Listen to our podcast 🎧

Introduction

The digitalization of insurance workflows has made transactions significantly faster and easier, with policyholders benefiting from seamless recurring payments and quicker claims processing. However, this convenience brings a new challenge for insurers.

Payment and claims fraud have risen sharply across the sector. This makes secure payment processing a top concern for CISOs. The Coalition Against Insurance Fraud reported losses reaching $308 billion in 2024. That figure reflects a 25 per cent jump compared to previous years.

Companies also face growing compliance pressure from standards like PCI DSS. This marks the urgency for CISOs to implement robust security techniques and protect the organization’s assets.

This article explains the key strategies for CISOs in securing payment gateways and also how automation in insurance underwriting contributes to modern security practices.

The Challenge of PCI/DSS Compliance and Payment Gateway Risk Management for CISOs

For CISOs in insurance, compliance and payment security are key to ensuring an organization’s regulatory positioning, operational resilience, and policyholder trust. But with increasing online fraud and evolving regulations, it poses challenges, including:

1. Frequent Updates to PCI DSS Standards

Ongoing revisions under PCI DSS standards require insurers to constantly adjust payment security steps, record-keeping methods, and login checks. Without technology, this creates resource strain and compliance fatigue for CISOs.

2. Accountability for Third-Party Gateway Compliance

Insurance companies often depend on external payment providers. When vendors lag in compliance or fail audits, CISOs remain accountable, exposing the organization to regulatory and financial risks.

3. Increased Fraud in Digital Premium Transactions

Premium payments attract sophisticated fraud methods, including synthetic identities, account takeovers, and automated attacks. With manual risk checks, organizations fail to maintain detection accuracy.

4. Growing Regulatory Issues and Audit Demands

Supervisory authorities have expanded expectations for continuous monitoring and evidence-based reporting. Teams face increasing pressure to deliver compliance proof under strict timelines.

5. Increased Exposure to Gateway Disruptions

Attacks on payment gateways are significantly increasing every year. Even brief downtime disrupts policyholder trust and damages the insurer’s operational resilience.

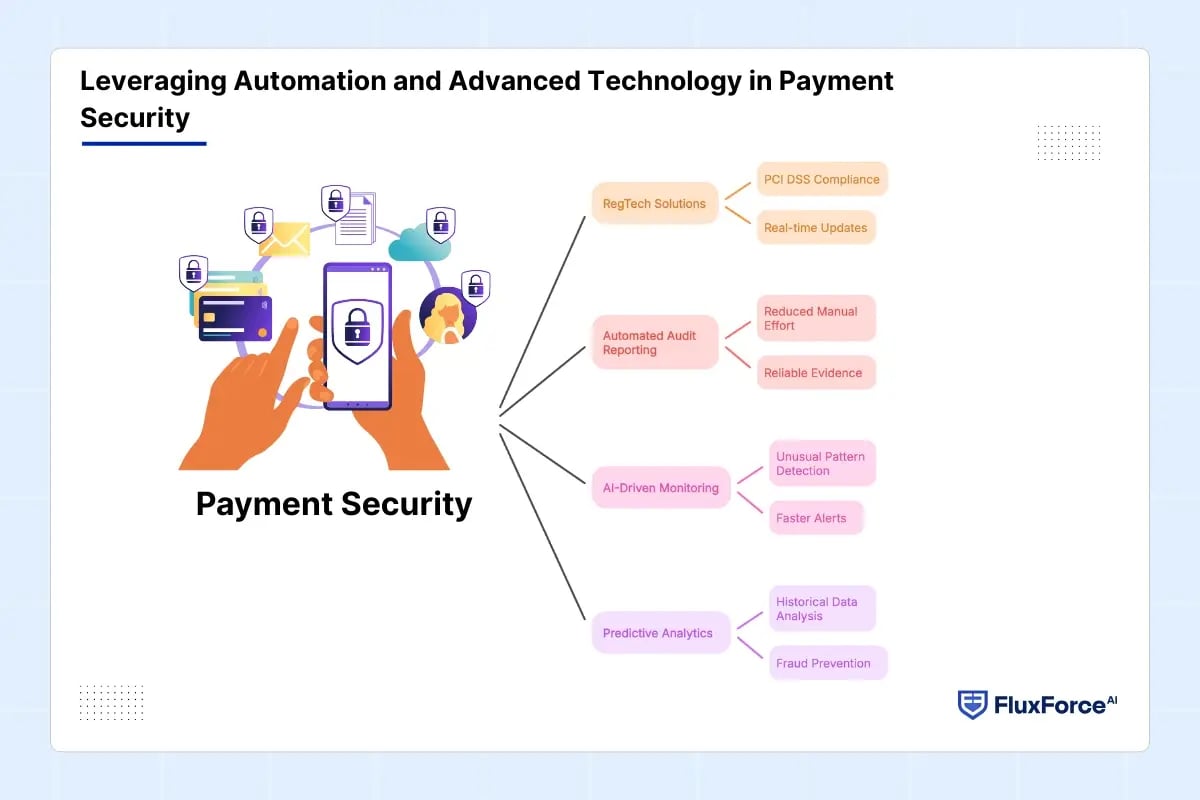

Leveraging Automation and Advanced Technology in Payment Security

With growing challenges faced by CISOs, manual controls are no longer enough. Insurance underwriting systems need automation and advanced tools that support proactive payment security and maintain compliance with PCI DSS standards. These include:

1. RegTech Solutions for Real-time Compliance Updates- RegTech platforms update compliance checks instantly. They track PCI DSS changes, flag gaps, and keep insurance companies aligned with evolving requirements without relying on yearly audits.2. Automated Solutions for Consistent Audit Reporting- Automated underwriting systems help CISOs optimize audit reporting by cutting manual preparation time, reducing mistakes, and providing reliable compliance evidence to regulators.

3. AI-Driven Continuous Monitoring- AI-driven monitoring checks recurring payments and claim transactions instantly. It identifies unusual patterns in real time and reduces false positives. This helps CISOs gain faster alerts for quick fraud response.

4. Predictive Analytics for Risk Forecasting- Predictive tools study historical premium payments and claims data patterns. They spot irregularities like sudden policy cancellations or repeated claim attempts. These insights help CISOs address fraud before it spreads.

Enterprise-Level Secure Payment Gateway Strategies for Insurance CISOs

Protecting digital payments in insurance requires strategies that combine cybersecurity, regulatory compliance, and advanced monitoring across all gateways.

1. Cybersecurity Strategy for Secure Insurance Digital Payments

1. Multi-Factor Authentication (MFA):

MFA protects policyholder accounts by combining OTPs, push notifications, and biometric verification. This ensures only authorized users have access to premium payment portals and sensitive insurance data.

2. Encryption and Tokenization:

Encrypt all transaction and policy data during transfer and storage. Tokenization replaces card or bank details with unique tokens, minimizing exposure if systems are breached.

3. DDoS and Threat Mitigation:

Deploy intrusion detection, traffic filtering, and anti-DDoS tools. This safeguards online premium collections, underwriting platforms, and claim processing against downtime or cyberattacks.

4. Endpoint Security Controls:

Install endpoint protection on staff devices and internal servers. Monitoring and device hardening prevent breaches affecting payment gateways, underwriting systems, and claims databases.

2. Payment Compliance Strategy in the Insurance Sector

1. PCI DSS Alignment:

Regular mapping of premium processing systems to PCI DSS standards reduces compliance gaps. CISOs maintain audit readiness while avoiding fines or operational disruptions.

2. RegTech for Compliance Tracking:

Automated RegTech tools continuously track changing insurance and payment regulations, flagging gaps in premium collections, recurring policy management, and claims processing.

3. Audit-Ready Reporting:

Automated reporting tools generate standardized compliance evidence, showing secure premium collection, claims transactions, and adherence to PCI DSS, reducing manual documentation errors.

3. Technology-Driven Strategy for Payment Security

1. AI-Powered Transaction Analysis:

AI monitors recurring premiums, claim payouts, and policy adjustments. It detects anomalies like duplicate payments, sudden cancellations, or unusual claim patterns in real time.

2. Predictive Risk Modelling:

Historical claims, premium history, and underwriting data feed predictive models. Insurers can identify potential fraud hotspots and operational vulnerabilities before incidents escalate.

3. Adaptive Fraud Alerts:

Alerts prioritize high-risk activities, including multiple policy cancellations, suspicious claim sequences, or irregular premium amounts. Teams can intervene instantly to prevent losses.

-1.png?width=1200&height=628&name=hubspot%20blog%20(6)-1.png)

Shaping the Future of AI in Finance

Fluxforce research uncovers how banks and enterprises are adapting to fraud, compliance, and data challenges in 2025.

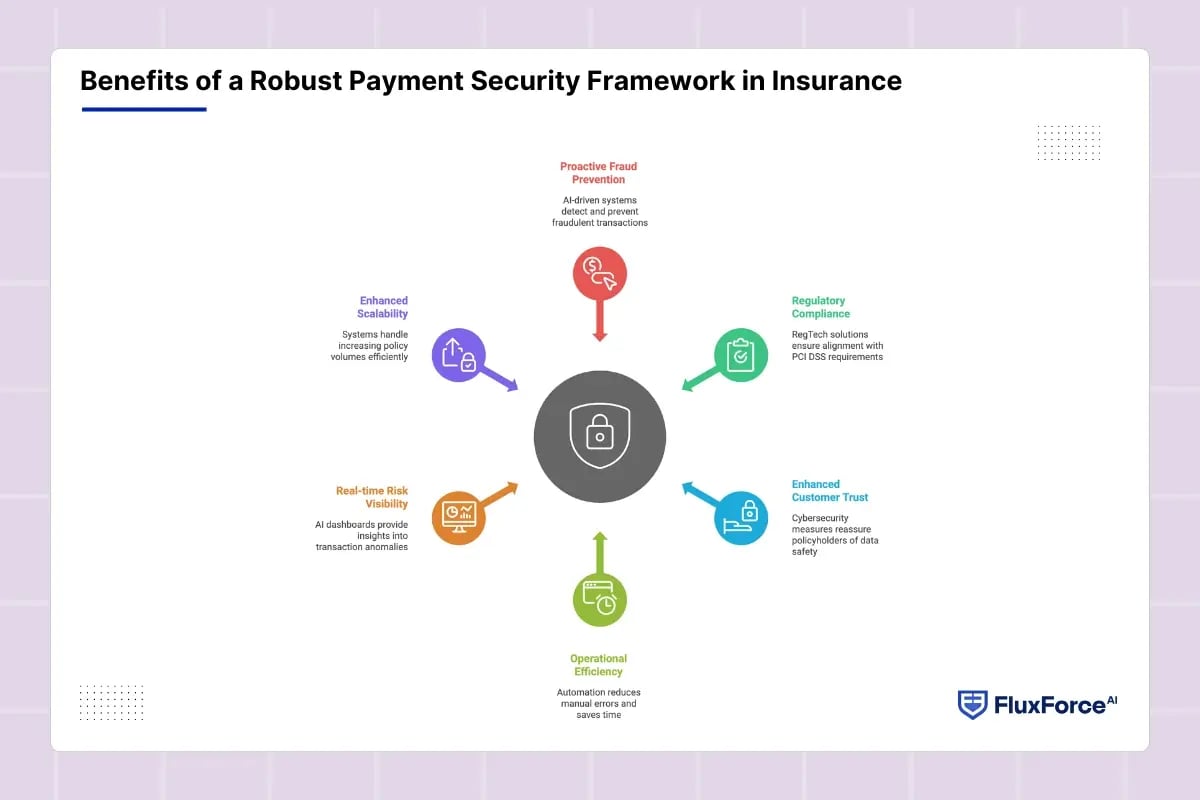

Benefits of a Robust Payment Security Framework in Insurance

A strong policy payment security framework strengthens online transaction processing and ensures consistent compliance. Key benefits include:

- Proactive Fraud and Loss Prevention: AI-driven payment gateways detect suspicious transaction patterns early and prevent fraudulent claims. In 2024, insurers reduced payment fraud losses by 18% using automated monitoring.

- Regulatory Compliance: Modern RegTech solutions help organizations align with PCI DSS compliance requirements in real-time. CISOs can also ensure audit readiness and avoid penalties while maintaining operational continuity.

- Enhanced Customer Trust: Robust cybersecurity protection reassures policyholders that their payments and claims data remain safe. Higher trust correlates with a 12–15% increase in policy renewals.

- Operational Efficiency: Automation reduces manual payment processing and reconciliation errors significantly. Underwriting teams can save time, money, and allow staff to focus on high-value tasks like risk assessment.

- Real-time Risk Visibility: AI-enabled continuous monitoring provides CISOs with dashboards showing transaction anomalies and compliance gaps. This helps make faster, data-driven decision making.

- Enhanced Scalability: Automated payment and claims systems handle increasing policy volumes efficiently. This supports new insurance products and ensures consistent security and PCI DSS.

Best Practices for Secure Online Premium Collection for Insurance Companies

Ensuring fair transaction processing and maintaining compliance with evolving regulations is the top priority for CISOs in insurance companies. Below are the best practices for secure online premium collection:

1. Securing Payment Gateway

Payment gateways should use multi-factor authentication, encryption, and tokenization. Furthermore, CISOs must regularly test systems for vulnerabilities. This ensuring fraud attempts are detected early, and transactions remain compliant with PCI DSS standards.2. Leveraging the Best Automated Underwriting Technology

Automated underwriting platforms integrate payment validation and fraud detection. They reduce manual errors, accelerate premium processing, and maintain consistent PCI compliance.3. Implementing AI for Transaction Monitoring

AI analyses premium payments and claim transactions in real time. It detects irregular patterns, flags suspicious activity, and alerts risk teams immediately, reducing fraud losses and operational exposure across insurance workflows.4. Automating Audit Reporting and Compliance Tracking

Integrated automation generates audit-ready compliance reports for regulators. This helps gain instant visibility into PCI gaps, transaction anomalies, and system performance, eliminating manual documentation and streamlining regulatory inspections.5. Strengthening Policyholder Payment Interfaces

Secure, intuitive portals for premium submission minimize errors and fraud attempts. Consistently educating policyholders on safe payment practices further reinforces trust.

Conclusion

Effective payment gateway risk management is critical for insurance companies to protect premiums, policyholder data, and claims processes. Combining advanced tools with underwriting process automation reduces manual errors, accelerates premium collection, and strengthens operational resilience.

Maintaining strict PCI compliance ensures regulatory adherence while minimizing audit risks and potential penalties. Enterprise-level strategies—including multi-factor authentication, AI monitoring, predictive analytics, and RegTech solutions—create a secure, efficient, and trustworthy payment environment.

Insurers that integrate these measures can detect fraud early, optimize workflows, and maintain policyholder confidence, positioning their organizations for secure and sustainable digital growth in the evolving insurance landscape. ompliance.

.webp)

Share this article