Listen to our podcast 🎧

Introduction

Real-time payments now account for over 195 billion transactions globally per year, with the network processing payments in under 10 seconds. However, the increasing speed also leaves a narrow window for detecting fraud. Traditional rule-based systems, which often take hours to flag suspicious activity, seem completely outdated for 2026.

Meanwhile, leveraging agentic AI for fraud detection is proving to be highly effective. With autonomous fraud detection solutions making decisions in milliseconds, banks and fintechs can detect unusual patterns and block fraudulent transactions immediately.

This playbook outlines future-ready strategies for applying agentic AI in real-time payments, showing how different intelligent models work together to maintain secure, compliant payment processes.

The Challenge of Fraud in Real-Time Payments

Fraud in real-time payments has grown increasingly sophisticated. Instant settlements allow fraudsters to execute multiple rapid transactions before traditional systems can react. In 2025, Several types of fraud emerge across the financial sector. Some of the most common ones are identity theft, account takeover, synthetic accounts, and cross-border transaction manipulation.

Banks and fintechs face three main challenges in combating this type of fraud:

- High transaction volumes: Real-time payment networks handle thousands of transactions per second. Traditional systems cannot scale efficiently without slowing processing speeds.

- Complex, evolving fraud patterns: Fraudsters now use behavioural techniques that evade simple rule-based monitoring. Rapid micro-transactions, network hopping, and collusive attacks make detection difficult.

- Regulatory pressures: Institutions must maintain AML compliance, ISO 20022 fraud analysis AI standards, and FedNow fraud detection strategy alignment while ensuring transactions remain seamless for customers.

Without robust AI-powered systems, the risk includes financial losses, reputational damage, regulatory penalties, and customer attrition.

How Agentic AI Will Enhance Fraud Detection in 2026

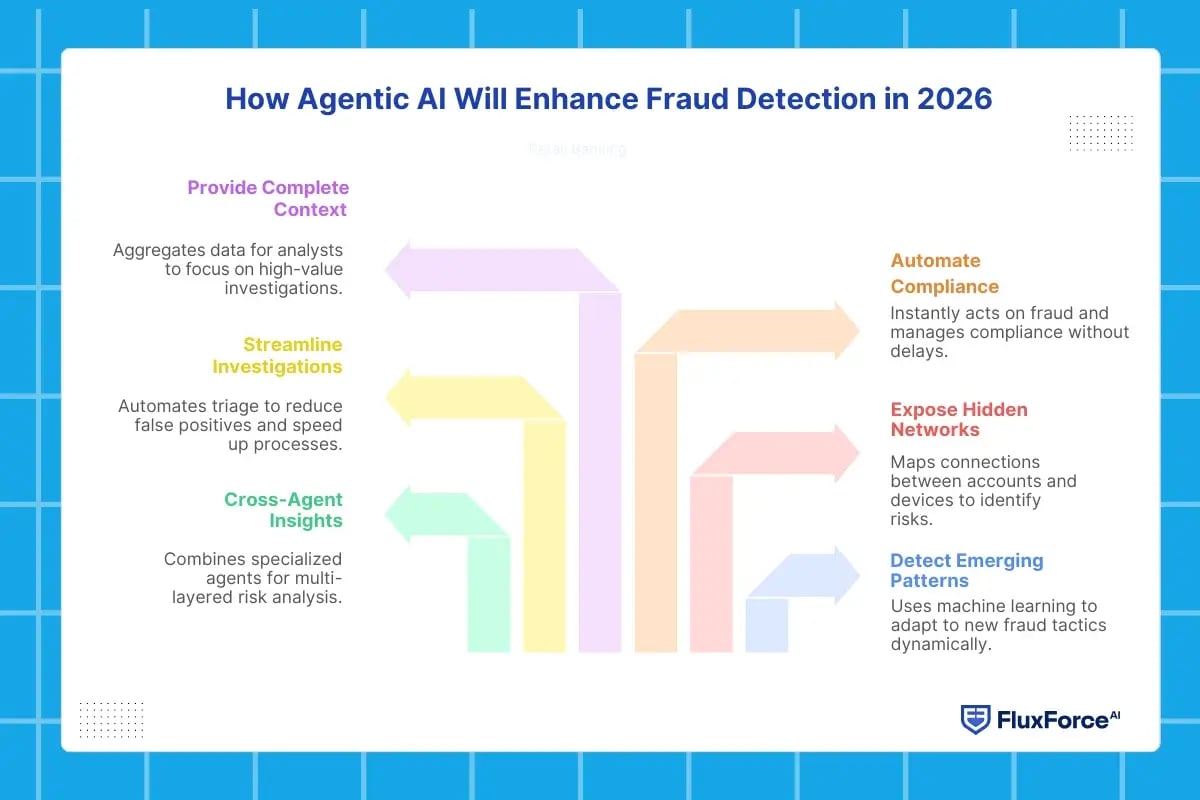

In 2026, Agentic AI will collaborate with several dedicated agents to enhance fraud detection in real-time payment networks. With improved adaptive strength and autonomous decision-making capabilities, these systems will continuously monitor transactions, detect unusual patterns, and respond to potential threats without delaying payment processing.

Key enhancements include:

1. Detecting Emerging Fraud Patterns Instantly

Dedicated monitoring agents will continuously analyse transaction streams using machine learning engines and behavioural analytics models. These agents detect new fraud patterns as they emerge, adapting their detection thresholds dynamically to respond to evolving tactics without human intervention.

2. Cross-Agent Insights for Multi-Layered Risk Analysis

Multiple specialized agents will operate in tandem: a transaction analysis agent examines payment flows, a user behaviour agent monitors account activity, and a correlation agent aggregates outputs to identify potential risks. The combination of these agents creates a multi-layered intelligence network for dynamic threat assessment.

3. Exposing Hidden Networks Across Accounts and Devices

Graph-analysis agents work alongside risk-scoring engines to map connections between accounts, devices, and entities. By combining advanced algorithms with agentic monitoring, these systems can highlight hidden relationships, assess risk levels, and provide investigators with actionable insights.

4. Streamlining Investigations While Reducing False Positives

Investigation agents coordinate with initial-analysis and anomaly-detection agents to automate the triage of suspicious transactions. This combination reduces false positives and accelerates investigative workflows, converting tasks that previously took hours into processes completed in minutes.

5. Automating Compliance Decisions Without Payment Delays

Response agents are integrated with compliance and AML monitoring engines to act on detected fraud instantly. They can block or flag transactions autonomously and manage routine compliance reviews, ensuring efficiency and audit readiness without impacting legitimate payments.

6. Providing Analysts Complete Context for Complex Cases

Collaboration agents aggregate outputs from monitoring, correlation, and response agents to provide human analysts with complete context and evidence. This enables analysts to focus on high-value investigations, improving decision-making, and maintaining regulatory compliance.

Real-World Projections for Agentic AI in Fraud Detection

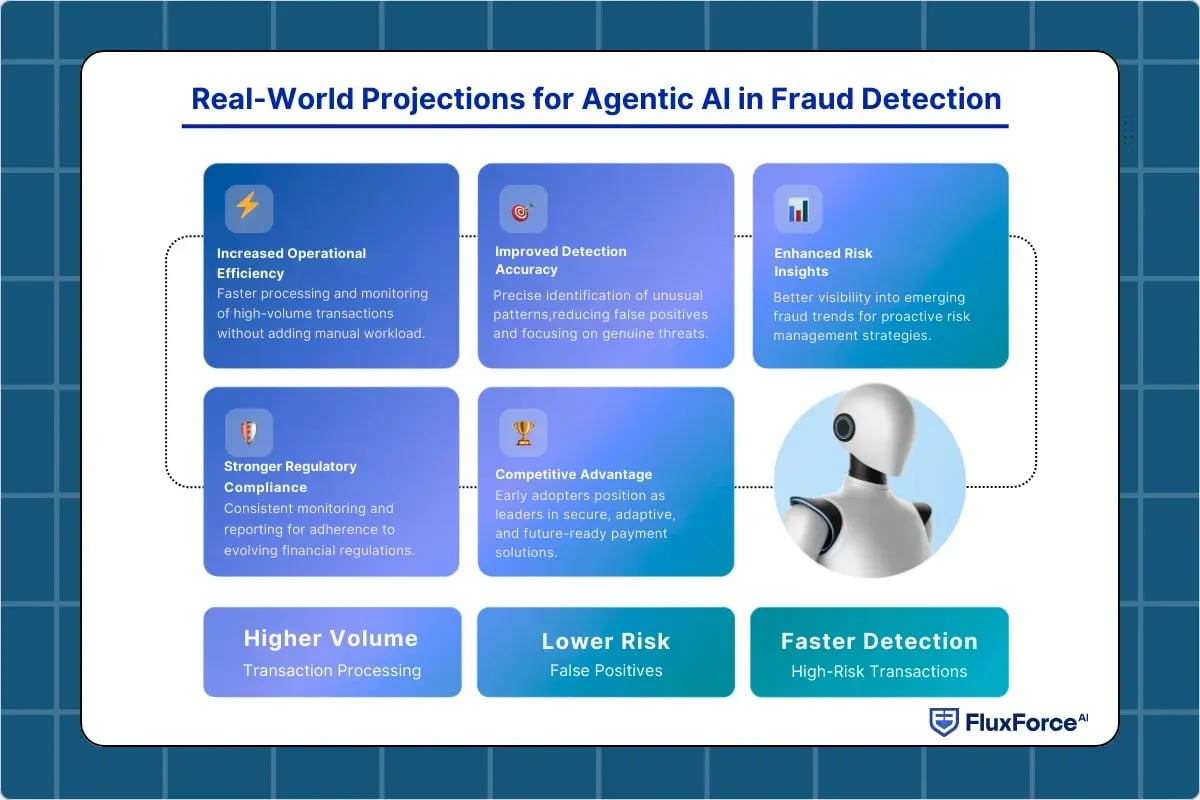

Leading financial institutions, including HSBC, JPMorgan, and Standard Chartered, are investing in Agentic AI to modernize fraud detection. By 2026, organizations can experience steady growth in payment efficiency, faster identification of high-risk transactions, and a significant reduction in suspicious activity.

Key projections include:

- Increased Operational Efficiency: Agentic AI will enable faster processing and monitoring of transactions, helping institutions manage higher volumes without adding manual workload.

- Improved Fraud Detection Accuracy: Banks are expected to see more precise identification of unusual patterns, reducing false positives and focusing attention on genuine threats.

- Enhanced Risk Insights: AI-driven analytics will provide better visibility into emerging fraud trends, allowing proactive adjustments to risk management strategies.

- Stronger Regulatory Compliance: By supporting consistent monitoring and reporting, Agentic AI helps institutions maintain adherence to evolving financial regulations.

- Competitive Advantage and Innovation: Organizations that adopt these technologies early are likely to position themselves as leaders in secure, adaptive, and future-ready payment solutions.

Best Practices for Leveraging Agentic AI in 2026 or Beyond

Implementing proven approaches enhances decision-making and reliability, supporting both system efficiency and long-term sustainability in complex fraud detection environments.

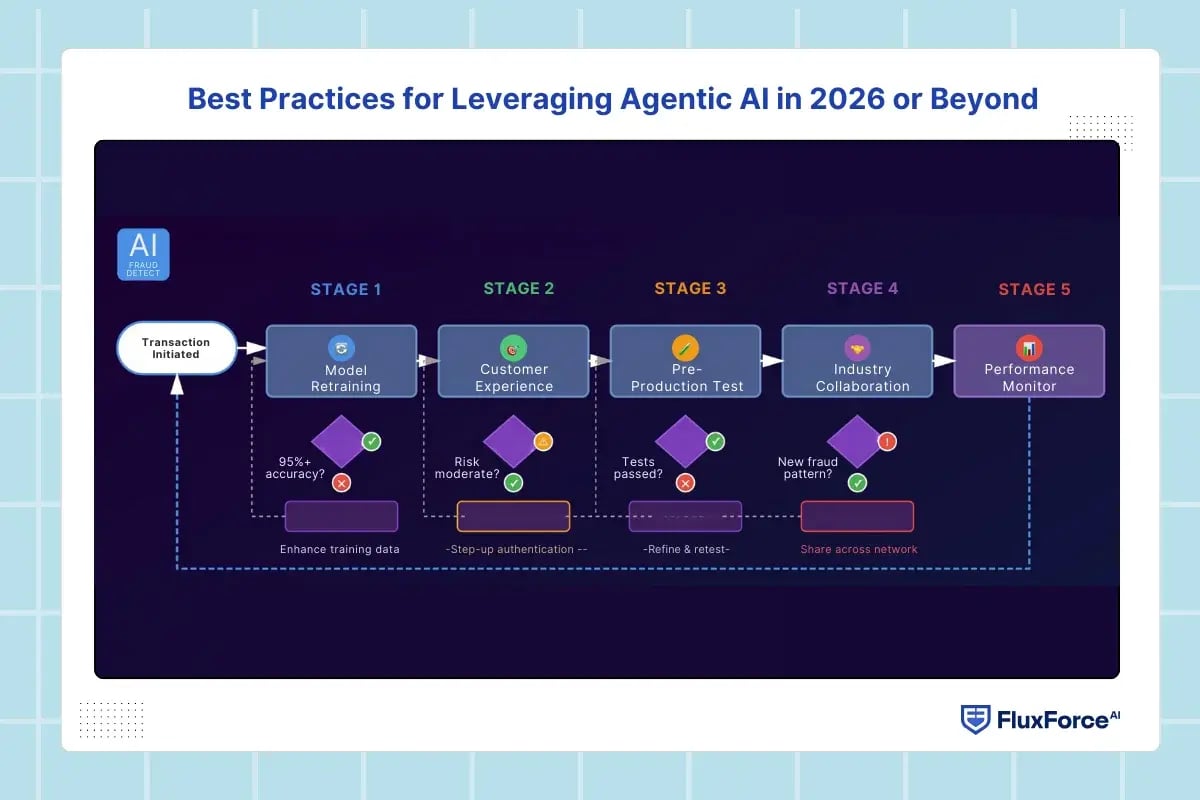

1. Model Retraining Protocols

Banking fraud detection using agentic AI requires periodic or continuous model updates. Fraud tactics change monthly, so models trained on older patterns or rules become less effective. Leading institutions retrain models weekly, incorporating new mechanisms into training datasets. Weekly feedback loops keep detection accuracy above 95%.

2. Customer Experience Optimization

Ensuring real-time transaction security using autonomous agents should not compromise customer experience. Setting thresholds too conservatively results in blocking of legitimate transactions, driving customers to competitors. Institutions should aim for false positive rates below 5%, using step-up authentication rather than outright declines when risk scores fall in moderate ranges.

3. Pre-Production Testing Frameworks

The fraud detection playbook for digital banking in 2026 strongly emphasizes testing in production with shadow mode deployment. Run new AI systems alongside existing fraud tools, comparing results without affecting transaction processing. The approach identifies model weaknesses before full deployment.

4. Industry Collaboration Networks

Cross-institution data sharing improves detection across the ecosystem. Fraud networks operate across multiple banks, so sharing anonymized fraud patterns strengthens collective defense. Industry consortiums now enable real-time sharing of fraud intelligence without exposing customer data.

5. Performance Monitoring Dashboards

Model governance requires designated owners who monitor performance metrics, review model decisions, and update training data. Key metrics include precision, recall, false positive rate, detection latency, and customer friction scores. Monthly reviews identify when models need retraining or threshold adjustments.

Conclusion

Real-time payments demand a proactive approach to fraud detection. Agentic AI provides a practical framework for monitoring and responding to suspicious transactions in real time. The updated models of agents will integrate advanced machine learning anomaly detection and intelligent fraud risk scoring collaboratively to protect instant payments while maintaining sub-second processing times.

This playbook demonstrates that integrating agentic AI into payment systems is not just about detection but about building a resilient and adaptive defense.

Share this article