Listen to our podcast 🎧

Introduction

Why do so many digital banks still lose customers during onboarding even after investing in advanced KYC tools? The main reason is weak digital identity proofing and outdated verification systems.

Identity fraud, long verification steps, and strict regulations are creating serious pressure on banks. A recent report found that 67% of banks lost clients because of slow or inefficient KYC onboarding.

Another study from LSEG shows that 15% to 80% of users drop out during the digital identity verification stage.

These are not just customer experience issues. Most banks still depend on manual checks and disconnected systems that are not built for digital scale. Problems like data silos in banking AI, fragmented workflow automation, and old know your customer processes make onboarding slower and less reliable. These gaps lead to higher compliance costs and lower conversion rates.

Fraud tactics are also becoming more advanced. Cases involving fake or synthetic identities are increasing across digital channels. LSEG’s 2025 fraud report highlights a sharp rise in these threats, which means banks now need identity proofing that looks beyond just document verification.

This is where digital identity proofing comes in. It brings together biometric verification in banking, customer identity authentication, and real-time data validation across systems. It supports identity verification for banks and helps build faster, safer, and more compliant digital banking onboarding processes.

For onboarding leaders, the goal now is not just to check identities but to prove them in depth. Embedding proofing directly into every onboarding step is the foundation of a modern KYC AML strategy that can handle both scale and security.

How digital identity proofing

strengthens KYC and AML ?

Digital banks today need more than just compliance checklists. They need a KYC and AML framework that prevents fraud, speeds up onboarding, and keeps regulators satisfied. Digital identity proofing makes this possible by linking every step of the customer onboarding verification process to real-time identity intelligence.

Moving from manual reviews to automated proofing

Most banks still rely on manual identity checks that take hours or even days to complete. These methods often lead to errors and slow customer approval. With onboarding automation in banking, digital identity proofing replaces these steps with AI-driven workflows.

For example, biometric verification in banking confirms a customer’s face or fingerprint within seconds. At the same time, eKYC solutions for digital banks match identity data across trusted databases and flag inconsistencies automatically. This not only reduces fraud but also ensures full AML compliance in digital banking.

Making compliance smarter and more transparent

Traditional KYC systems often create compliance silos that make audit trails hard to maintain. Digital identity proofing builds a unified, traceable process. It gives compliance teams an instant view of every identity check, approval, and risk flag in one place.

Modern regtech for banking compliance tools now embed this transparency into their platforms, offering risk-based KYC processes that adjust checks according to customer risk profiles. This reduces manual review efforts and improves accuracy.

In short, digital identity proofing is reshaping how banks approach know your customer processes and anti-money laundering frameworks. It creates a system where compliance and customer experience work together instead of against each other.

How digital identity proofing integrates into KYC and AML systems?

Understanding the core workflow

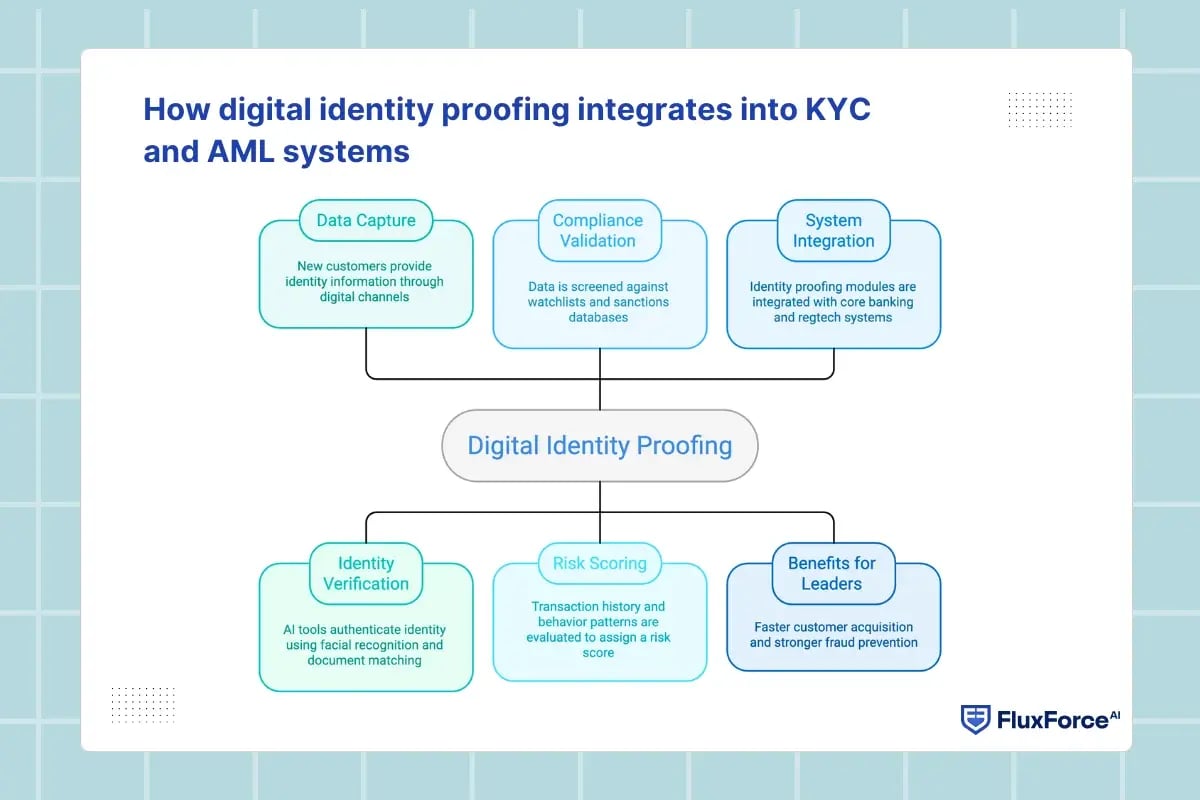

In digital banking onboarding, digital identity proofing is not a single step — it’s an integrated process that connects data capture, identity verification, and compliance validation in real time. The workflow starts when a new customer provides identity information through an app or web portal. APIs then connect this data to eKYC solutions for digital banks, pulling records from trusted sources such as government IDs, credit bureaus, and biometric databases.

Data validation and risk scoring

Once data is captured, AI-driven verification tools authenticate the identity using facial recognition, liveness detection, and document matching. These tools ensure that the person behind the device is the same as the one on the ID. The verified data is then sent through AML compliance frameworks where it is screened against watchlists, sanctions databases, and politically exposed person (PEP) lists. Risk-based KYC processes evaluate transaction history, behavior patterns, and device intelligence to assign a risk score.

Integration with core banking and regtech systems

Modern banks integrate these identity proofing modules directly with their core banking systems and regtech platforms. Through onboarding automation in banking, data moves securely between systems, eliminating manual reviews and reducing onboarding time from days to minutes. Audit trails and automated reports help compliance teams meet AML and KYC regulatory obligations without adding operational overhead.

Why this matters for leaders ?

For heads of customer onboarding and compliance, this integration delivers two outcomes: faster customer acquisition and stronger fraud prevention. Instead of relying on siloed verification tools, digital identity proofing builds a unified identity verification framework for banks that improves accuracy, compliance, and customer trust simultaneously.

What’s holding banks back from a strong KYC and AML framework ?

If banks already use modern verification tools, why are compliance delays and audit gaps still common?

The issue often isn’t the technology itself, but how disconnected systems work together inside the organization.

Fragmented systems create blind spots

In many digital banks, KYC and AML processes run separately. One system manages customer identity authentication, while another handles transaction screening.

This separation leads to missed alerts, duplicated work, and incomplete audit trails. Without a unified view, teams struggle to identify risks across the customer lifecycle and meet new compliance expectations.

Manual reviews slow everything down

Compliance analysts still spend hours reviewing low-risk cases that could easily be automated. This manual approach increases errors and wastes valuable time. Modern RegTech for banking compliance can automate up to 70 percent of these tasks if it’s implemented effectively.

Compliance and customer experience remain misaligned

Many onboarding leaders see compliance as a barrier to customer growth. In reality, it should be part of the customer experience.

Digital identity proofing enables faster and safer onboarding without compromising accuracy. Customers expect real-time approvals, while compliance teams need confidence that every verification meets AML requirements. Both goals can be achieved together with the right framework.

Limited use of data and analytics

Fraud is becoming more subtle, and static rules often fail to catch it in time.

Using predictive analytics for financial services, banks can detect unusual patterns early and flag potential issues before they escalate. Unfortunately, many institutions still rely on rule-based alerts instead of dynamic analytics that evolve with risk behavior.

Effective digital identity proofing for KYC/AML in digital banking

and find the best fit for your bank.

Strategic Cloud Adoption Approach for CTOs

Cloud adoption strategies must align with enterprise priorities, compliance requirements, and digital transformation objectives. A strategic approach ensures scalability, operational efficiency, and regulatory adherence.

Hybrid and Multi-Cloud Deployment

Hybrid cloud models keep sensitive workloads on private infrastructure while offloading scalable services to public clouds. Multi-cloud strategies reduce vendor dependency and improve resilience. Core banking on cloud ensures critical services remain available while allowing flexible scaling for high-demand operations.

Regulatory Compliance and Data Management

Cloud-native systems must meet regulatory requirements. Cloud regulatory compliance (Banking) ensures proper data handling, audit readiness, and secure reporting. Integrated compliance features reduce operational risk and align modernization efforts with legal obligations, supporting overall core banking system reliability.

Integration with Existing Core Solutions

During modernization, legacy banking core solutions often remain active. Cloud-native systems integrate with these via APIs, messaging platforms, or event buses. This ensures transactional consistency while allowing gradual migration to cloud core banking systems without disrupting ongoing operations.

Implementation Roadmap for Transaction Processing Modernization

A structured roadmap guides C-level executives through transaction processing modernization, minimizing risk and ensuring measurable improvements in efficiency and scalability. Below is a four-step effective guide:

1. Assessing Core Banking Components

Evaluate existing core banking system modules to identify areas with high impact. Focus on high-volume services, regulatory-critical workflows, and modules supporting digital banking. Clear prioritization ensures modernization delivers tangible improvements in efficiency, performance, and scalability.

2. Pilot Deployment

Deploy cloud-native modules in controlled environments to validate performance, resource allocation, and orchestration. Pilots allow banks to refine digital core banking migration strategies before full enterprise rollout, minimizing disruptions while ensuring operational reliability.

3. Phased Enterprise Rollout

Critical modules such as payments, settlements, and account management migrate first. Gradual deployment reduces operational risk and allows monitoring of performance metrics. Continuous assessment ensures that cloud core banking system operations maintain expected efficiency and reliability.

4. Continuous Optimization

Cloud-native systems improve continuously through monitoring and iterative adjustments. Banking workload orchestration dynamically allocates resources based on demand. Updates occur without downtime, while performance, latency, and throughput metrics guide further optimization. This approach maintains system resilience and operational stability.

Measuring Success in Core Banking Modernization

Measuring success ensures cloud-native banking systems deliver expected outcomes.

Key metrics to measure:

Transaction Throughput and Latency

Track the number of transactions processed per second and measure latency. Cloud-native systems should handle high volumes efficiently. Reduced processing delays improve service quality, operational performance, and customer satisfaction.

Operational Efficiency

Monitor uptime, error frequency, and resource utilization. Cloud core banking systems reduce manual interventions, simplify maintenance, and lower operational costs while supporting banking technology modernization initiatives.

Digital Product Delivery

Measure the time taken to launch new services. Cloud-based core banking enables rapid deployment of digital features and APIs. Faster delivery allows banks to respond effectively to evolving customer and market needs.

Risk and Compliance Metrics

Monitor adherence to regulatory standards and audit readiness. Cloud-native monitoring provides visibility into workflows. Operational risks decrease, ensuring cloud regulatory compliance (Banking) and reliable processing of all transactions.

Building a practical KYC and AML Strategy for digital banking leaders

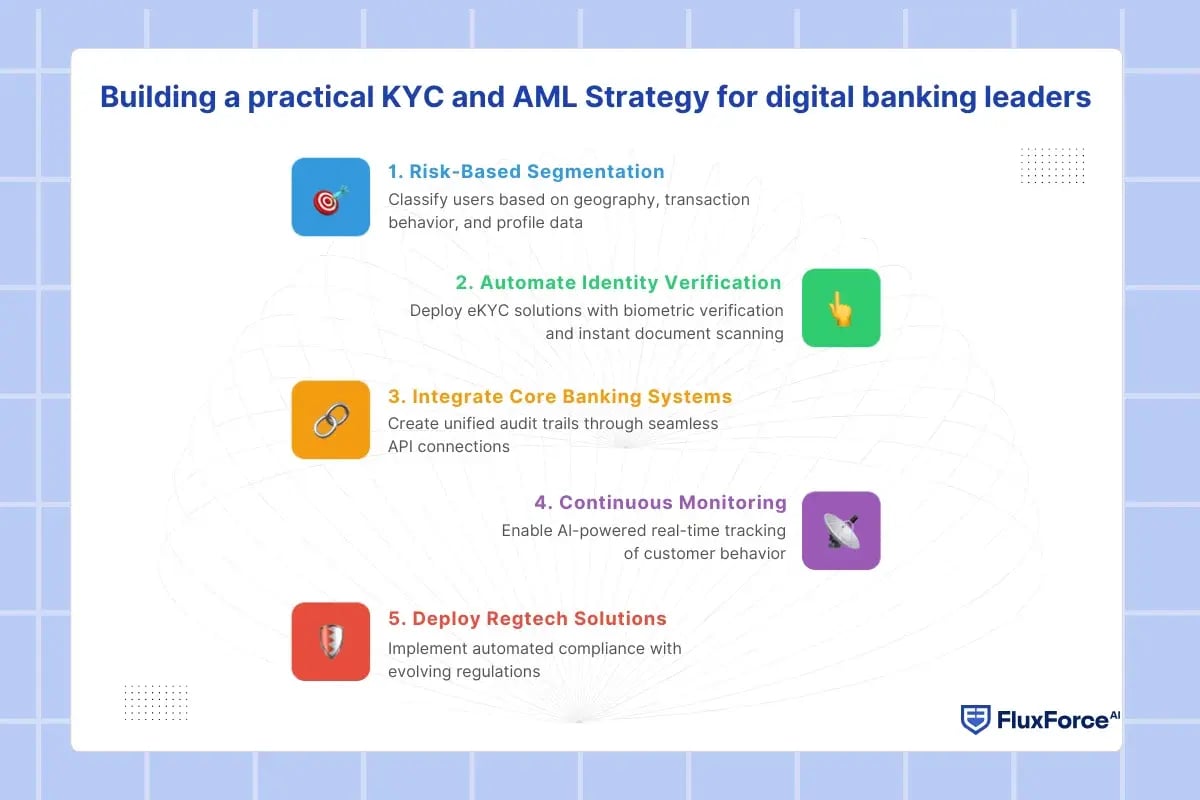

For heads of customer onboarding, the challenge is clear: how can you maintain strict AML compliance in digital banking without slowing down customer acquisition? The solution lies in building a strategy that combines automation, intelligence, and transparency across every step of the onboarding process.

Start with risk-based segmentation

The first step is to use a risk-based KYC process that classifies users based on geography, transaction behavior, and profile data. This approach helps allocate compliance resources where they matter most and ensures high-risk clients receive deeper identity checks.

Automate identity verification at the core

Manual verification slows down onboarding and creates inconsistency. By adopting onboarding automation in banking, institutions can run instant checks through eKYC solutions for digital banks. These systems use biometric verification, government database validation, and document scanning to confirm identity within seconds, ensuring both speed and accuracy.

Integrate compliance with core banking systems

A strong KYC AML strategy requires seamless data exchange between onboarding, compliance, and core banking platforms. APIs connect these systems to create a unified audit trail that regulators can easily review. This integration reduces errors and improves accountability across teams.

Adopt continuous monitoring instead of static checks

Traditional onboarding treats KYC as a one-time step. Modern digital identity proofing enables continuous monitoring, where AI tools track customer behavior over time to identify suspicious changes. This real-time oversight reduces manual re-verification and strengthens long-term AML frameworks.

Use Regtech for proactive compliance

Regulations evolve faster than most banks can adapt. Implementing regtech for banking compliance ensures policies are updated automatically and aligned with local and global standards.

Effective digital identity proofing for KYC/AML in digital banking

Enhance onboarding efficiency and security

Conclusion

For heads of onboarding, the real opportunity lies in transforming compliance from a checklist into a continuous intelligence system. Traditional KYC methods verify once but modern digital identity proofing verifies continuously as behavior, data, and risk evolve.

That’s where the next stage of AML strategy is heading toward predictive models that not only detect fraud but also anticipate it. Leaders who act early can reduce investigation time, lower operational costs, and build a more resilient compliance posture.

In the next few years, digital identity proofing will determine who wins in the digital banking race. Banks that can combine automation, AI-driven verification, and transparent governance will onboard faster, comply better, and retain more customers with less risk.

Share this article