Listen To Our Podcast🎧

Introduction

Compliance has evolved from a quarterly check to a real-time mandate. As regulatory frameworks evolve and enforcement pressure intensify, enterprises often struggle with conventional AI to monitor, detect, and show adherence continuously.

Under this demanding phase, Agentic AI brings compliance systems that can act, learn, and adapt autonomously. With regulatory workflows operating continuously and independently, these systems detect irregularities instantly.

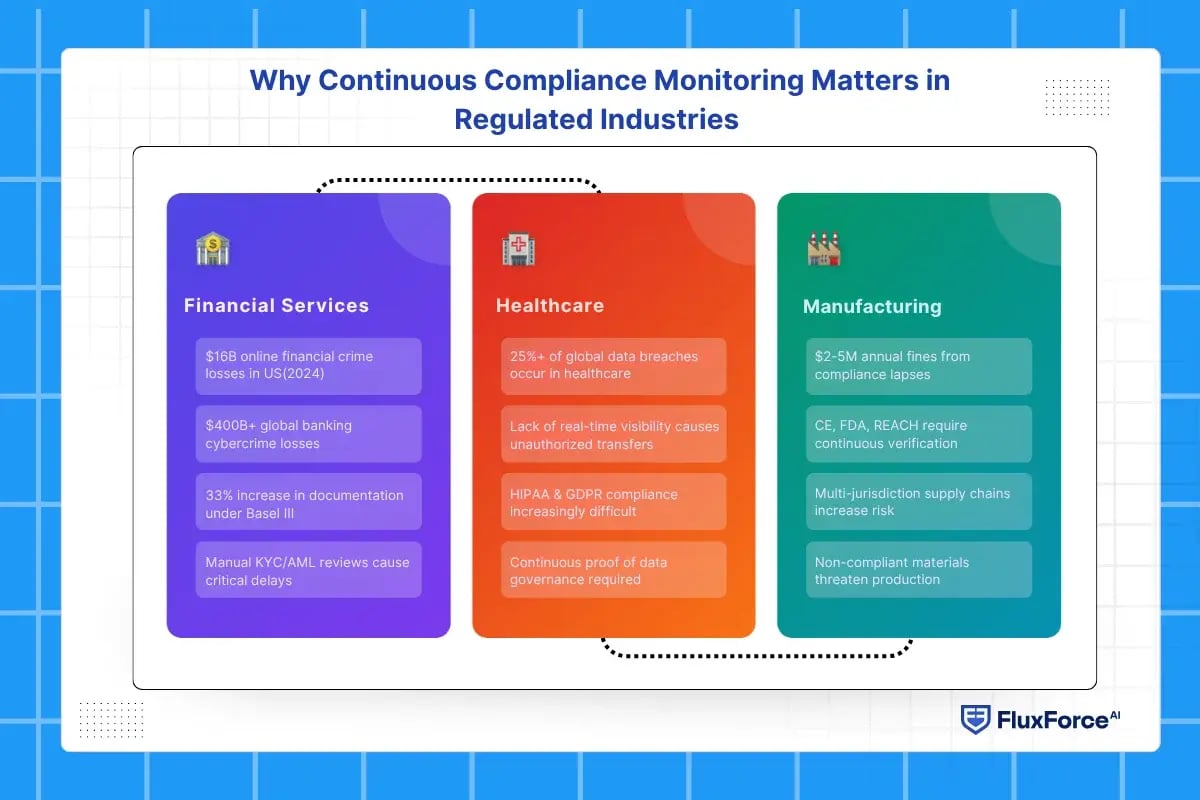

Why Continuous Compliance Monitoring Matters in Regulated Industries

Compliance requirements have evolved as digital transformation has accelerated. Organizations have experienced a sharp rise in transaction volumes and increasingly vulnerable data surfaces, contributing to online financial crime losses worth $16 billion in the US alone in 2024.

For regulated industries, continuous compliance monitoring is no longer only about avoiding fines. It’s about strengthening security and enabling faster responses to unusual activities. Here’s why the shift toward continuous compliance has become essential across sectors:

In Financial Services

- With the rise in transaction volumes, manual KYC and AML reviews led to financial and reputational losses due to delays and human error.

- Global banking cybercrime losses reached over $400 billion, highlighting the cost of delayed response.

- Complex regulations like Basel III and FATF require constant evidence, increasing operational burden.

- Compliance teams face heavier workloads under Basel III and FATF frameworks, with documentation requirements increasing by nearly one-third.

In Healthcare

- Healthcare is now accounting for more than 25% of global data breaches, making compliance with HIPAA and GDPR increasingly difficult.

- The primary cause of unauthorized data transfers is a lack of real-time visibility.

- Audit pressure has intensified as regulators demand continuous proof of data governance and clinical adherence.

In Manufacturing & Supply Chain

- Product safety and environmental standards such as CE marking, FDA, and REACH now require continuous verification.

- Supply chains spanning multiple jurisdictions increase the risk of non-compliant materials entering production.

- Every year, compliance lapses cost manufacturers between $2–5 million annually in fines.

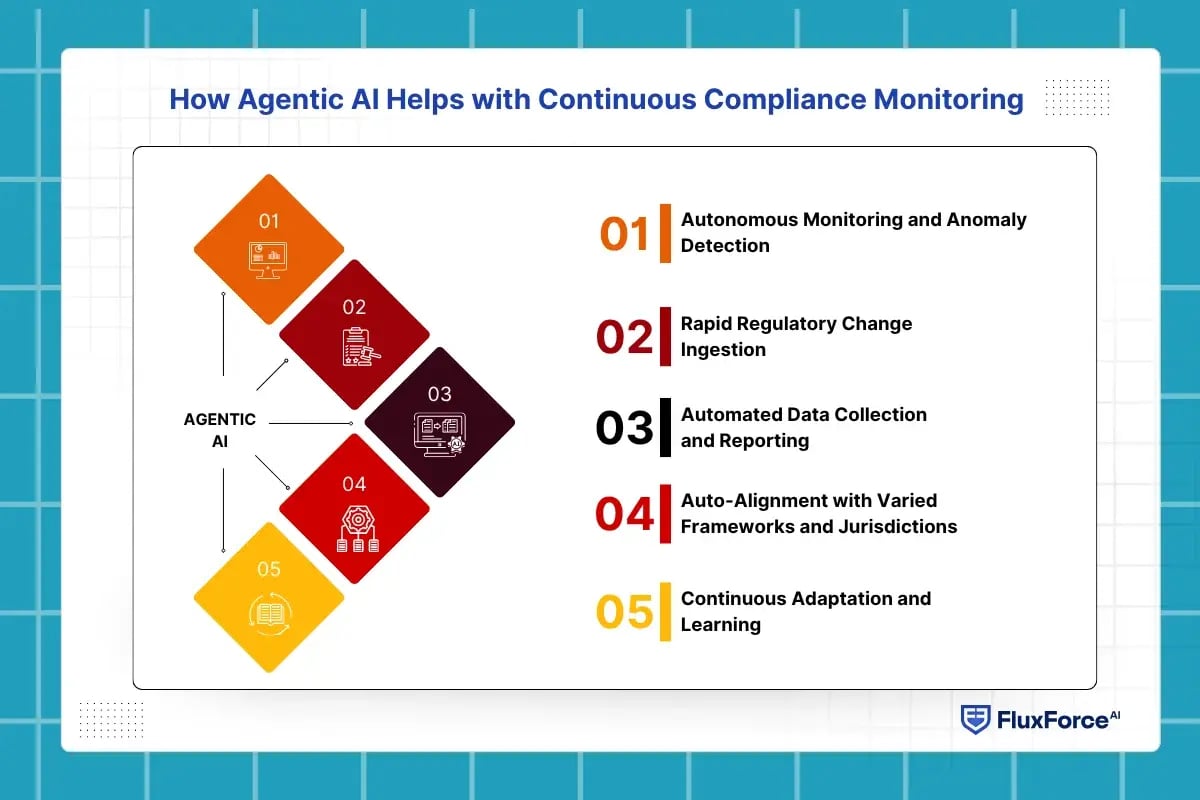

How Agentic AI Helps with Continuous Compliance Monitoring

Agentic AI operates autonomously. Rather than just offering insights, it actively executes compliance tasks to enable intelligent compliance management for organizations. Here’s how this advanced AI ensures continuous, real-time compliance reporting and monitoring:

1. Autonomous Monitoring and Anomaly Detection

Agentic AI 24/7 scans transactions, communications, and system logs to detect unusual patterns. With its self-directed ability to flag or assign alerts, it enables near-instant responses, reducing detection time by up to 70% compared to manual reviews.

2. Rapid Regulatory Change Ingestion

When new regulatory rules or updates are issued, AI agents integrated with regulatory databases automatically interpret and apply them within existing compliance frameworks. This minimizes policy lag, enabling institutions to align with revised FATF, GDPR, or HIPAA requirements within hours.

3. Automated Data Collection and Reporting

AI agents aggregate compliance data across departmental channels, independently validate its accuracy, and compile structured, immutable reports for internal audits. This process eliminates manual handling errors and achieves over 90% accuracy in report generation.

4. Auto-Alignment with Varied Frameworks and Jurisdictions

Agentic AI automatically aligns compliance controls across multiple regulatory frameworks and jurisdictions. It interprets overlaps between standards such as Basel III, GDPR, and FATF guidelines, streamlining control structures to reduce redundancy.

5. Continuous Adaptation and Learning

Powered by machine learning, Agentic AI continuously refines its compliance logic through reinforcement learning and past case handling. It adapts to emerging fraud patterns and enhances predictive accuracy capabilities that conventional AI systems struggle to achieve.

Shaping the Future of AI in Finance

Fluxforce research uncovers how banks and enterprises are adapting to fraud, compliance, and data challenges in 2025.

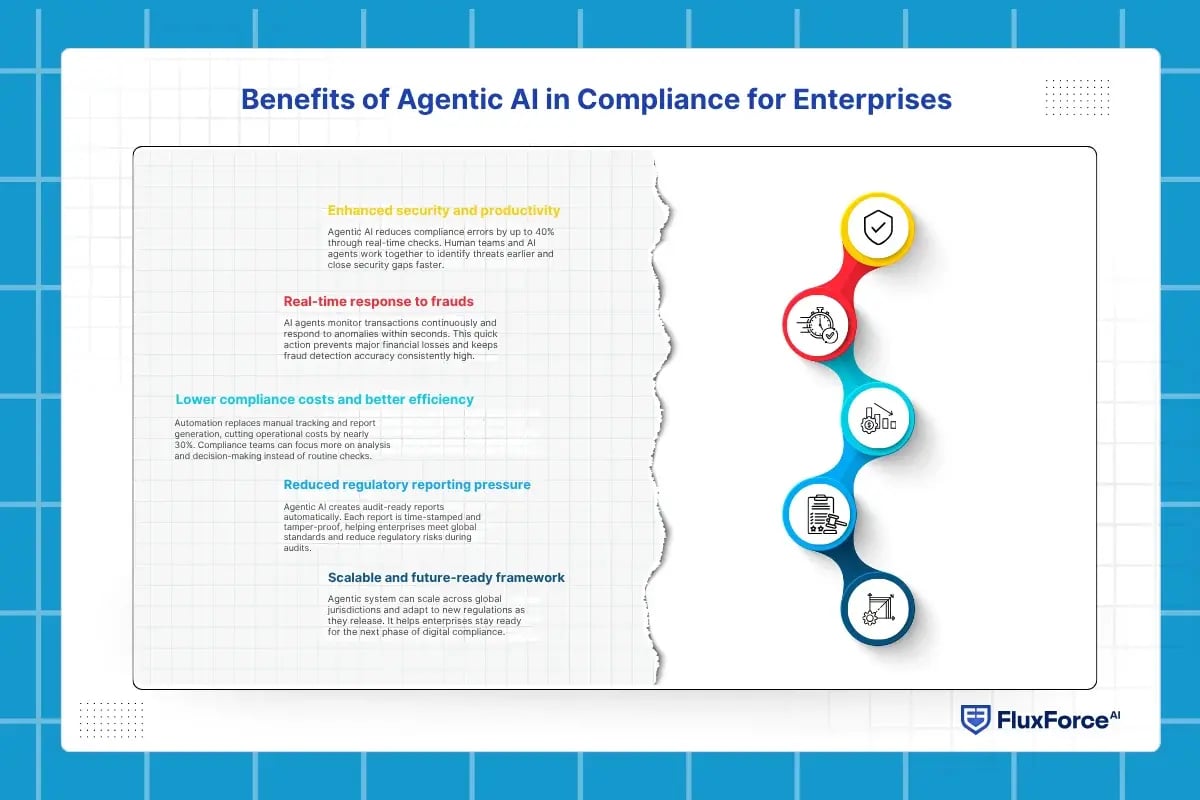

Benefits of Agentic AI in Compliance for Enterprises

Integrating Agentic AI into compliance operations enables organizations to manage evolving fraud techniques, rising data complexity, and regulatory workloads with higher accuracy and lower response time.

Key benefits include:

- Enhanced security and productivity: Agentic AI reduces compliance errors by up to 40% through real-time checks. Human teams and AI agents work together to identify threats earlier and close security gaps faster.

- Real-time response to fraud: AI agents monitor transactions continuously and respond to anomalies within seconds. This quick action prevents major financial losses and keeps fraud detection accuracy consistently high.

- Lower compliance costs and better efficiency: Automation replaces manual tracking and report generation, cutting operational costs by nearly 30%. Compliance teams can focus more on analysis and decision-making instead of routine checks.

- Reduced regulatory reporting pressure: Agentic AI creates audit-ready reports automatically. Each report is time-stamped and tamper-proof, helping enterprises meet global standards and reduce regulatory risks during audits.

- Scalable and future-ready framework: Agentic system can scale across global jurisdictions and adapt to new regulations as they release. It helps enterprises stay ready for the next phase of digital compliance.

Using AI Agents for Regulatory Compliance Tracking: Real World Cases

SecureBank (Regional U.S. Bank) Case Study (Improptu)

SecureBank implemented an agentic-AI platform to monitor transactions in real time, automate regulatory reporting, and reduce operational risk.

The discovered benefits after integrating an AI agent:

- Compliance rate improved to 95% after deployment.

- Operational risk reportedly reduced by 80% via predictive analytics and continuous monitoring.

- Accuracy of flagged transactions rose to 99.9%.

Key Insights for Businesses

- AI agents dramatically increase monitoring coverage and identify more issues earlier.

- Faster detection leads to lower fraud losses and fewer manual hours spent on oversight.

- Higher accuracy reduces false positives and keeps compliance teams focused on real risks.

- Automated systems produce audit-ready documentation, helping handle regulatory pressure more reliably.

- Implementation cost savings allow reallocation of human resources to strategic tasks rather than rote compliance.

- Continuous monitoring frameworks scale across larger volumes and evolving regulations, helping firms remain resilient.

Onboard Customers in Seconds

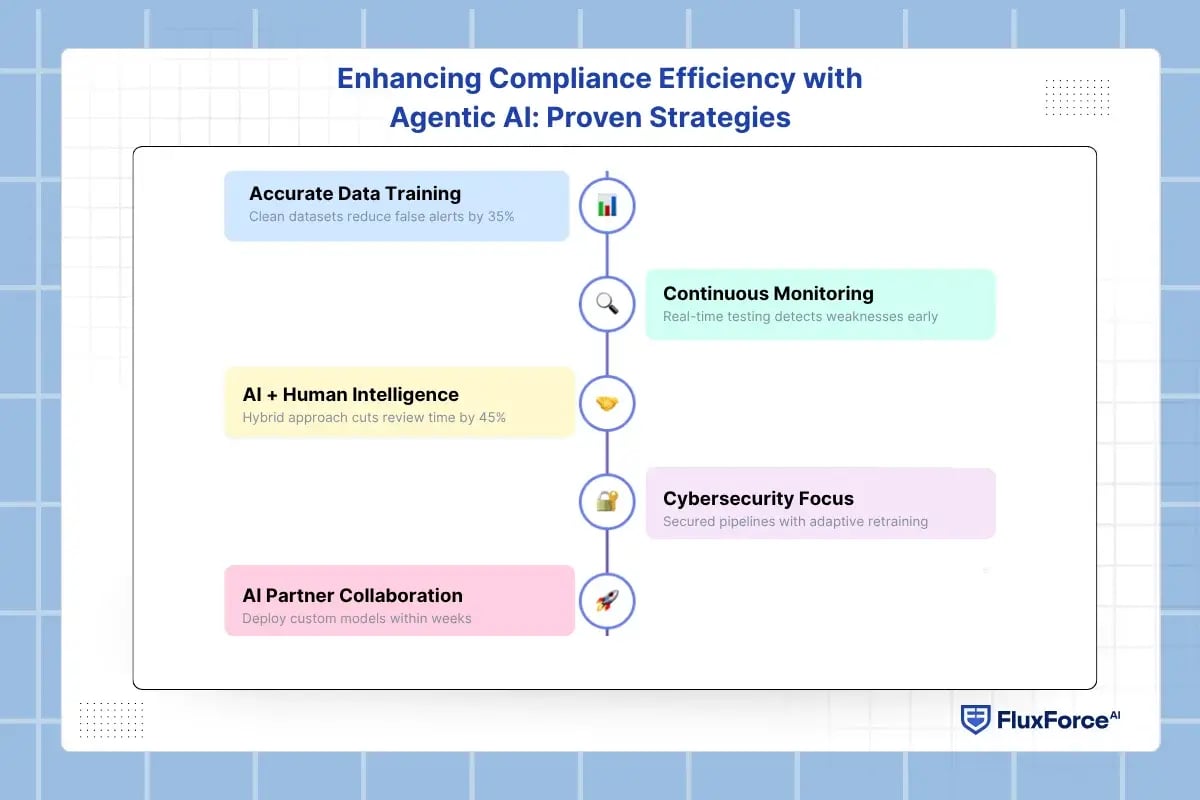

Enhancing Compliance Efficiency with Agentic AI: Proven Strategies

For organizations, it is essential to know about scalable strategies that help Agentic AI operate with precision, resilience, and transparency.

Proven strategies include:

1. Ensuring Model Training with Accurate Data

Agentic AI delivers reliable results only when trained on verified, bias-free data. Using clean datasets and synthetic validation reduces false alerts by up to 35%. With consistent data labelling and multi-source verification, organizations can improve decision accuracy and model accountability.

2. Implementing Continuous Monitoring in Testing Environments

Running compliance models in controlled, real-time testing environments detects weaknesses before deployment. Continuous monitoring helps identify drift, adapt to new regulations, and maintain consistent performance metrics without disrupting ongoing compliance operations.

3. Combining Agent’s Autonomy with Human Intelligence

While agents act independently, human intervention ensures contextual decision-making. This hybrid model boosts accuracy and trust, cutting manual review time by 45%.

4. Cybersecurity and Model Optimization

Securing model pipelines protects sensitive data from tampering and breaches. Regular optimization, encryption, and threat modelling improve response time and resilience. Moreover, updating the system through adaptive retraining keeps compliance models aligned with the latest security standards.

5. Partnering with Specialized AI Providers

Working with compliance-focused AI partners like FluxForce helps enterprises deploy custom, pre-built AI models within few weeks. With tech partners, organizations get domain expertise, pre-trained frameworks, and scalable infrastructure, reducing integration time and ensuring full transparency in audit trails.

Conclusion

Ensuring continuous compliance with regulations requires systems that enable real-time monitoring and make decisions with precision. Agentic systems deliver exactly that—autonomous capabilities to monitor, interpret, and act on regulatory changes as they occur.

The role of Agentic AI in governance and risk management is unmatched, offering analytical precision, contextual intelligence, and verifiable audit readiness beyond traditional AI.

Its agents operate within defined parameters while continuously learning from evolving regulatory inputs. This advancement defines a new phase of intelligent compliance monitoring—where accuracy, accountability, and agility combine to maintain enterprise alignment with complex, regulatory demands.

.webp)

Share this article