Listen To Our Podcast🎧

Introduction

False positives in transaction monitoring, compliance workflows, and AML programs impose hidden but serious issues for organizations. Analysts spend millions resolving alerts that rarely indicate real risk.

Industry reports show that nearly 70% of alerts generated under AML and transaction monitoring frameworks are false positives. The cost of investigating these unnecessary alerts can sometimes exceed the impact of actual breaches.

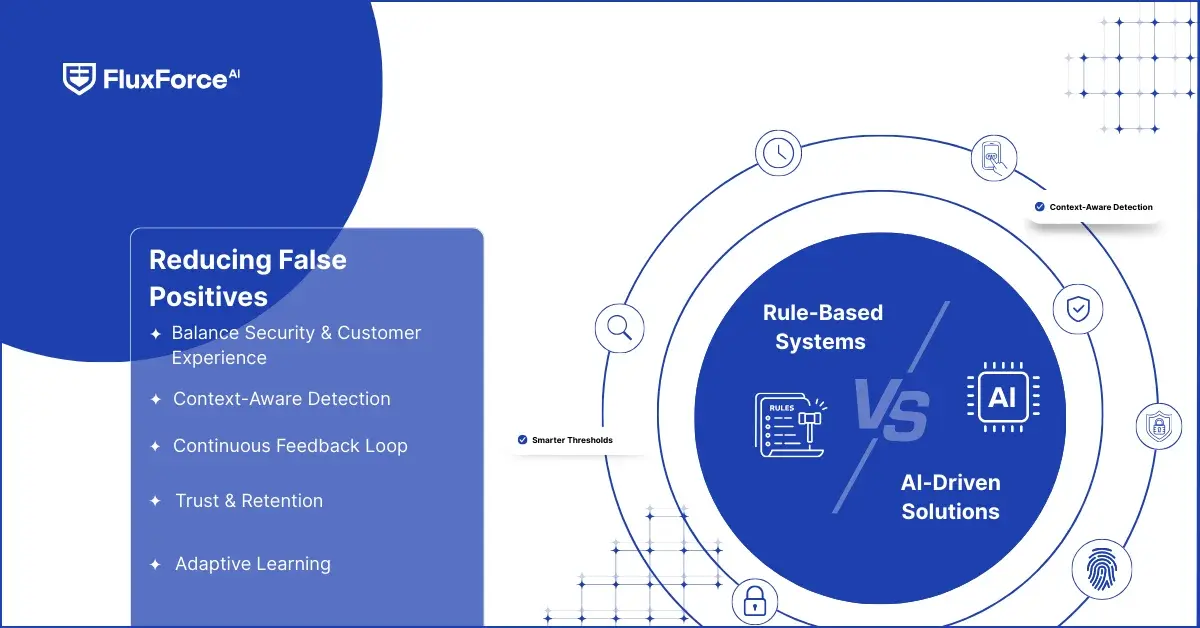

Two primary approaches: traditional rule-based screening, which relies on static thresholds, and advanced AI-driven solutions, which adapt to behavioural patterns, offer distinct mechanisms for reducing false positives and operational burden.

This article examines the comparative effectiveness of both rule-based systems and AI-driven solutions in reducing false positives. Also, it highlights measurable improvements and practical considerations for implementation.

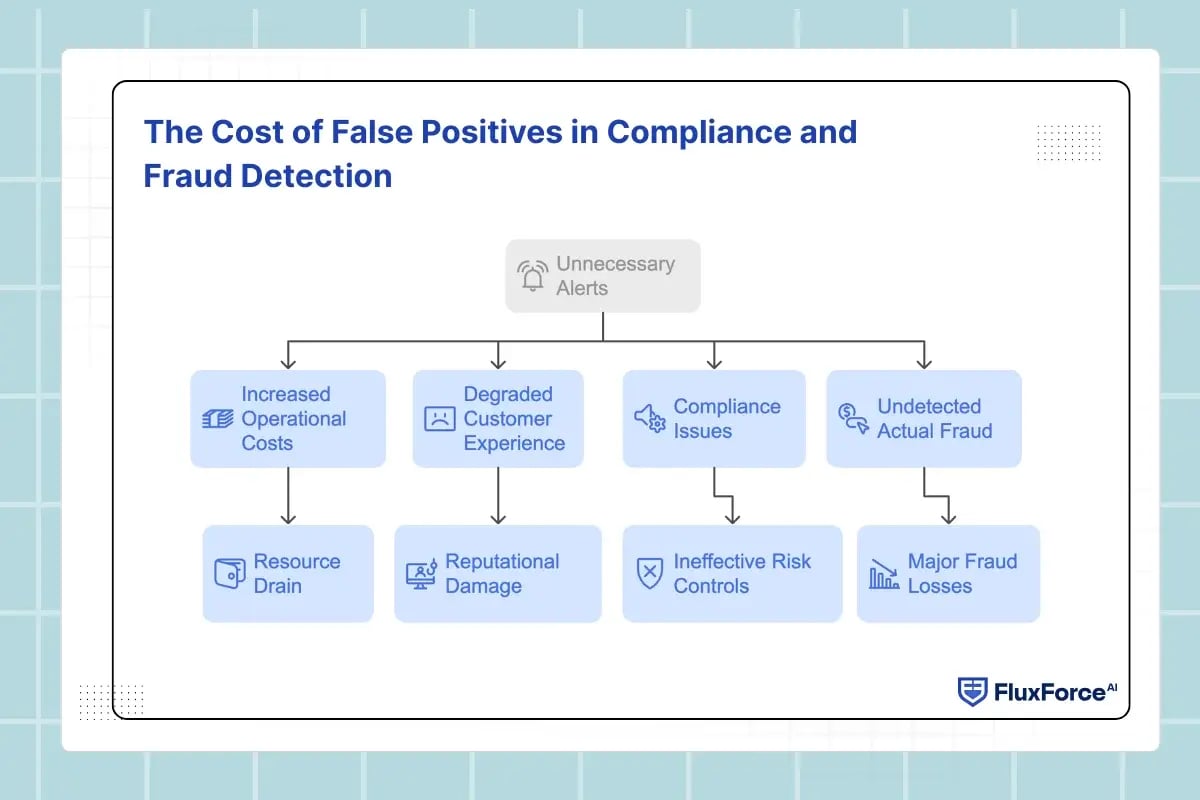

The Cost of False Positives in Compliance and Fraud Detection

In regulated environments, each unnecessary alert drains resources and reduces the overall effectiveness of fraud prevention frameworks.

- Increased Operational Costs: Institutions spend billions annually reviewing alerts that lead nowhere. A 2023 study estimated that banks waste nearly £2.7 billion each year chasing false AML leads.

- Degraded Customer Experience: In high-volume retail banking, excessive false positives result in repeated customer requests and reputational damage, ultimately leading to customer and revenue loss.

- Compliance Issues: Excessive false positives undermine the credibility of an institution’s monitoring framework. Regulators interpret high false positive volumes as a sign of ineffective risk controls, even if no violations are found.

- Undetected Actual Fraud: Analysts buried under thousands of false alerts often lose focus on true suspicious activity. This leads to major fraud-related losses.

Increased false positives are primarily a result of the limitations of rule-based detection that applies rigid rules, static thresholds, and has no learning capability.

How Rule-Based Monitoring Systems Impact False Positive Rates

In high-volume, digitally operated banks and large-scale transaction environments, rule-based systems are prone to producing elevated false positive rates.

The key reasons rule-based screening creates inefficiencies include:

Static Thresholds and Rules-Based Flagging:

- Rules are predefined and do not adjust to changing transaction patterns, making them prone to triggering alerts for legitimate activities.

- Lack of contextual understanding leads to an overabundance of unnecessary alerts.

Limited Adaptability:

- Rule-based systems cannot learn from historical outcomes or adjust dynamically.

- They fail to account for evolving fraud strategies, leaving institutions reactive rather than proactive.

High Volume of Alerts:

- With an increase in transaction volumes, the number of false alerts rises.

- Analysts are often burdened, which increases investigation time and operational costs.

Difficulty in Handling Complex Scenarios:

- Multi-dimensional transactions and cross-border operations often fall outside the scope of static rules.

- Complex fraud patterns can go undetected, while legit transactions are flagged unnecessarily.

Maintenance and Update Challenges:

- Rules require constant manual updates to remain relevant to new regulations or fraud patterns.

- Inefficient updates can increase both false positives and gaps in detection.

How AI Reduces False Positives in Fraud Detection

Modern AI systems leverage machine learning for false positive detection and automatically flag genuinely suspicious activity through major integrated technologies.

Adaptive Pattern Recognition

- Machine learning models identify unusual behaviour based on historical trends rather than static thresholds.

- Reduces irrelevant alerts by distinguishing between legitimate anomalies and actual risk.

Intelligent Compliance Automation

- AI automates repetitive monitoring and initial investigations, reducing manual workload.

- Enables analysts to focus on high-risk cases, improving efficiency and decision accuracy.

Predictive Analytics in Fraud Detection

- Models predict potentially fraudulent activity before it occurs using transactional and behavioural data.

- Proactively reduces false positives by prioritizing high-probability risk events.

Continuous Learning and Feedback Loops

- Systems update models in real-time as new data becomes available.

- Improves detection accuracy over time, adjusting to emerging fraud patterns.

Context-Aware Risk Scoring

- AI evaluates transactions in a multi-dimensional context, including customer behaviour and historical trends.

- Minimizes unnecessary alerts while maintaining compliance with regulatory requirements.

AI vs Rule-Based Approaches in Compliance & Transaction Monitoring

The operational and detection efficiency between rule-based and AI-driven systems is significant. Here’s a quick comparison of their performance across key metrics.

|

Key Metrics |

Rule-Based Systems |

AI-Driven Solutions |

|

Detection Accuracy |

Moderate accuracy, often 60–70% of alerts are false positives in high-volume banking environments. |

High accuracy; enterprise-grade AI models by FluxForce reduce false positives by 90% using adaptive learning. |

|

False Positive Rate |

Frequently exceeds 70% in AML and transaction monitoring alerts, requiring extensive manual review. |

Typically under 30%, with dynamic models filtering irrelevant transactions automatically. |

|

Alert Volume |

Generates large volumes of alerts, often overwhelming analysts during peak transaction periods. |

Optimized alert volume based on risk scoring, reducing analyst workload by 50% or more. |

|

Operational Efficiency |

Low efficiency; analysts spend thousands of hours reviewing non-risk alerts annually. |

High efficiency; automated monitoring reduces manual review and accelerates case resolution. |

|

Adaptability |

Rigid and dependent on manual updates, unable to adjust to new fraud patterns rapidly. |

Continuously adapts using real-time data and historical patterns, detecting emerging threats. |

|

Scalability |

Limited scalability; adding new rules increases complexity and maintenance overhead. |

Highly scalable; AI models handle growing transaction volumes without proportional resource increases. |

Key False Positive Reduction Strategies in Banking Environments

Reducing false positives in banking requires combining technology, process optimization, and data-driven insights. Below are proven strategies to implement for ensuring banking security.

1. Implement Adaptive AI Models

Machine learning models continuously analyse historical transactions and evolving patterns, enabling banks to identify genuine risks more accurately. These models reduce irrelevant alerts and enhance detection precision beyond static rule-based systems.

2. Risk-Based Prioritization of Alerts

By assigning dynamic risk scores to each transaction based on behaviour, context, and historical patterns, institutions can prioritize high-probability alerts, optimizing analyst focus and significantly reducing the manual review workload.

3. Human-Driven Verification for Edge Cases

Complex high-risk cases flagged by AI often require expert review. Combining machine accuracy with human judgment ensures false positives are minimized while capturing subtle fraud that automated systems might miss.

4. Continuous Feedback Loops

Integrating analyst outcomes into AI models allows systems to learn iteratively. Over time, this feedback enhances predictive accuracy, reduces irrelevant alerts, and ensures detection adapts to emerging fraud patterns.

5. Regular Rule Optimization and Data Quality Management

Updating rule-based AI models and maintaining clean, consistent data feeds prevents outdated thresholds from generating unnecessary alerts. Effective data governance minimizes errors and supports accurate, efficient compliance monitoring.

6. Transaction Context Enrichment

Incorporating customer behavior, location, and historical trends into transaction analysis allows context-aware decisions. This reduces irrelevant alerts while preserving regulatory compliance and improving detection effectiveness.

Onboard Customers in Seconds

Conclusion

A single false positive may appear minor, but in high-volume banking, it makes a significant impact on operational costs, analyst workload, and customer experience.

Rule-based systems are rigid, generating excessive irrelevant alerts, whereas AI-driven solutions leverage adaptive learning, risk scoring, and context-aware analysis to reduce false positives while maintaining compliance integrity.

Combining rule-based AI with human expertise allows unmatched accuracy in flagging transactions, checking against compliance, and maintaining AML workflows. With strategic planning and implementation, financial institutions can improve detection efficiency, lower operational burdens, and strengthen their overall fraud and compliance frameworks.

Share this article