Listen to our podcast 🎧

.png)

Introduction

Financial institutions face growing pressure from fraud, regulatory demands, and operational inefficiencies. How can banks and insurers respond faster without overloading staff or systems? The answer is Agentic AI in financial services.

Agentic AI modules go beyond rule-based automation. They analyze real-time data, make contextual decisions, and execute actions across workflows. This includes AI-driven fraud detection, financial compliance automation, and AI for banking automation, enabling institutions to reduce errors, speed up decision-making, and maintain compliance.

According to Blue Prism’s 2025 Global AI Survey, financial institutions reported significant reductions in manual compliance tasks and improvements in operational efficiency.

By uniting intelligent financial workflow automation with AI-powered customer support in banking, Agentic AI allows firms to act proactively rather than reactively. It creates a single framework where compliance, risk management, and customer experience work in sync.

Now, we will explore the top 10 use cases in detail, showing how agentic AI is transforming core financial workflows from fraud monitoring to portfolio optimization.

Ready to future-proof your financial services strategy?

AI transforms finance and boosts efficiency.

Case 1: Real-time fraud detection

In modern banking, fraud can happen in milliseconds. Agentic AI modules continuously ingest transaction streams, cross-reference them with historical patterns, and weigh contextual signals like device location, transaction velocity, and behavioral anomalies. Unlike traditional alert systems, these agents can autonomously block or flag high-risk transactions and generate an audit trail for compliance. Banks piloting these systems report that analysts now spend 60% less time reviewing false positives, allowing them to focus on complex investigations.

Case 2: Automated credit decisioning

Loan processing and credit scoring often involve multiple teams reviewing overlapping datasets. Agentic AI integrates borrower history, market data, and predictive risk models into a single, autonomous workflow. The AI agent can approve low-risk applications instantly, escalate borderline cases for human review, and continuously learn from past outcomes to refine decision thresholds.

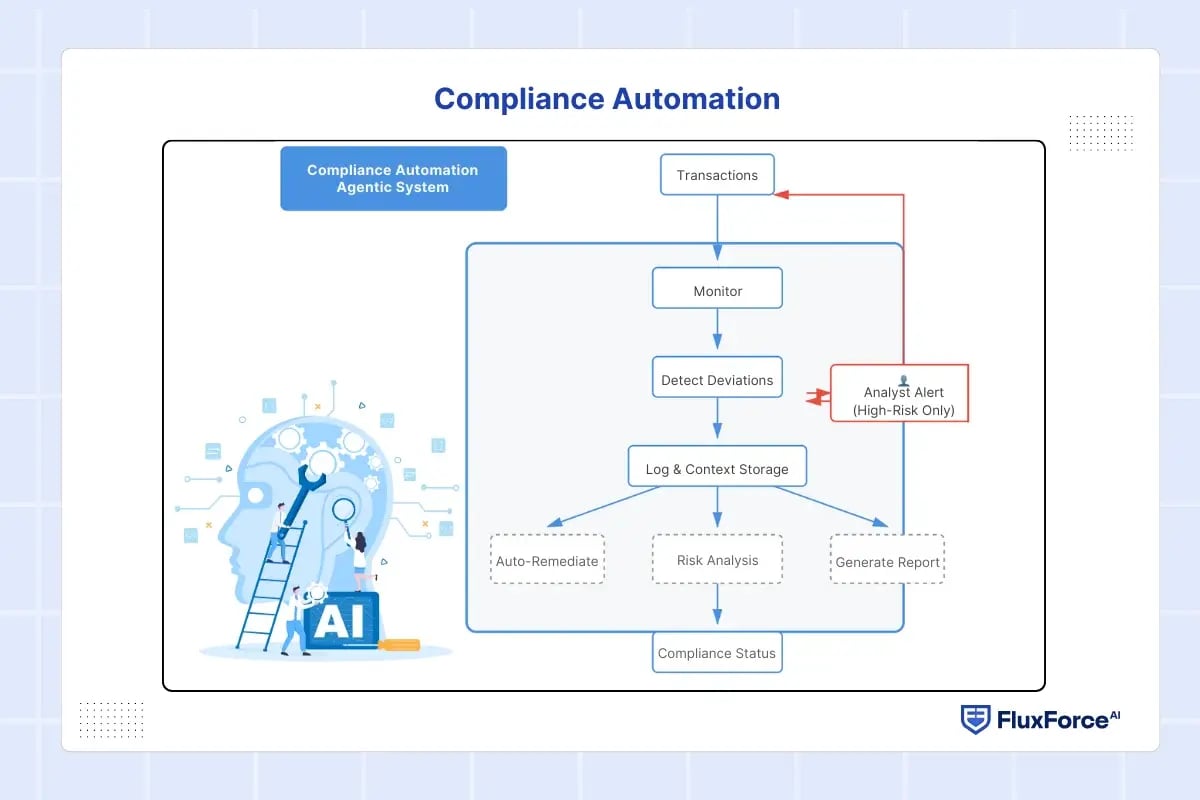

Case 3: Compliance Automation

In modern banking, compliance involves tracking hundreds of rules across multiple systems. Agentic AI modules continuously monitor transactions, policy changes, and operational workflows. They detect deviations, log them with context, and trigger automated remediation. This ensures no compliance gap goes unnoticed. Analysts are alerted only for exceptions, letting them focus on high-risk areas. Financial compliance automation becomes a continuous, intelligent process rather than periodic manual checks.

Case 4: Regulatory Reporting

Regulatory reporting requires consolidating data from core banking, CRM, and risk systems. Agentic AI modules pull, normalize, and validate this data in real time. They generate reports that are submission-ready and fully auditable. When rules change, the AI adapts, updating workflows and validations automatically. AI for banking automation removes repetitive work, reduces errors, and ensures that regulators always receive accurate, timely reports.

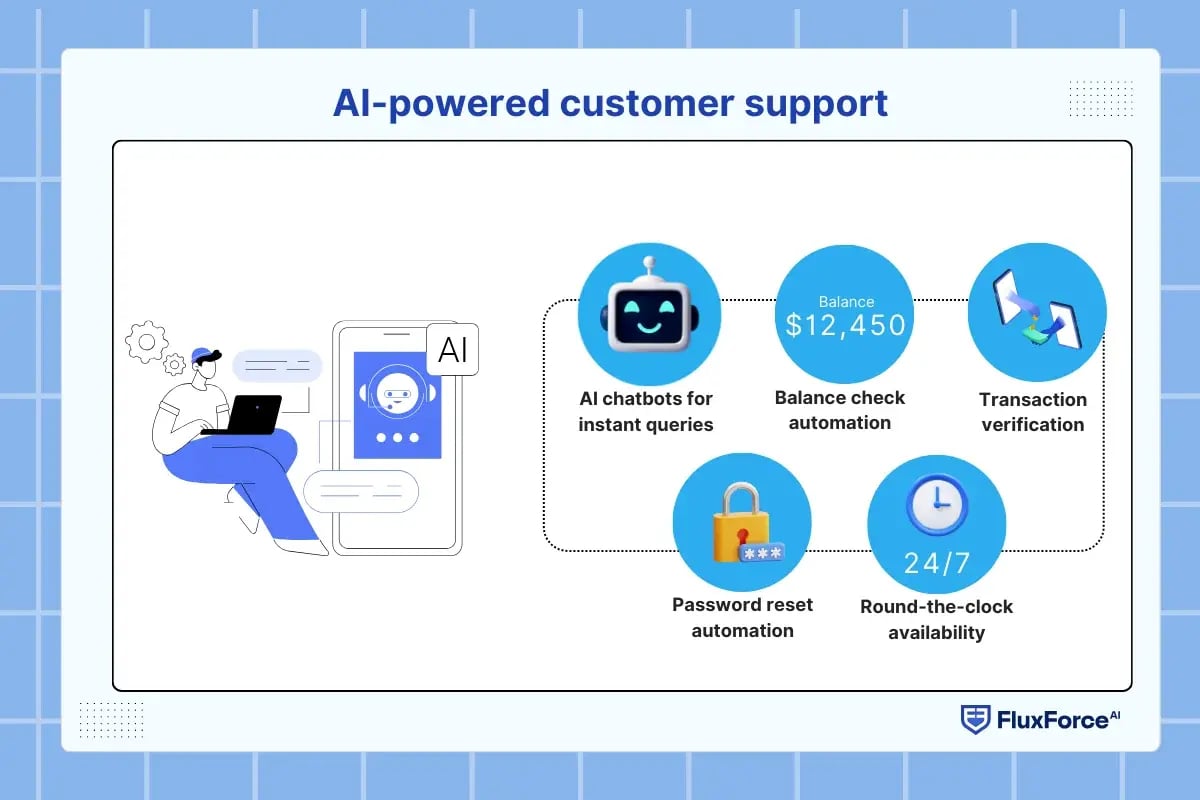

Case 5: AI-powered customer support

Customer service in financial institutions is under pressure. Clients expect instant, accurate answers, but repetitive queries like balance checks, transaction verification, or password resets take up most of the team’s time. Agentic AI in financial services automates these tasks through AI-powered customer support in banking, handling routine queries instantly and accurately.

Beyond simple automation, these AI agents are context-aware. For instance, if a client reports suspicious activity, the system automatically checks recent transactions, customer risk profiles, and compliance rules before escalating to a human agent. This not only reduces response time but also minimizes errors and builds customer trust. Staff can focus on complex issues, improving operational efficiency and client satisfaction.

Case 6: Portfolio optimization

Portfolio management involves tracking market trends, client preferences, and risk exposure. Manual methods are slow and prone to errors, which can cost both clients and the institution. Agentic AI modules continuously analyze multiple data streams, including market data, historical performance, and risk models. They can suggest real-time portfolio adjustments, predict risk scenarios, and highlight opportunities for optimization.

These AI agents also create a full audit trail, ensuring all actions comply with internal policies and regulatory requirements. Intelligent financial workflow automation integrates these recommendations into advisors’ workflows, allowing faster decision-making and better risk-adjusted returns.

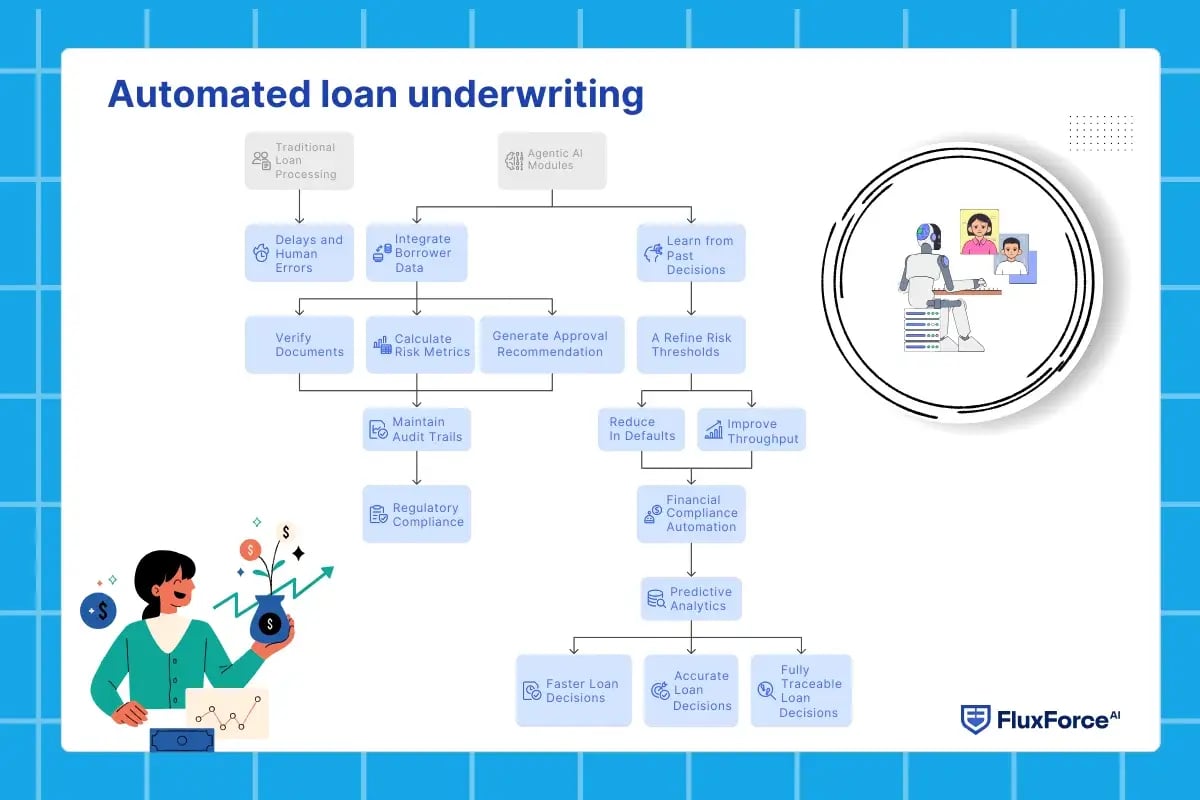

Case 7: Automated loan underwriting

Traditional loan processing involves multiple teams reviewing documents, credit histories, and risk scores, often leading to delays and human errors. Agentic AI modules integrate borrower data from core banking systems, credit bureaus, and market trends. They automatically verify documents, calculate risk metrics, and generate an approval recommendation while maintaining full audit trails for regulatory compliance.

The AI also continuously learns from past decisions to refine risk thresholds, helping banks reduce defaults and improve throughput. By using financial compliance automation alongside predictive analytics, institutions achieve faster, accurate, and fully traceable loan decisions.

Case 8: Risk scoring and predictive analytics

Managing enterprise risk requires constant monitoring of accounts, portfolios, and transactions. Agentic AI in financial services applies risk scoring AI models to evaluate individual clients and entire portfolios, detecting patterns that indicate potential defaults or exposure spikes.

The system integrates with intelligent financial workflow automation, allowing alerts to be generated for high-risk clients automatically. Risk officers receive contextual insights, not just raw scores, enabling data-driven intervention before issues escalate. Predictive models continuously update using real-time transaction data and market signals, ensuring risk scoring remains accurate even in volatile conditions.

Case 9: Advanced portfolio insights

Portfolio management is not just about balancing assets. Agentic AI modules consolidate market trends, client investment goals, and historical performance, then generate actionable insights in real time. Using AI portfolio optimization, the system recommends rebalancing, hedging, or diversification strategies tailored to individual risk appetite.

Unlike standard analytics, the AI autonomously simulates multiple scenarios, highlights potential risk-adjusted returns, and integrates suggested actions directly into advisor workflows. This enables advisors to make faster, evidence-based decisions, improving client satisfaction and overall portfolio performance.

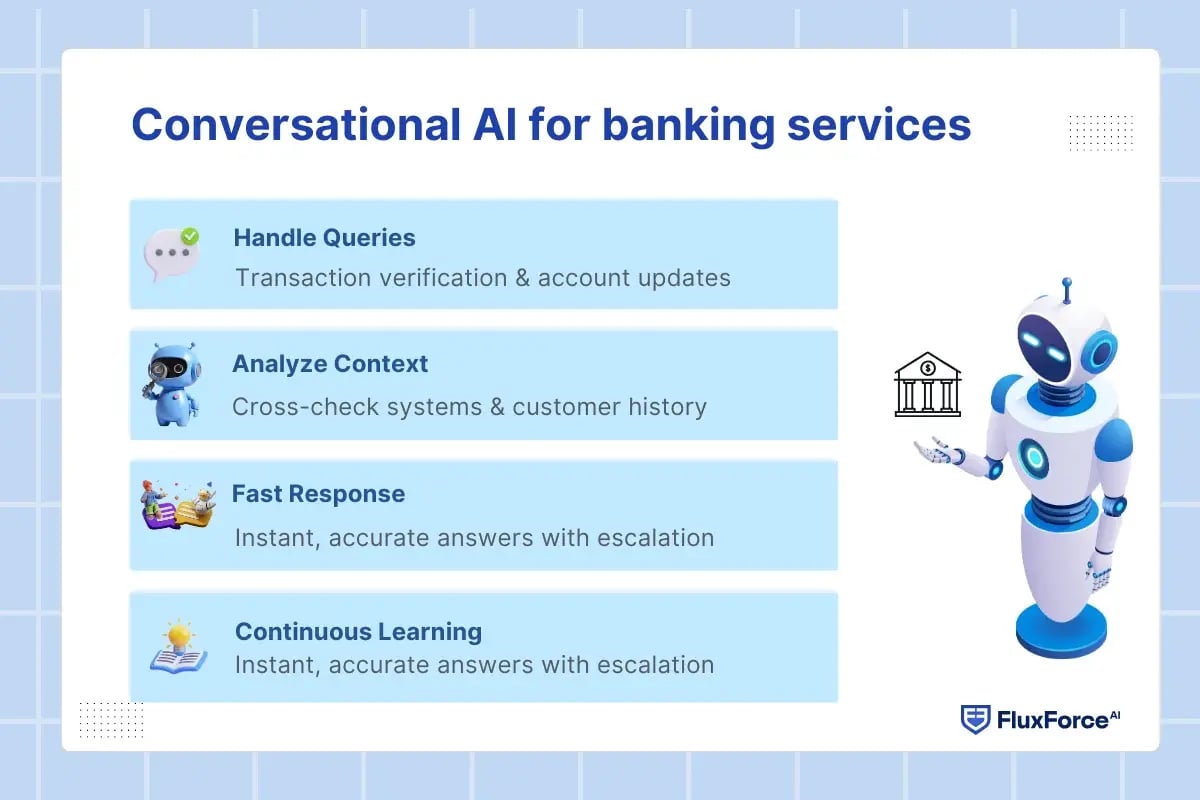

Case 10: Conversational AI for banking services

Banks face rising customer expectations for instant, accurate responses. Conversational AI for banking service desks handles queries such as transaction verification, account updates, and policy clarifications.

Agentic AI agents do more than respond—they analyze the customer context, cross-check internal systems, and escalate only when exceptions arise. Integrated with AI-powered customer support in banking, this reduces manual workload, speeds response time, and ensures consistency. Historical interaction data also feeds back into the AI, continuously improving its accuracy and personalization.

Struggling to keep up with the rapidly evolving demands of financial services?

AI transforms finance and boosts efficiency.

Conclusion

Adopting agentic AI in financial services is changing how banks and insurers work, moving from reactive tasks to smart, autonomous decision-making. Beyond cutting errors and speeding up processes, these AI systems help institutions spot risks, adapt to new rules, and respond to market changes in real time. With AI-powered customer support, workflow automation, and predictive analytics, firms can improve both day-to-day operations and long-term planning.

Looking ahead, agentic AI will create connected, adaptive systems, where compliance, risk, and efficiency work together automatically. For instance, AI could adjust credit limits, optimize portfolios, or flag unusual activity before it becomes a problem. This shift will reshape how financial institutions manage resources, risk, and customer experience.

The future also brings continuous learning. As AI processes more data, it will get smarter, offer more accurate predictions, and provide useful business insights. Institutions adopting agentic AI today will not only see measurable ROI but will also gain a strategic advantage, turning their operations into agile, resilient, and forward-looking organizations ready for tomorrow.

.webp)

Share this article