Listen To Our Podcast 🎧

Introduction

In an era where digital payments and interconnected financial systems dominate, the Digital Operational Resilience Act (DORA) establishes rigorous benchmarks for European institutions to withstand cyber disruptions and operational failures.

Effective from January 2025, DORA mandates comprehensive ICT risk management, incident reporting, resilience testing, and other key controls that, when done manually, often leave gaps in oversight and increase the risk of operational disruptions.

Agentic AI (autonomous systems capable of independent decision-making) emerges as a key solution for institutions navigating these regulatory requirements.

By automating end-to-end compliance workflows, agentic AI is transforming DORA obligations from administrative burdens into strategic operational advantages for European banks.

Why DORA Readiness is Essential for European Financial Institutions ?

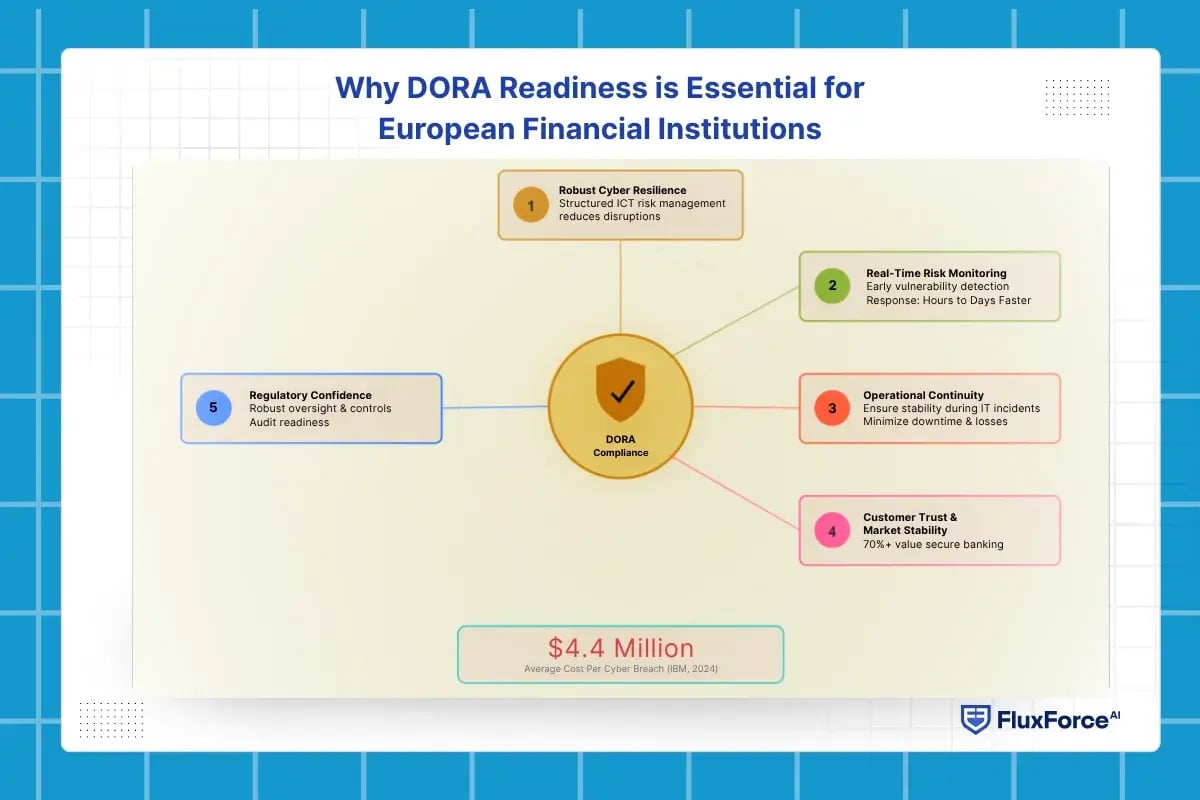

For financial organizations, DORA readiness is not just about avoiding fines. It strengthens the operational and cyber resilience of European institutions. With cyber breaches averaging $4.4 million per incident (IBM, 2024), it is essential to operate within DORA standards for stability and risk management.

Key DORA-compliant advantages include:

- Robust Cyber Resilience: Through structured information and communication technology (ICT) risk management, DORA-ready institutions reduce chances of operational disruptions.

- Real-Time Risk Monitoring: Continuous monitoring and automated controls allow early detection of vulnerabilities, which can shorten incident response times by several hours to days.

- Operational Continuity: Maintaining DORA standards helps financial institutions ensure stability during IT incidents, minimizing service downtime and operational losses.

- Customer Trust and Market Stability: Institutions with robust operational and cyber resilience maintain client confidence. Surveys indicate that over 70% of customers value secure, reliable digital banking operations.

- Regulatory Confidence: Compliance with DORA demonstrates to regulators that robust oversight and controls are in place, supporting audit readiness and effective ICT risk management.

Shaping the Future of AI in Finance

Fluxforce research uncovers how banks and enterprises are adapting to fraud, compliance, and data challenges in 2025.

How Agentic AI Strengthens DORA Compliance Frameworks

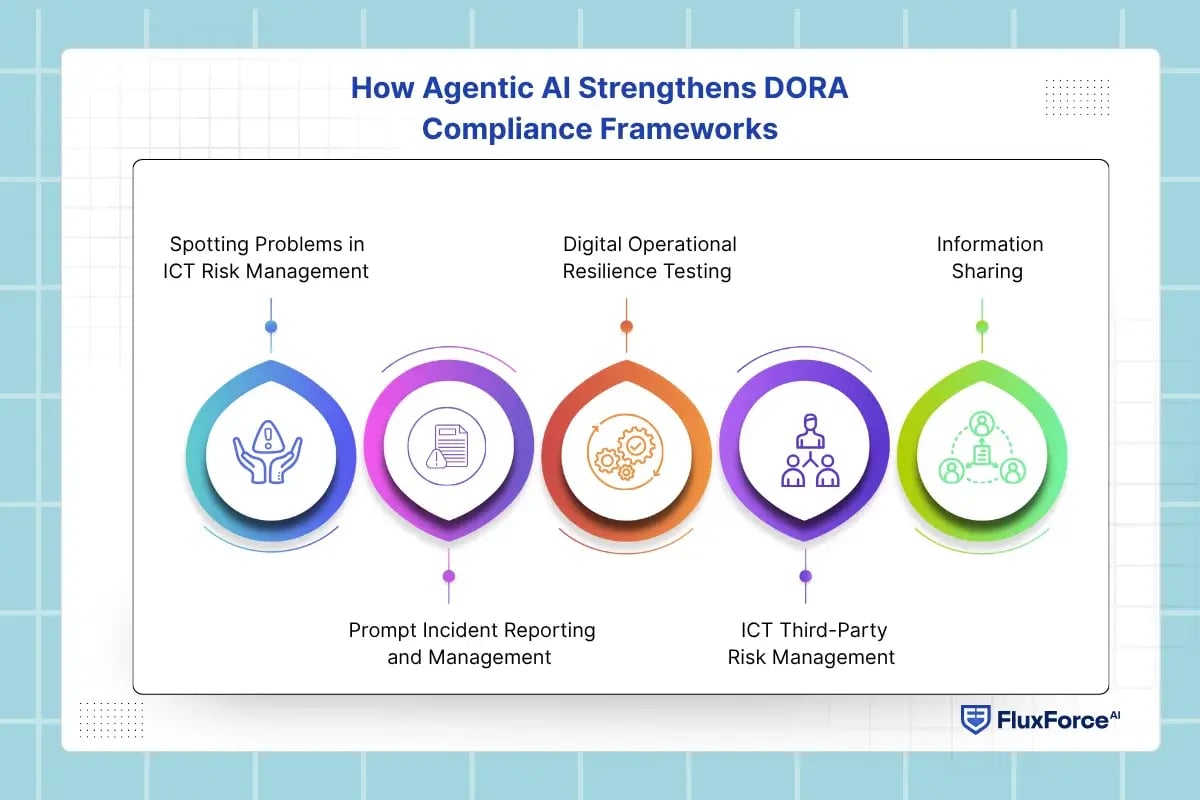

Under DORA-regulated institutions, many cyber risks persist due to delayed detection, fragmented monitoring, and manual reporting. Agentic AI acts like a smart digital assistant, watching systems, spotting issues, fixing problems, and following the rules without human input.

- Spotting Problems in ICT Risk Management

Agentic AI continuously evaluates ICT environments, identifying subtle anomalies that traditional monitoring may miss. This reduces operational blind spots, allows early intervention, and supports sustained system stability aligned with DORA standards.

- Prompt Incident Reporting and Management

- Digital Operational Resilience Testing

- ICT Third-Party Risk Management

- Information Sharing

Automated Resilience: Use Cases of Agentic AI in Financial Institutions

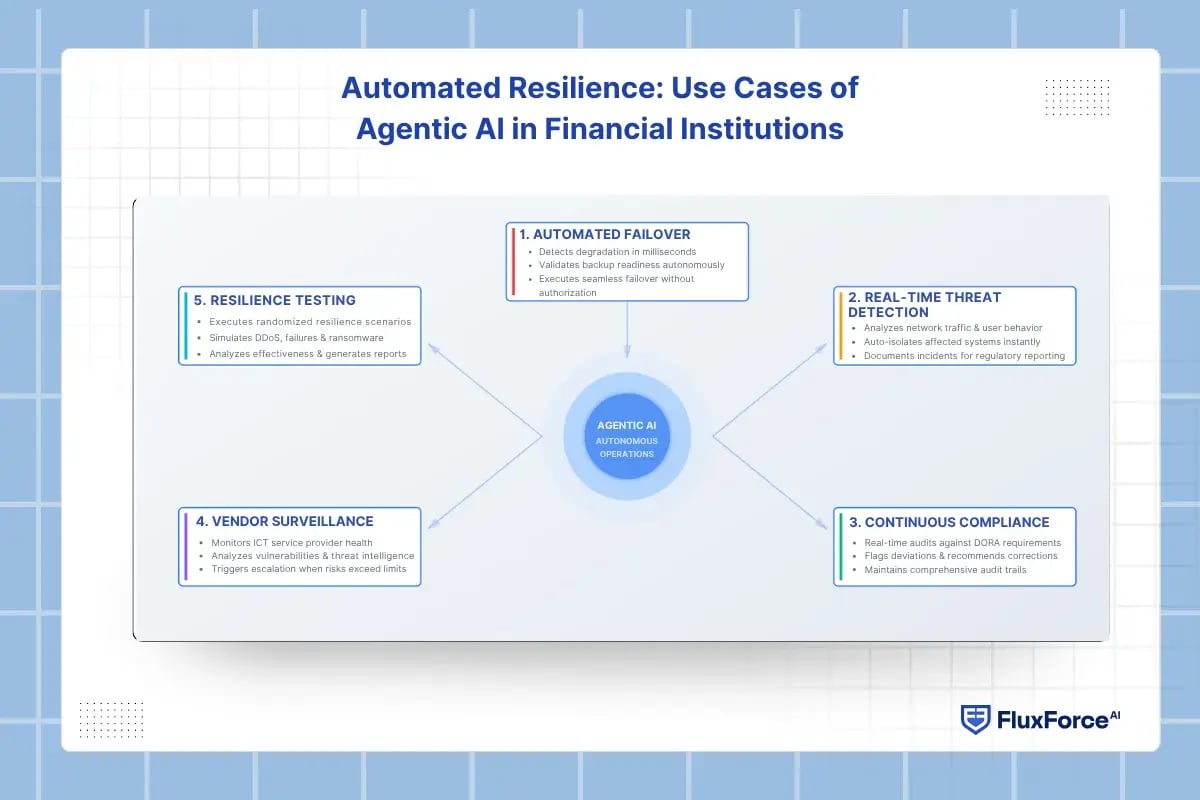

Agentic AI transforms theoretical compliance into operational resilience by autonomously managing the regulatory requirements. Below are its key use cases in European financial institutions.

1. Automated Failover to Backup Systems

When primary payment processing infrastructure experiences degradation, agentic AI detects performance anomalies within milliseconds, validates backup system readiness, and executes seamless failover without human authorization.

2. Real-Time Threat Detection and Mitigation

AI continuously analyses network traffic patterns, user behaviour, and system logs to identify potential cyber threats. Upon detecting suspicious activity, it automatically isolates affected systems, alerts security teams, and documents incidents for regulatory reporting.

3. Continuous Compliance Monitoring

Agentic systems audit configuration changes, access controls, and data flows against DORA requirements in real time. They flag deviations instantly, recommend corrective actions, and maintain comprehensive audit trails for supervisory authorities.

4. Intelligent Third-Party Vendor Surveillance

AI monitors the operational health and security posture of critical ICT service providers by analysing service level metrics, vulnerability disclosures, and threat intelligence. It triggers escalation protocols when vendor risks exceed defined thresholds.

5. Automated Resilience Testing Orchestration

Rather than periodic manual testing, agentic AI schedules and executes randomized resilience scenarios. By simulating DDoS attacks, data centre failures, or ransomware incidents, it analyses response effectiveness and generates improvement recommendations aligned with DORA Article 24 requirements.

Strategic Advantages of Integrating Agentic AI for DORA Compliance

Beyond regulatory checkbox compliance, agentic AI delivers measurable operational and strategic value. Here are some of the reported advantages:

Accelerated Incident Response Times

- Reduction from hours to minutes: Institutions using agentic AI for incident management report average response time reductions from 4-6 hours to under 15 minutes for critical incidents.

- Automated regulatory notifications: DORA Article 19 mandates incident reporting within strict timeframes. AI ensures classification, documentation, and submission occur within regulatory windows.

- Continuous availability: Unlike human teams, AI systems monitor and respond 24/7/365, eliminating blind spots during off-hours when many cyberattacks occur.

Enhanced Risk Visibility and Predictive Intelligence

- Comprehensive environmental scanning: AI aggregates risk signals across infrastructure, applications, third-party connections, and threat intelligence feeds into unified dashboards.

- Predictive vulnerability identification: Machine learning models identify emerging risk patterns before they result in incidents, enabling preventive action rather than reactive response.

- Cross-institutional threat correlation: Advanced systems can identify sector-wide threat patterns by analysing anonymized threat data across multiple institutions, strengthening collective resilience.

Operational Cost Efficiency

- Reduced manual compliance overhead: Automation eliminates repetitive monitoring, documentation, and reporting tasks, allowing compliance teams to focus on strategic risk management.

- Lower incident resolution costs: Faster detection and response directly correlate with reduced financial impact. Industry data suggests early threat detection can reduce breach costs by 30-40%.

- Optimized resource allocation: AI-driven prioritization ensures critical vulnerabilities receive immediate attention while lower-risk issues are queued appropriately.

Regulatory Examination Readiness

- Audit trail completeness: Automated systems maintain comprehensive, tamper-evident logs of all risk events, control activities, and decision rationales required for supervisory reviews.

- Demonstration of continuous compliance: Regulators increasingly expect real-time compliance monitoring rather than periodic assessments. AI systems provide ongoing evidence of adherence.

- Rapid response to regulatory inquiries: When supervisory authorities request documentation or analysis, AI systems can compile relevant information within minutes rather than days.

Future-Proofing Against Evolving Threats

- Adaptive learning capabilities: Unlike static rule-based systems, agentic AI continuously learns from new threat patterns, regulatory updates, and operational incidents, maintaining effectiveness as the threat landscape evolves.

- Scalability for regulatory expansion: As European authorities extend DORA principles to additional sectors or introduce complementary regulations, AI frameworks can adapt without complete system redesigns.

- Integration with emerging technologies: Agentic AI systems can incorporate quantum-resistant cryptography, blockchain-based audit trails, or other emerging security technologies as they mature.

Turn Your Data into Real-Time Decisions

Transform your third-party risk management with Agentic AI Agents.

Conclusion

The Digital Operational Resilience Act strengthens cybersecurity preparedness for European banks as they expand digital financial services. Implementing Agentic AI is a complex but necessary step for sustainable DORA compliance.

By monitoring ICT systems continuously, managing resilience tests, overseeing third-party risks, and supporting timely regulatory reporting, it helps institutions turn compliance into a source of operational strength and reliability.

Share this article