Listen To Our Podcast🎧

Introduction

Organizations operating under the PSD2 Strong Customer Authentication (SCA) directive face constant challenges to meet security compliance and maintain transaction speed.

With rising expectations for fast and authenticated online payments, banks often struggle to keep pace using manual or rule-based security systems. While over 94% of licensed European banks now comply with PSD2, those still relying on older workflows deal with ineffective decisions and unnecessary resource strain.

Agentic AI, through autonomous decisioning and adaptive intelligence, is enabling banks to balance user convenience with regulatory precision. Across European institutions such as Deutsche Bank and HSBC, these systems are already transforming authentication operations.

Agentic AI streamlines Strong Customer Authentication (SCA),

boosting security and efficiency

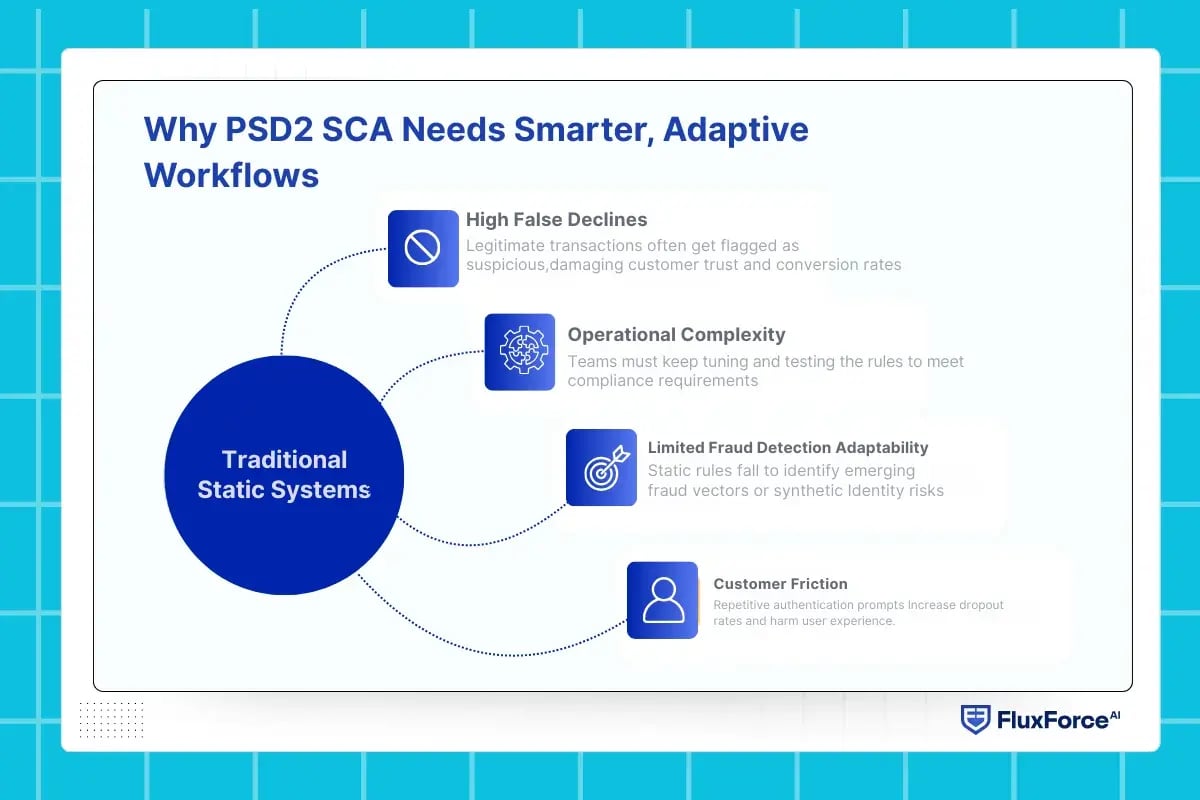

Why PSD2 SCA Needs Smarter, Adaptive Workflows?

Traditional rule-based systems trained with SCA datasets treat customers uniformly, regardless of context, risk level, or transaction behaviour. Every user is subjected to the same two-step verification sequence involving OTPs, password checks, or device confirmations.

However, PSD2 strong customer authentication now emphasizes dynamic, risk-based validation. Static systems fail to read real-time signals such as changes in behaviour, device, or location, causing several problems, such as:

- High false declines: Legitimate transactions often get flagged as suspicious, damaging customer trust and conversion rates.

- Limited fraud detection adaptability: Static rules fail to identify emerging fraud vectors or synthetic identity risks.

- Operational complexity: Teams must keep tuning and testing the rules to meet compliance.

- Customer friction: Repetitive authentication prompts increase dropout rates and harm user experience, especially in low-risk transactions.

Without adaptive, AI-driven authentication workflows, organizations lack the data intelligence needed to identify transaction intent. This limited visibility blurs the difference between legitimate users and fraudulent activity, leading to unnecessary verification steps and degraded user experience.

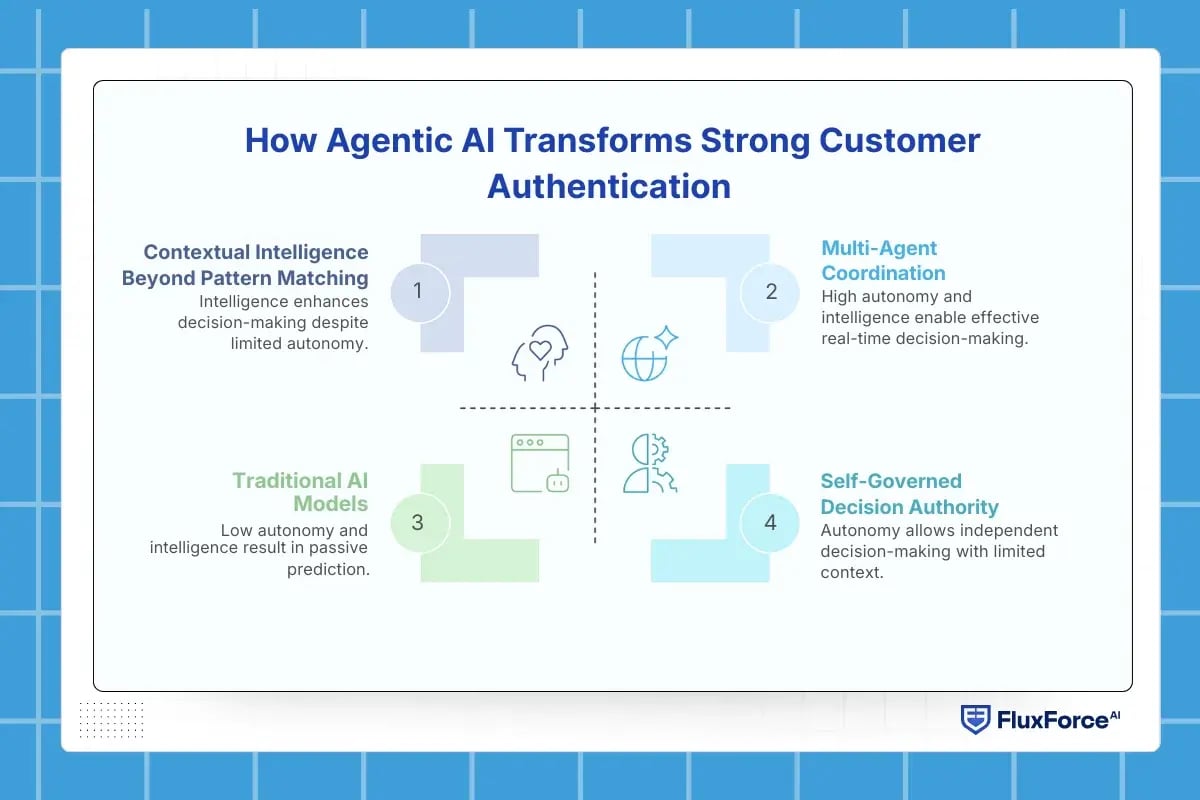

How Agentic AI Transforms Strong Customer Authentication ?

Agentic AI differs from traditional machine learning models by operating as autonomous agents rather than passive prediction engines. Where conventional AI waits for queries and returns scores, agentic AI initiates actions, monitors outcomes, and adjusts strategy without human oversight.

Core capabilities of Agentic AI

Self-Governed Decision Authority

Agentic AI differs from traditional machine learning models by operating as autonomous agents rather than passive prediction engines. Where conventional AI waits for queries and returns scores, agentic AI initiates actions, monitors outcomes, and adjusts strategy without human oversight.

Contextual Intelligence Beyond Pattern Matching

Traditional AI models flag anomalies based on historical patterns. Agentic AI interprets context, evaluating factors such as login time, device type, network origin, and transaction metadata. A login from a corporate IP during business hours receives different treatment than the same login from a VPN at night.

Continuous Learning Loops

Agents update authentication models based on real-world outcomes. When false positives occur, the agent adjusts risk thresholds for similar future scenarios. When new fraud patterns emerge, such as SIM swap attacks or synthetic identity schemes, agents incorporate these vectors into decision logic without waiting for manual model retraining.

Multi-Agent Coordination

Multiple specialized agents handle different authentication domains: one monitors device fingerprinting, another tracks behavioural biometrics, a third evaluates transaction patterns. These agents communicate findings and coordinate authentication decisions in real-time.

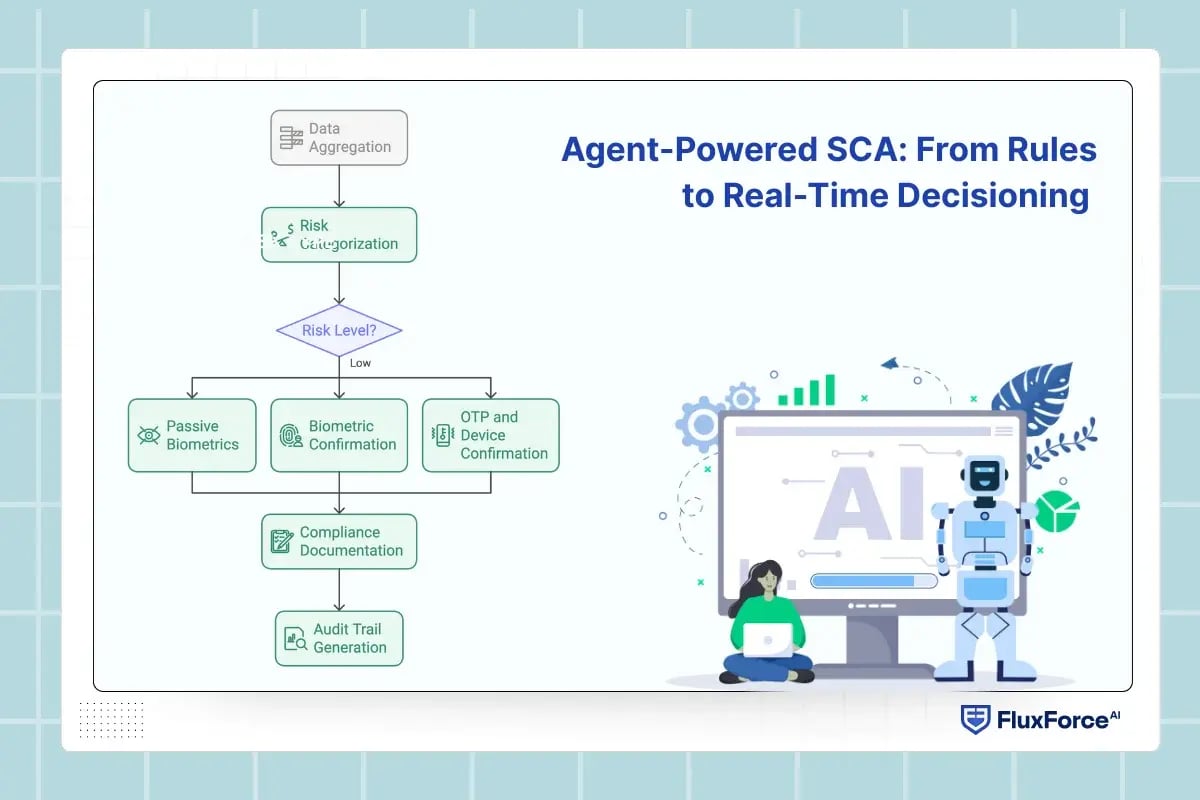

Agent-Powered SCA: From Rules to Real-Time Decisioning

AI agents handle end-to-end authentication workflows, processing transactions dynamically while maintaining speed and security. This advanced system brings operational shift that moves from predefined rules to autonomous execution across the entire authentication lifecycle.

1. Data Aggregation Across Payment Channels

Agents ingest transaction metadata from card networks, Open Banking APIs, and SWIFT rails simultaneously. Each payment channel feeds data beyond credentials, such as device fingerprints, geolocation coordinates, and merchant details into unified customer profiles. Agents assemble context before authentication requests reach verification systems, eliminating data silos between payment methods.

2. Risk Categorization and Score Assignment

Agents calculate fraud probability scores by comparing transaction amounts to historical patterns, device trust scores, and geographic consistency. Low-value transactions from recognized devices bypass further verification. High-risk transfers to unfamiliar beneficiaries trigger multi-factor authentication automatically.

3. Authentication Method Selection and Execution

Based on assigned risk scores, agents select verification intensity.

- Low-risk transactions pass through with passive behavioural biometrics verification.

- Medium-risk scenarios trigger biometric confirmation requests (fingerprint or face scan).

- High-risk transactions escalate to OTP delivery plus secondary device confirmation.

Agents execute these authentication sequences without consulting rule tables or decision trees.

4. Compliance Documentation and Audit Trail Generation

Agents document every decision point: risk factors evaluated, authentication methods deployed, and regulatory exemptions applied. Each transaction generates a compliance record showing why specific verification steps were chosen and which PSD2 requirements were satisfied.

When regulators audit authentication practices, agents produce transaction-level justification automatically, demonstrating how decisions aligned with strong customer authentication automation standards.

Integrating Agentic AI within PSD2 Compliance Frameworks

Deploying agentic AI for SCA requires connecting autonomous decision engines to existing authentication infrastructure without disrupting transaction flows or creating compliance gaps.

1. API-Level Integration with Payment Infrastructure

Agentic AI operates as middleware between payment gateways and authentication services. When a transaction enters the payment stack, the agent intercepts the request, evaluates risk in real-time, and returns an authentication decision to the gateway—all within 50-100 milliseconds.

Integration occurs through RESTful APIs that connect to card processors, SEPA systems, and Open Banking endpoints. Agents communicate using standard authentication protocols, making implementation compatible with existing PSD2-compliant infrastructure.

2. Dynamic Application of Regulatory Exemptions

Agents apply Transaction Risk Analysis exemptions autonomously. When transactions meet low-value thresholds (under €30) or involve trusted beneficiaries, agents waive SCA requirements per PSD2 guidelines.

The system tracks cumulative transaction values across sessions—if five sub-€30 transactions exceed €100 total, the agent triggers authentication on the sixth. Corporate payment flows receive different treatment than consumer transactions, with agents adjusting verification based on merchant category codes and account type.

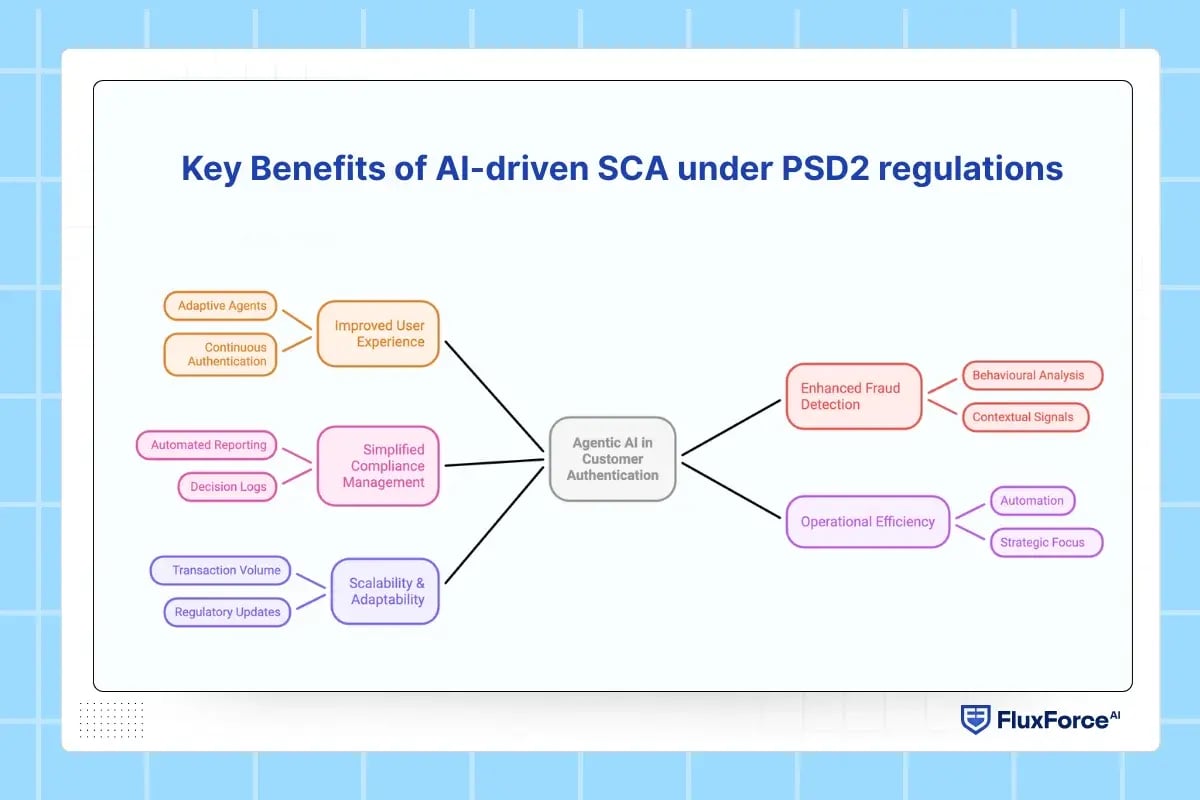

Key Benefits of AI-driven SCA under PSD2 regulations

Using Agentic AI to reduce friction in customer authentication delivers measurable improvements across operations. These include:

- Improved User Experience-Adaptive agents minimize repetitive verification steps, enabling smoother payment flow and faster onboarding. Continuous authentication and contextual checks reduce unnecessary interruptions.

- Enhanced Fraud Detection-AI agents continuouslyanalyse behavioural patterns and contextual signals. Real-time fraud detection with AI lowers fraud false positives while protecting high-risk transactions from emerging threats.

- Simplified Compliance Management-Automated reporting and decision logs enable automated compliance workflows, making audit preparation faster and more reliable. Verification steps scale with transaction risk without manual oversight.

- Operational Efficiency-End-to-end banking authentication automation reduces resource strain. Agentsmaintain risk analysis, verification execution, and reporting autonomously, allowing teams to focus on strategic initiatives rather than repetitive monitoring.

- Scalability & Adaptability

AI-driven SCA scales effortlessly with transaction volume, supporting growth without additional operational overhead. Adaptive agents adjust to evolving fraud patterns, regulatory updates, and new transaction types, maintaining consistent performance even under increasing load.

Conclusion

Agentic AI revolutionizes Strong Customer Authentication by replacing static verification sequences with autonomous, context-aware decision-making. Banks benefit from reduced authentication friction, enhanced fraud detection, automated compliance, and scalable transaction management. Integration of agentic AI establishes a robust foundation for PSD2-compliant, adaptive, and intelligent authentication frameworks.

Firms adopting AI-driven authentication achieve operational efficiency while ensuring secure, seamless customer experiences. Advanced agents empower banks to manage risk dynamically, maintain regulatory compliance, and evolve with emerging payment technologies.

.webp)

Share this article