational Resilience Act) makes sure insurers can keep running smoothly even during cyberattacks or system outages.

For most compliance teams, that means handling two large sets of rules, strict deadlines, and a single question — how to stay compliant without slowing down everyday operations?

This is where Agentic AI in insurance is making a difference. Instead of using different tools for risk, privacy, and compliance, insurers are now adopting one AI-powered system that combines both GDPR and DORA compliance automation.

These Agentic AI modules go beyond simple automation. They can watch systems, analyze activities, and take action automatically. They check policies, monitor risks, and keep audit records updated in real time. The outcome is a continuously managed setup where data security, resilience, and compliance work together.

A June 2024 Deloitte survey of 200 U.S. insurance executives found 76 % had implemented generative AI in at least one business function. What’s changing is not only the tools used, but who is doing the work. Intelligent AI systems are now handling repetitive compliance checks, catching issues faster and more accurately than manual reviews.

For insurers aiming to grow digitally without facing regulatory roadblocks, Agentic AI provides a clear and reliable path forward — one that supports compliance, improves efficiency, and builds stronger trust with both regulators and customers.

How insurers are moving from AI pilots to real compliance results ?

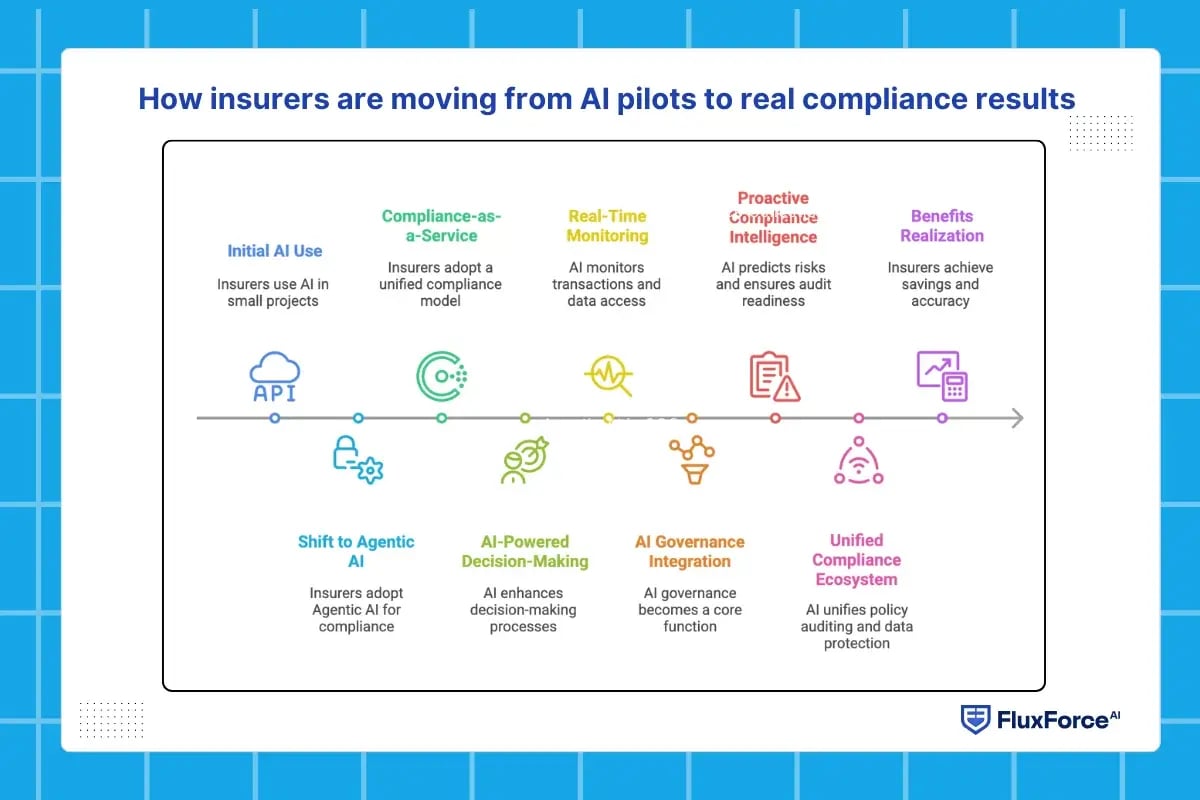

For years, most insurers used AI only in small projects like claim automation or fraud detection. These tests helped, but they didn’t solve the bigger challenge of managing complex regulations. Now, many companies are shifting toward Agentic AI in insurance to bring DORA compliance automation and GDPR compliance automation together in one place.

Instead of running different systems for risk, privacy, and resilience, insurers are adopting a compliance-as-a-service model built on AI governance frameworks. This connected approach helps risk, IT, and compliance teams work from the same data environment, cutting down duplication and manual effort.

How insurers are scaling compliance agility

Regulations like DORA focus on digital operational resilience, while GDPR demands strict data privacy control. Managing both manually can slow operations and raise costs. With AI-powered decision-making and insurance workflow automation, insurers can detect compliance gaps early, respond faster, and maintain accurate audit trails automatically.

For example, Agentic AI modules monitor transactions, data access, and user activity in real time. If the system finds any irregularity, it instantly alerts compliance officers or triggers automated corrections. This helps maintain continuous oversight and reduces the time spent on manual reviews.

From experimentation to continuous compliance

Today, AI governance in insurance is becoming a core business function rather than a pilot project. These intelligent modules learn from past compliance data, predict potential risks, and help teams stay audit-ready throughout the year.

The shift is clear. Insurers are moving from reactive reviews to proactive compliance intelligence. By using AI-driven regulatory controls, they can now unify policy auditing, data protection, and cybersecurity within one connected ecosystem.

The benefits go beyond faster reporting. With improved accuracy and fewer human errors, companies are seeing real savings through intelligent process automation (IPA) and scalable AI systems that adjust to new regulations automatically.

How agentic AI works across insurance operations ?

From fragmented tools to a living compliance system

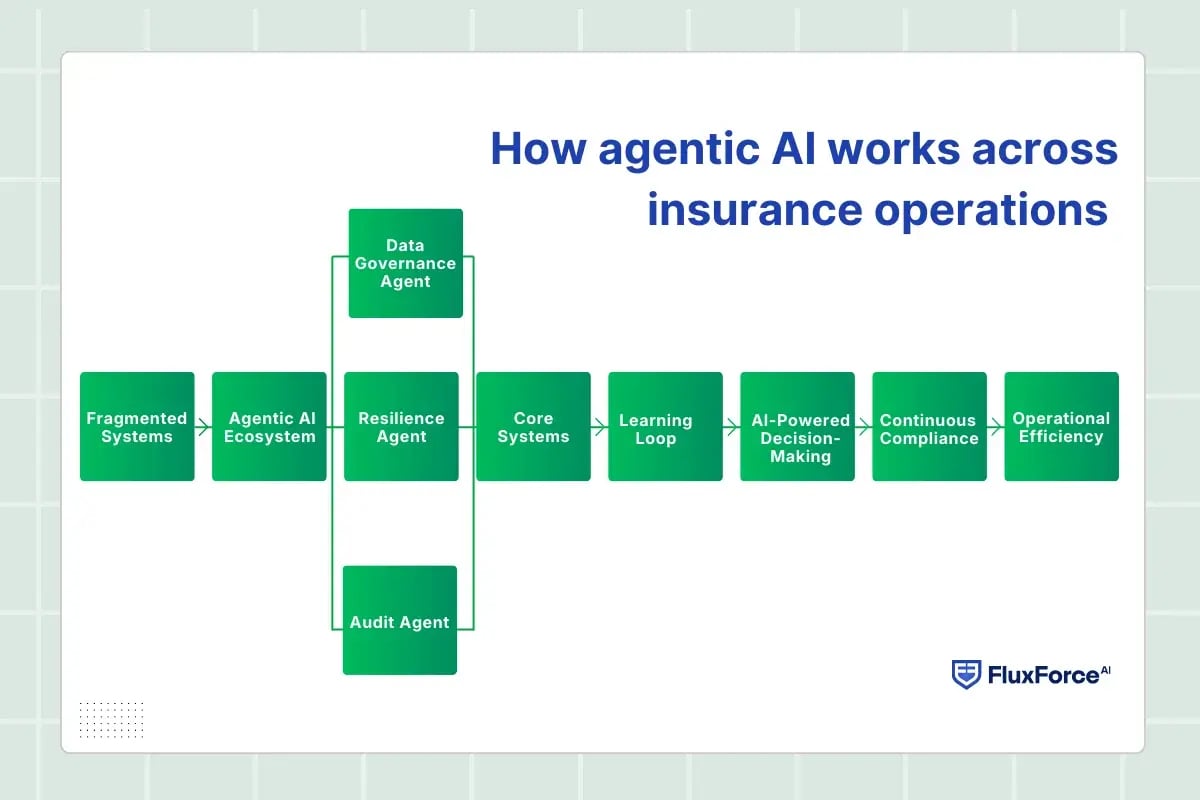

Most insurers today rely on a patchwork of systems for audits, risk checks, and data monitoring. These tools rarely talk to each other, which means compliance officers spend hours reconciling reports or chasing manual validations. This fragmentation is where Agentic AI in insurance shows its real strength.

Instead of functioning as a single tool, it behaves like an ecosystem of intelligent modules that coordinate across departments. One module watches GDPR compliance automation, another handles DORA resilience controls, and a third monitors internal audit trails. Together, they maintain a constant line of defense.

How the stack works inside an insurance firm

Inside a typical insurer’s environment, Agentic AI modules plug into existing core systems — claims, underwriting, CRM, and data warehouses using secure connectors. Each module has a specific role.

- Data Governance Agent: Tracks how personal and policyholder data moves across systems and ensures it follows GDPR privacy rules.

- Resilience Agent: Continuously tests backup systems and incident response processes for DORA compliance.

- Audit Agent: Maintains version-controlled regulatory records that are ready for inspection at any time.

These agents exchange information in real time, so if the resilience agent detects a delayed recovery system, it can alert the data governance agent to trigger a secondary control. This orchestration removes the silos between IT and compliance, creating a unified regulatory AI stack that operates 24/7.

Agentic AI builds a learning loop around them. Every compliance event — from a flagged privacy breach to a successful audit test — feeds into a shared memory system. Over time, the AI learns what patterns signal early warning signs, such as rising response times or recurring policy gaps.

This capability is where AI-powered decision-making and insurance risk management AI merge. Instead of waiting for a compliance officer to review data, the system can recommend or execute next steps on its own. It also helps build trust and transparency in AI governance, as every action leaves an audit trail that regulators can verify.

Why this matters operationally ?

For insurers, this means compliance becomes a continuous process, not a quarterly project. Teams no longer scramble before audits or stress over regulatory updates because Agentic AI automation keeps the system in sync with the latest EU data governance standards.

This not only reduces operational strain but also builds long-term efficiency. The more data these modules process, the better they get at spotting irregularities and preventing compliance failures before they happen.

The business impact – From manual burden to measurable ROI

.webp?width=1200&height=800&name=How%20insurers%20are%20moving%20from%20AI%20pilots%20to%20real%20compliance%20results%20(2).webp)

For years, insurers have treated compliance as a cost center — something that protects the business but rarely adds value. However, the landscape has shifted. Regulations like GDPR and DORA now demand round-the-clock proof of resilience and data control.

This is where Agentic AI in insurance steps in. It turns compliance into a performance advantage. Instead of spending weeks preparing for audits or managing spreadsheets, teams now rely on GDPR compliance automation and DORA compliance automation systems that track everything in real time.

The result is a smoother operation where compliance tasks run quietly in the background, freeing skilled professionals to focus on risk strategy, underwriting, or customer engagement.

How Agentic AI translates into real ROI ?

The financial impact of Agentic AI modules becomes clear when you look at where insurers lose time and money today. Most compliance delays come from repetitive reporting, inconsistent documentation, and human error. By automating these steps through intelligent process automation (IPA) and AI workflow automation, companies can drastically reduce overhead costs.

Some insurers using AI governance in insurance report:

- Faster turnaround during audits with automated audit trail tracking

- A 30–40% reduction in compliance review time

- Better visibility across departments with unified regulatory AI stacks

When compliance runs itself, leaders can redirect talent toward innovation, customer analytics, or new product design.

Building a trust-ready compliance culture with agentic AI

Executives in insurance know that GDPR and DORA are two moving systems that constantly evolve. The challenge isn’t compliance itself but keeping pace without slowing down decision-making or risking data exposure.

This is where Agentic AI changes the operating rhythm of compliance. Instead of adding another tool, it builds a living control layer around the insurer’s existing systems. That layer connects data flows, risk triggers, and audit trails across every function.

Here’s what that means in practice:

- Instant risk visibility. When a policyholder’s data moves, the AI tracks it, validates it, and records compliance evidence automatically.

- Faster remediation. If a system vulnerability appears, the same AI can initiate DORA-aligned resilience checks or trigger recovery sequences without manual input.

- Continuous assurance. Leadership sees compliance status in real time instead of waiting for audit cycles or incident reports.

This unified structure turns compliance from a reactive department into a live feedback system that improves both resilience and decision quality.

Conclusion

Agentic AI shows that GDPR and DORA compliance don’t have to compete for attention. When combined in one AI-driven framework, both can work together to create stronger digital trust and operational stability. This shift helps insurers focus on improving customer experiences while AI quietly manages the complexity in the background. It’s a smarter, faster way to meet evolving regulations and a clear sign that compliance can now drive value, not limit it.

Share this article