Listen to our podcast 🎧

.png)

Introduction

Mobile banking has changed the way people handle their money. Today, people prefer using banking apps instead of visiting a branch. Mobile-first banks focus on apps and digital tools as the main way customers access their accounts. This gives convenience, but it also brings new security risks. Unlike traditional banks, mobile-first banks work across many devices and networks, which can make them easier targets for hackers and fraud.

According to a survey, over 70% of financial services firms face insider threats, making strong security a must for banks.

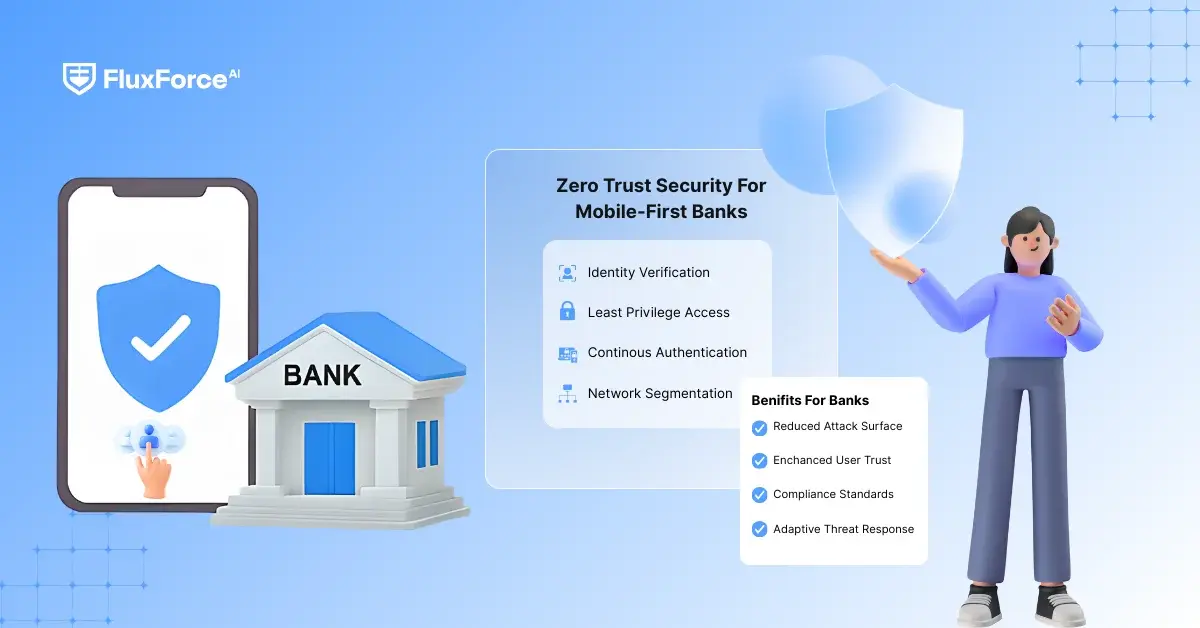

What is Zero Trust Security?

Zero Trust Security is a modern way to protect systems that assumes no user, device, or network can be trusted by default. Every access request must be checked before allowing entry. Old security systems usually trust people once they are inside the network, but Zero Trust works the other way: never trust, always check.

For mobile-first banks, Zero Trust is important because:

- Mobile apps are used on public Wi-Fi and other networks, which can be risky.

- Customers want fast, easy access, so security cannot slow them down too much.

- Employees and hackers can steal credentials, so extra checks are needed.

John Kindervag, who created the Zero Trust model, says:

"Security cannot depend on where a user is. Zero Trust assumes there might already be a breach and protects everything."

Why Mobile-First Banks Are at Risk?

- Mobile Fraud: Banking apps are targeted by malware, phishing, and account takeover attacks. The FBI reported that mobile banking fraud went up by more than 50% in 2024.

- Many Devices and Networks: Mobile apps are used on smartphones, tablets, and smartwatches, often on public networks. Each device can be a way for hackers to get in.

- Customer Trust: One security breach can hurt the bank’s reputation and make customers lose trust. Keeping systems safe is now essential for business.

How Zero Trust Helps

Zero Trust in mobile banking means:

- Continuous Verification Banking: Every user and device is checked all the time, not just once.

- Micro-Segmentation of Networks: Networks are split into small secure sections, so even if one part is attacked, the damage is limited.

- Identity-Centered Security: Only verified users can access sensitive data, no matter where they are or what device they use.

A study by Gartner found that banks using Zero Trust saw a 50% drop in security problems.

Banking Systems and Infrastructure

Mobile-first banks need to update their retail banking architecture to use Zero Trust properly. Old traditional systems built for branch banking cannot handle real-time mobile access safely. Banks need modern systems, cloud services, and secure APIs to support continuous checks and network segmentation.

Next, we will look at identity verification and continuous security in mobile banking, showing how banks can stop unauthorized access and fraud.

Identity Verification and Continuous Security in Mobile Banking

In mobile banking, proving who the customer really is the most important step. If this step fails, fraudsters can pretend to be someone else and steal money. That’s why banks are moving beyond just usernames and passwords. They now use remote identity verification and continuous checks to keep accounts safe.

Remote Identity Verification: The First Step

Remote ID verification allows people to prove their identity without visiting a branch. For example, a customer can scan their driver’s license or passport using their phone camera. With tools like trust ID mobile, the bank can check if the ID is real and match it with a live selfie of the customer.

This form of remote identity verification is becoming very common in banking. A report by Jumio found that 1 in 3 banking customers want a fully digital way to prove their identity.

Adding Device Reputation Checks

Fraud doesn’t always come from fake IDs. Sometimes, it comes from stolen or risky devices. This is where device reputation verification comes in. The system checks if the phone, tablet, or laptop has a history of fraud. If yes, the bank can block access or ask for extra checks.

Identity Verification on Mobile: Different Methods

Banks use many ways to make sure the person logging in is the real account holder:

- Biometrics: Face or fingerprint scan (easy and safe).

- App Push Notifications: Safer than SMS, since the check happens inside the banking app.

- Behavioral Biometrics: Looks at typing speed, touch patterns, or how someone holds their phone.

Old systems only checked users when they logged in. But with continuous verification, banks now keep checking during the session. For example, if a customer logs in from one country but suddenly switches to another, the system may ask for extra proof.

This approach is part of identity-centric security for banks, which means focusing on the person and their device, not just the network they’re on.

Gartner says: “By 2026, 80% of digital businesses will require continuous checks for both customers and employees to cut down fraud and insider risks.”

Banks are also using remote verify to make account recovery easier. If someone forgets their password, they don’t have to visit a branch. Instead, they can prove their identity again using their phone.

This makes life easier for customers and also reduces work for banks.

Zero Trust Security for Banking Networks and Mobile Systems

Why Traditional Banking Security Fails in Mobile-First Banking ?

Old “castle-and-moat” models trusted anyone inside the network. But in today’s world, customers connect through mobile apps, home Wi-Fi, and even public hotspots. This exposes weak spots in banking network infrastructure, giving hackers easy ways to slip in and cause damage.

With mobile fraud rising, relying on outdated defenses is too risky for banks.

How Zero Trust Strengthens Banking Network Security ?

Zero Trust security flips the script: no one is trusted until they are verified. For mobile-first banking security, this approach ensures every customer, employee, and device must prove their identity before accessing data.

Banks apply Zero Trust in three major areas:

Banking Network Micro-Segmentation

Splitting the network into smaller parts stops hackers from moving freely once inside.

Privileged Access Management in Banking

Employees only get access to the systems they truly need, reducing insider risks.

Endpoint Security Strategies for Mobile-First Banks

Every phone, tablet, or laptop is scanned for security issues before being allowed to connect.

Proof That Zero Trust Works in Financial Services

- As per IBM’s 2023 Cost of a Data Breach Report, banks with Zero Trust saved almost $1M per breach compared to banks without it.

- Microsoft Security Blog highlights: “Zero Trust is now the top security priority for financial services organizations, especially as mobile banking adoption grows.”

Clearly, Zero Trust for banking is delivering both cost savings and stronger protection.

Future of Secure Mobile Banking Access with Zero Trust

In the coming years, Zero Trust will work hand-in-hand with AI and automation to make banking safer and smoother. Banks will likely expand:

- Risk-based authentication for mobile banking users that adjusts checks based on unusual behavior.

- Continuous verification in banking sessions to spot and stop fraud in real time.

- Passwordless and secure mobile banking access for better customer experience.

With micro-segmentation, privileged access management, and strong endpoint protections, banks can build a secure mobile banking security strategy that is ready for the future.

Real-World Case Studies of Zero Trust in Mobile-First Banks

Banco Inter (Brazil): Securing a Digital-Only Bank with Zero Trust

Banco Inter, Brazil’s first fully digital bank, serves over 40 million customers mainly through its mobile platform. To keep operations safe, the bank turned to Zero Trust using Zscaler’s Zero Trust Exchange.

The bank secured internet use, private app access, and encrypted all customer traffic. It also extended protection to cloud services and AI tools like InterGPT. This gave Banco Inter a strong and flexible base to grow its mobile-first services while keeping customer data secure.

Source: SiliconANGLE

FirstBank (Romania): Faster Mobile Onboarding with Remote Identity Checks

FirstBank wanted to make account opening easier for mobile users. The bank moved away from slow, manual checks and adopted Entrust’s document and video-based identity verification.

This change cut onboarding time from two days to just eight minutes. Now, customers can safely open accounts and access banking services on their phones without visiting a branch. The process follows Zero Trust by confirming each user’s identity before granting access.

Source: Entrust

Shinhan Bank (South Korea): Mobile Banking Made Safer with Biometrics

Shinhan Bank, one of South Korea’s largest banks, upgraded its mobile app with FIDO-based authentication. Through the Sunny Bank app, customers can log in and manage services like account opening and loans using fingerprint or facial recognition.

This approach removed the need for passwords, lowered fraud risks, and made banking simpler for customers. By using mobile identity verification methods, Shinhan Bank improved both security and trust.

Source: FIDO Alliance

Key Takeaways from Mobile-First Banks

These case studies show how mobile-first banks are applying Zero Trust in practice:

- Banco Inter strengthened its digital services and AI with Zero Trust.

- FirstBank used remote identity verification to make onboarding faster.

- Shinhan Bank adopted biometrics to make mobile access safer.

Together, they prove that Zero Trust security solutions for mobile-first banks can protect customer data, reduce fraud, and support safe digital growth.

Shaping the Future of AI in Finance

Fluxforce research uncovers how banks and enterprises are adapting to fraud, compliance, and data challenges in 2025.

The Future of Zero Trust Security in Mobile-First Banking

Mobile-first banking is now the main way many people use financial services. But with more mobile use comes bigger risks like identity theft, account takeovers, and mobile fraud. This is why Zero Trust security is becoming the key part of mobile banking security strategies.

IBM’s Cost of a Data Breach Report 2023 shows that the average data breach in finance costs about $5.9 million. Juniper Research says global payment fraud losses may cross $343 billion from 2023 to 2027. These numbers show why mobile-first banks must act fast.

How Zero Trust Will Shape Mobile Banking Security

- Continuous Verification: Instead of checking only at login, banks will confirm identity at every step.

- Risk-Based Authentication: Users face extra checks only if their activity looks unusual.

- Device Reputation: Banks will block unsafe devices like rooted or infected phones.

- Stronger Mobile Identity Verification Methods: Biometrics, video checks, and document scans will become common.

- Micro-Segmentation in Banking Networks: Dividing systems into smaller parts will limit damage if a breach happens.

Moving Toward Identity-Centric Security

For mobile-first banks, security will focus on identity—checking the person, the device, and the situation before giving access. Managing employee access and keeping mobile banking safe for customers will be core steps.

As John Kindervag, creator of Zero Trust, said: “Never trust, always verify. Security must become the default position.”

Strengthen Trust in Global Trade

Conclusion

Zero Trust in banking is not a one-time setup. It requires ongoing updates, testing, and monitoring because new risks appear every day. For mobile-first banks, this approach is not just about protecting data. It also helps create smoother mobile services, faster onboarding, and stronger customer confidence.

Banks that adopt Zero Trust can move forward with more freedom to innovate because security is built into every step. By combining strong identity checks, safer devices, and smarter mobile fraud prevention, they can grow in the digital world while keeping customer trust at the center.

Share this article