Listen to our podcast 🎧

Introduction

In the insurance sector, providing the right financial coverage to the right person has always been a key responsibility. While insurers perform a range of checks, from basic identity verification to rigorous AML (Anti Money Laundering) and KYC (Know Your Customer) screenings, errors and oversights still occur, putting companies at risk of fraud, regulatory penalties, and reputational damage. The problem does not lie in the checks themselves but in working without a strategic, well-integrated plan that ensures accuracy, efficiency, and compliance throughout the policy issuance process. Without a clear framework, even advanced verification tools may fail to catch subtle risks or streamline workflows effectively.

In this blog, we will discuss the essential AML and KYC strategies for insurance policy issuance, how to implement them efficiently, and how AI and automation can enhance risk detection and identity verification for claims directors.

What is an AML Check and How It Works for Insurance

An AML check, or Anti-Money Laundering check, is a regulatory requirement designed to prevent financial crimes such as fraud, money laundering, and terrorism financing.

Just as banks perform AML checks to verify the legitimacy of their clients and transactions, insurance companies must ensure that policyholders are not engaged in illicit activities (any kind of fraud, money laundering, or terrorism financing).

Key Elements of AML Checks in Insurance Include:

- Customer Identification: Collecting personal details and verifying government-issued IDs to ensure the policyholder is legitimate.

- Screening Against Watchlists: Checking applicants against global sanctions lists, politically exposed persons (PEP) databases, and negative media reports.

- Transaction Monitoring: Tracking premium payments and claims for unusual or suspicious activity.

- Risk Assessment: Evaluating each policyholder with risk assessment techniques to identify potential financial crime involvement.

How to Implement AML Checks During Insurance Policy Issuance

Implementing effective AML checks is essential to protect insurance companies from fraud and financial crime. A well-structured process helps identify high-risk applicants, ensures compliance, and allows claims directors to manage risk efficiently. Below is a checklist for a successful AML implementation:

1. Customer Onboarding Verification

Collect accurate personal information and verify government-issued IDs during onboarding. This foundational step ensures applicants are legitimate and forms the first layer of AML risk checks in the insurance policy issuance process.

2. Screening Against Watchlists

Rigorously screen applicants against global sanctions lists, PEP databases, and negative media sources to identify high-risk individuals. Using automated tools for this step improves accuracy, speed, and consistency across all applications.

3. Risk-Based Assessment

Assign risk scores to each applicant based on location, financial background, and transaction history. High-risk applicants undergo enhanced scrutiny to minimize exposure to fraud.

4. Transaction and Policy Monitoring

Monitor premium payments, claims submissions, and overall policy activity for unusual or suspicious patterns. Real-time monitoring enables early detection of fraud or money laundering attempts, allowing timely intervention.

5. Documentation and Audit Trails

Maintain comprehensive records of onboarding, screenings, risk scores, and monitoring outcomes. Proper documentation provides transparency, ensures audit readiness, and demonstrates compliance with regulatory requirements.

6. Periodic Review and Updates

Regulations and fraud tactics evolve rapidly. Regularly update watchlists, refine risk models, and review AML protocols to ensure the system stays effective and aligned with current compliance standards.

The Importance of Integrating AML Screening into Digital Insurance Onboarding

With the rise of digital insurance platforms, traditional AML and KYC processes have become less effective. Conducting AML checks online is now essential to verify applicants quickly and accurately. Here's how insurers can strengthen digital onboarding with AML screening:

Automated Identity Verification

Using AML ID check tools, insurers can instantly verify government-issued documents and personal details. This reduces manual errors and ensures applicants are legitimate from the start.

Real-Time Watchlist Screening

Integrating automated screening against sanctions lists, PEP databases, and negative media sources allows instant detection of high-risk applicants. This ensures suspicious profiles are flagged immediately for further review.

Seamless Digital Workflow

Embedding AML screening into digital insurance onboarding ensures compliance checks occur without disrupting the applicant experience. Policies can be issued faster while maintaining full regulatory adherence.

Continuous Monitoring and Updates

Digital onboarding systems enable ongoing monitoring of policies and transactions. Coupled with regular updates to watchlists and verification protocols, this approach ensures that AML risk checks in the insurance policy issuance process remain effective over time.

Benefits for Claims Directors

By adopting these strategies, claims directors can focus on high-risk cases, reduce fraud exposure, and improve operational efficiency, making the onboarding process safer and faster.

-1.png?width=1200&height=628&name=hubspot%20blog%20(6)-1.png)

Shaping the Future of AI in Finance

Fluxforce research uncovers how banks and enterprises are adapting to fraud, compliance, and data challenges in 2025.

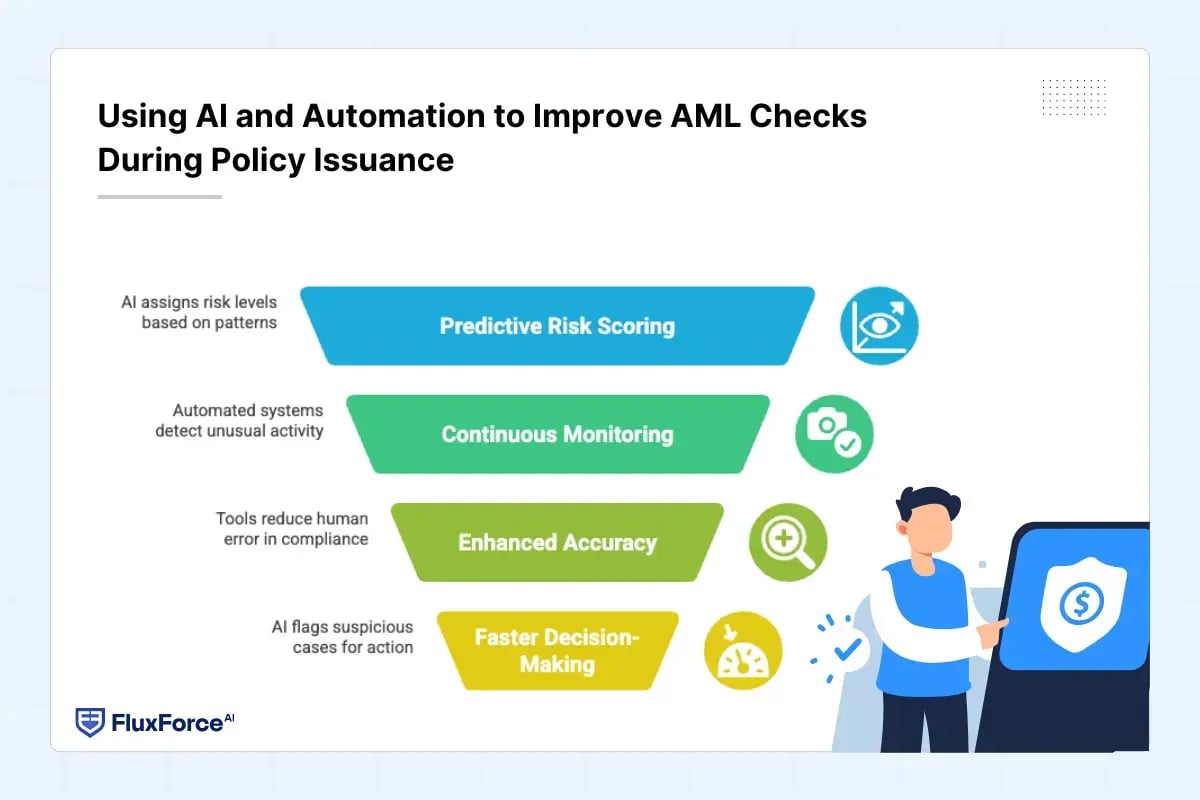

Using AI and Automation to Improve AML Checks During Policy Issuance

AI and automation are transforming how insurance companies perform AML verification. By leveraging AI for AML checks in insurance policy issuance, firms can process large volumes of applications quickly and accurately. Here are some of the benefits of AI and automation in AML checks:

- Predictive Risk Scoring: AI systems analyse applicant data to assign risk levels based on historical fraud patterns. This complements AML checks and strengthen the insurance policy issuance process.

- Continuous Transaction Monitoring: Automated systems detect unusual payment or claims activity, providing real-time alerts for potentially fraudulent behaviour.

- Enhanced Accuracy and Consistency: AML and KYC automation tools for insurance companies reduce human error, ensuring consistent application of compliance rules across all applicants.

- Faster Decision-Making: AI can instantly flag suspicious applicants or transactions, allowing claims directors to take prompt action without delaying policy issuance.

Key KYC/AML & Identity Verification Strategy for Claims Directors

For claims directors, processing claims while protecting against financial crimes is a critical responsibility. Without strong KYC and AML strategies, they risk compliance failures and increased exposure to fraud.

Here are some effective strategies designed to strengthen verification, monitoring, and reporting within daily operations.

- Risk-Based Onboarding: Not all applicants pose the same risk. Implement risk scoring during the AML verification process to identify high-risk clients for enhanced checks.

- Layered Verification: Combine AML checks, government ID verification, and watchlist screening to ensure comprehensive compliance.

- Real-Time Monitoring: Use online AML checks and automated monitoring tools to track policy activity and flag suspicious transactions immediately.

- Regular Review and Updates: Stay updated with evolving regulations, sanctions list, and KYC compliance requirements. For example, KYC compliance requirements for insurance companies in 2025 may require additional identity verification measures or enhanced reporting.

- Training and Awareness: Ensure all staff involved in policy issuance understand AML and KYC requirements. Well-informed claims directors can make better decisions on flagged accounts or high-risk applicants.

- Documentation and Audit Trails: Maintain detailed records for every step of the AML verification process. An AML check is not just compliance—it ensures accountability and regulatory readiness.

Conclusion

AML and KYC checks are now a critical component of risk management in insurance policy issuance. While traditional verification methods reduce some risk, errors often persist without a strategic, well-integrated plan. By combining AI-driven solutions with automated AML checks, thorough identity verification, and regular monitoring, claims directors can safeguard their companies from fraud and regulatory penalties. Implementing robust AML verification frameworks, risk-based assessments, and digital onboarding integrations ensures that policies are issued efficiently, safely, and compliantly.

.webp)

Share this article