Listen To Our Podcast🎧

.jpeg)

Introduction

Africa’s financial landscape is undergoing a massive digital shift. Mobile-first banking has become the default model, powered by platforms like M-Pesa, Airtel Money, and emerging microfinance AI adoption networks. These systems are driving financial inclusion in Africa, connecting millions of users who rely on mobile phones for payments, savings, and even small-scale lending.

But with rapid growth comes new threats. Digital banking fraud prevention has become a pressing concern as cybercriminals target mobile money platforms that handle billions of dollars in transactions each month. According to the GSMA Mobile Money Report (2024), Africa processed over $1.2 trillion in mobile money transactions.

Traditional compliance systems can’t keep up. Most rely on rule-based automation that reacts after fraud occurs. In contrast, agentic AI in financial services introduces proactive intelligence systems that detect, analyze, and act before a breach happens. These AI-driven financial security models continuously learn transaction patterns, adapt to new fraud vectors, and automate decision-making to reduce human error and delay.

The shift toward intelligent automation

Across the continent, banks and fintech startups are deploying automated compliance for banks and real-time compliance automation tools to meet growing demands from regulators and customers. Governments are tightening controls around KYC and AML, while international frameworks are influencing local data protection.

That’s why agentic AI is a necessity. It powers intelligent transaction monitoring, identifies anomalies at the source, and connects with RegTech solutions in Africa for policy enforcement automation and threat intelligence automation for fintech apps.

At the same time, it helps balance the two toughest goals in finance today: enhancing trust and maintaining speed. Financial institutions can now deliver AI-powered fraud detection for African banks, ensuring smoother compliance workflows without slowing down customer transactions.

Agentic AI is shaping the future of mobile-first banking in Africa

Explore the future of digital finance today!

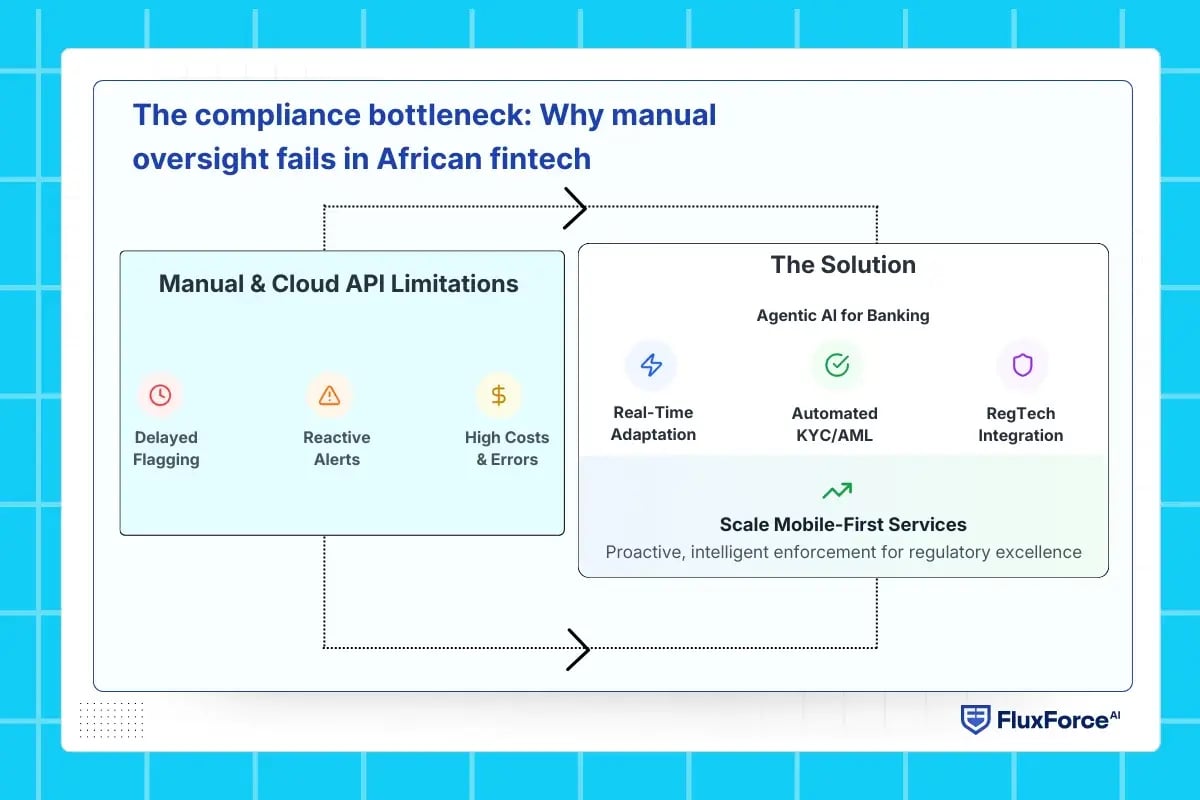

The compliance bottleneck: Why manual oversight fails in African fintech

As mobile-first banking continues to expand across Africa, compliance has become a significant challenge. Banks and fintechs operate in fragmented regulatory environments, where local laws, cross-border payment rules, and data protection standards vary widely. Traditional manual compliance processes cannot keep pace, leaving institutions vulnerable to operational, financial, and reputational risks.

The limits of manual and cloud API solutions

Many African fintechs rely on cloud API services for payments, KYC verification, and AML monitoring. While these tools are convenient, they have limitations:

- They often cannot enforce policy automation across multiple jurisdictions, creating delays in flagging suspicious activity.

- They provide reactive alerts, identifying issues only after transactions occur.

- They demand heavy manual oversight, which increases costs and error rates, especially as transaction volumes grow into the billions.

This illustrates why the choice between DIY AI vs enterprise AI is critical. Off-the-shelf AI or simple API integrations lack the sophistication required for real-time compliance monitoring in complex African regulatory environments.

How agentic AI bridges the gap ?

Agentic AI for banking introduces autonomous intelligence into compliance workflows. These AI agents do more than monitor transactions—they:

- Adapt in real time to new fraud patterns and changing local regulations

- Automate KYC and AML workflows, reducing manual effort and improving accuracy

- Integrate with RegTech solutions to maintain compliance across multiple frameworks seamlessly

By deploying AI-driven regulatory technology (RegTech), financial institutions can achieve operational efficiency, reduce the risk of fines, and strengthen customer trust.

So, Can African banks scale mobile-first services while maintaining regulatory excellence? The answer lies in embedding automated compliance for banks directly into AI-driven systems, shifting from reactive oversight to proactive, intelligent enforcement.

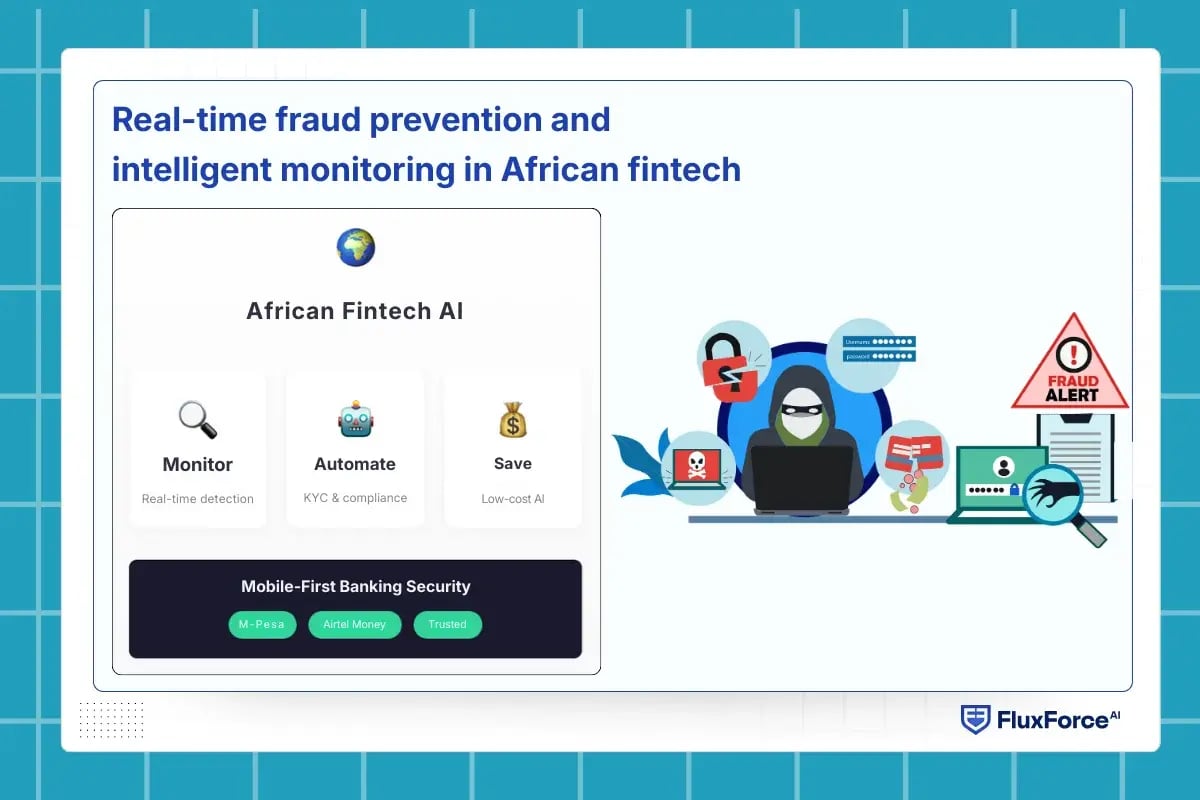

Real-time fraud prevention and intelligent monitoring in African fintech

Africa’s mobile-first banking sector has expanded rapidly, bringing both opportunities and risks. Traditional monitoring tools and cloud APIs struggle to keep up with evolving digital threats. AI-driven financial security has become critical for maintaining trust, regulatory compliance, and operational efficiency.

Intelligent transaction monitoring at scale

Platforms like M-Pesa and Airtel Money handle millions of transactions daily. Intelligent transaction monitoring powered by agentic AI for African fintech enables institutions to:

- Detect suspicious activity in real time, even in high-volume microtransactions

- Learn evolving fraud patterns autonomously, reducing manual oversight

- Integrate automated compliance for banks, ensuring that alerts align with local regulations

By leveraging AI-powered fraud detection for African banks, institutions can anticipate risks before they escalate, ensuring safer mobile-first finance operations.

Automating KYC and AML workflows

Regulatory compliance across African markets is complex. Automating KYC and AML with agentic AI in Africa helps institutions:

- Onboard customers quickly while maintaining robust verification

- Maintain real-time compliance monitoring across multiple jurisdictions

- Use agent-based AI compliance engines for fintechs to simplify reporting and audit processes

This approach allows fintechs and mobile-first banks to scale securely while ensuring operational and regulatory excellence

Low-cost AI solutions for emerging markets

Agentic AI provides low-cost AI solutions for digital banking security, enabling financial institutions to:

- Reduce operational expenses for compliance and fraud monitoring

- Improve efficiency without compromising data confidentiality

- Build customer trust through mobile banking cybersecurity

For African banks and fintechs, securing mobile-first finance with AI agents in financial services is essential. By deploying intelligent transaction monitoring and agent-based AI compliance engines for fintechs, institutions can modernize operations, scale compliance, and maintain trust while staying ahead of evolving threats.

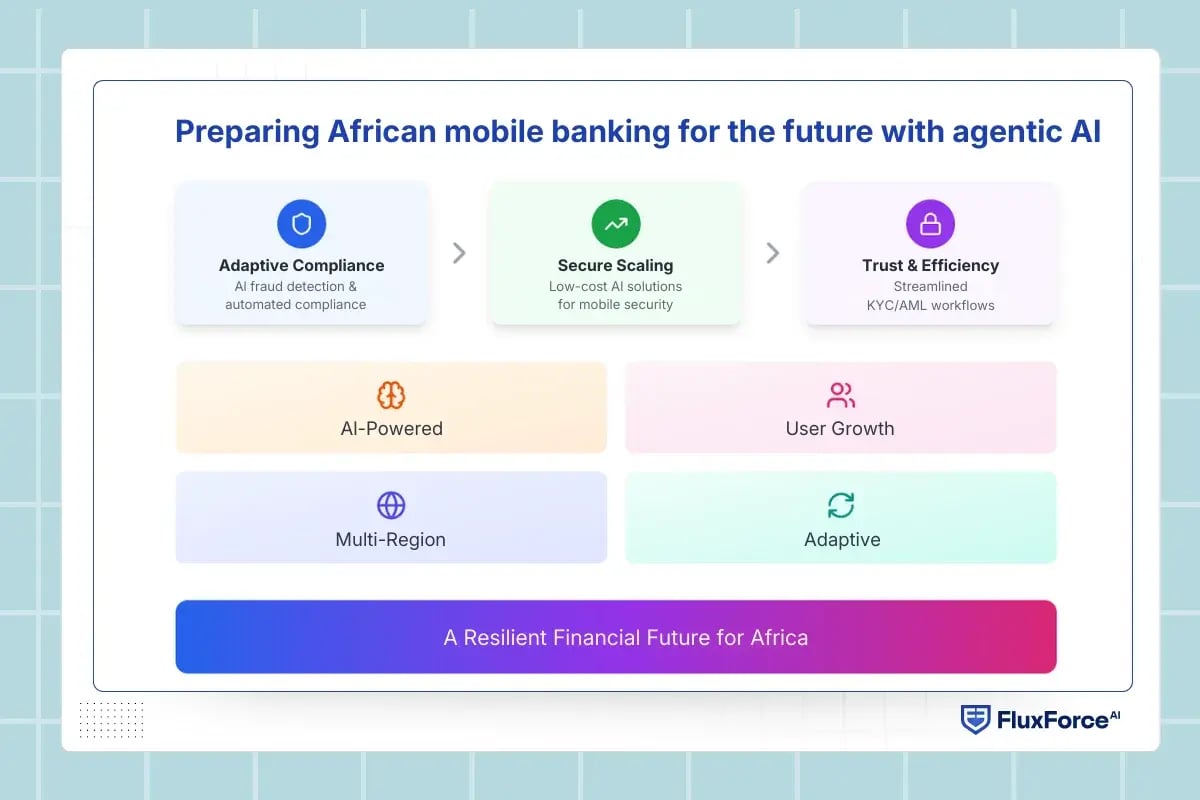

Preparing African mobile banking for the future with agentic AI

As Africa’s mobile-first banking ecosystem grows, the challenges are evolving. Cyber threats, regulatory requirements, and transaction volumes will continue to increase. Agentic AI in financial services positions banks to meet these future demands proactively.

Adaptive compliance and real-time security

Future-ready banks will rely on AI-powered fraud detection for African banks that adapts autonomously to new fraud patterns. By integrating agent-based AI compliance engines for fintechs and real-time compliance monitoring, institutions can anticipate threats and enforce automated compliance for banks across diverse jurisdictions.

Scaling mobile-first services securely

With low-cost AI solutions for digital banking security, African banks can expand services to more users without increasing operational risk. Agentic AI ensures mobile banking cybersecurity and intelligent transaction monitoring that scales with transaction growth, keeping both users and institutions secure.

Building a trustworthy, efficient financial ecosystem

By adopting threat intelligence automation for fintech apps, banks can maintain regulatory adherence, streamline KYC and AML workflows, and future-proof operations. Agentic AI transforms mobile-first banking into a system where growth, security, and compliance evolve together, making it resilient to emerging challenges and ready for the next wave of innovation in digital finance.

Agentic AI is shaping Africa’s mobile-first banking, enhancing security and innovation

Explore the future of digital finance today

Conclusion

Africa’s mobile-first banking sector is growing rapidly. Platforms like M-Pesa and Airtel Money are driving financial inclusion, but increasing transaction volumes and complex regulations create higher risks for fraud and operational gaps. Traditional compliance systems and cloud API solutions are often reactive and cannot keep up with these challenges.

Agentic AI in financial services provides a practical solution. By using AI-powered fraud detection for African banks, intelligent transaction monitoring, and agent-based AI compliance engines for fintechs, banks can spot unusual activity in real time, automate KYC and AML workflows, and maintain real-time compliance monitoring across multiple jurisdictions. These systems help reduce errors, cut costs, and strengthen customer trust while allowing services to scale efficiently.

Partnering with specialized providers like FluxForce AI allows banks to deploy secure, enterprise-grade solutions faster. Their prebuilt AI modules integrate into banking operations to deliver compliance automation, threat intelligence for fintech apps, and robust mobile banking cybersecurity, ensuring both regulatory compliance and operational reliability.

The future of mobile-first banking in Africa depends on integrating agentic AI as a central part of operations. Institutions that adopt these intelligent systems will meet regulatory demands, improve efficiency, and create a secure, scalable, and trusted financial ecosystem.

Share this article