Listen To Our Podcast 🎧

Introduction

With the pressure to optimize insurance processes for customers, insurers are increasingly seeking ways to prevent losses before they occur. Every incorrect or fraudulent application can cost companies millions, affecting both revenue and reputation.

Under this pressure, Agentic AI offers an effective solution. Its autonomous capabilities enable real-time verification and anomaly detection, flagging potentially fraudulent applications as they arise.

Common Challenges with Traditional Fraud Underwriting

Insurance companies unknowingly carry significant risks with outdated underwriting processes. Traditional AI or rule-based systems often miss evolving fraudulent claims and inconsistencies, ultimately leading to greater financial losses.

Here are some key challenges that insurers continue to face in 2026.

1. Ineffective Fraud Underwriting- Manual verification and rule-based systems slow down processes and increase errors. With stricter compliance expectations and rising customer demands for instant policy decisions, traditional models cannot maintain both speed and accuracy.

2. Lack of Hidden Data Analysis- Legacy systems depend highly on declared customer data, ignoring external data sources like credit reports, social activity, or telematics. This limited view prevents accurate risk assessment and enables fraudsters to take advantage of gaps.

3. Inability to Detect Modern Fraud- Fraudsters now use synthetic identities, deepfakes, and AI-generated documents to manipulate applications. Traditional systems cannot adapt to these dynamic threats in real time

4. High Chances of Loss- Ineffective underwriting causes insurance institutions severe financial losses. The impact of limited fraud detection is evident across key insurance lines:- Commercial Auto: Recorded underwriting losses of approximately $4.9 billion.

- Medicare Advantage: Reported losses exceeding $5.7 billion.

- Homeowners/Farmowners: Suffered losses of about $2.1 billion.

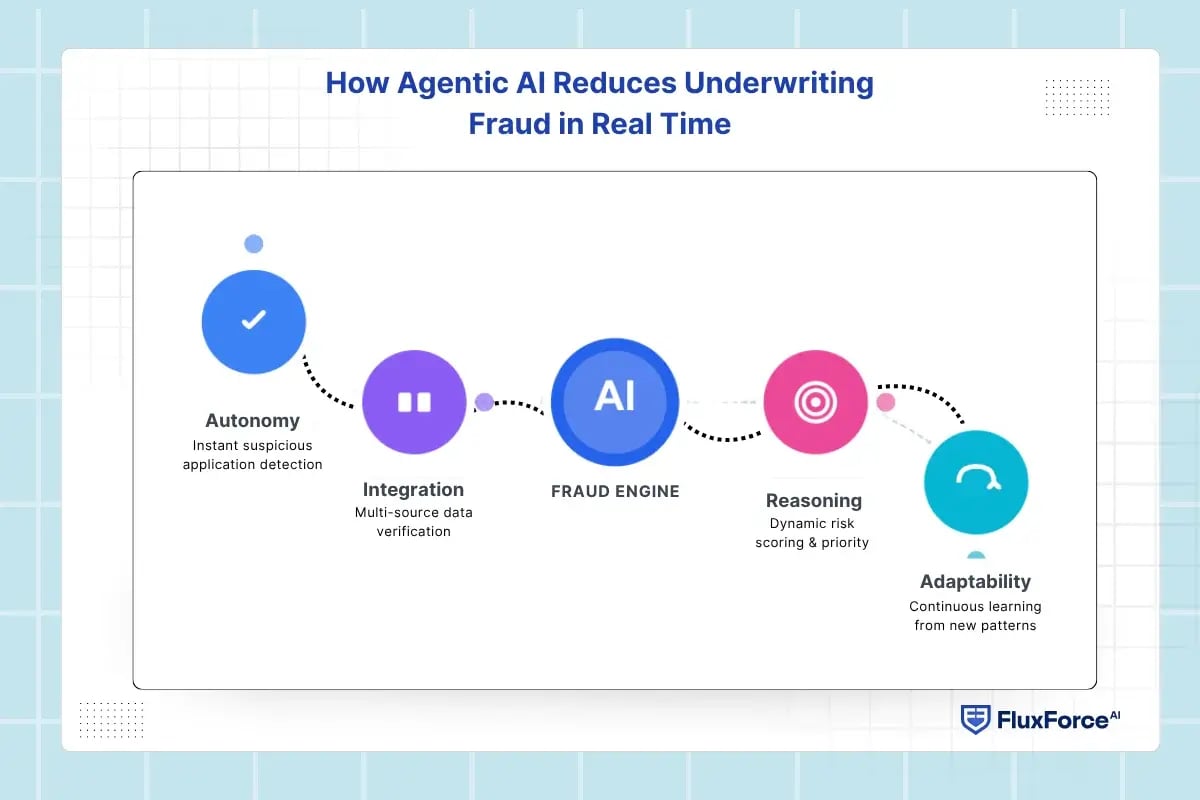

How Agentic AI Reduces Underwriting Fraud in Real Time

Agentic AI in insurance serves a more active purpose compared to traditional AI models. Rather than simply analysing data, it gathers, verifies, monitors, and decides autonomously, allowing insurers to act against fraud in real time.

Here’s how an Agentic AI model’s core capabilities help reduce underwriting fraud:

Autonomy: Detecting Suspicious Applications Quickly

Agentic AI evaluates each application independently with speed and accuracy that manual or rule-based methods cannot match. It analyses structured data (financials, policy fields) and unstructured data (documents, emails) using machine learning and anomaly detection algorithms. The AI identifies inconsistencies such as repeated addresses, falsified income, or unusual policy requests instantly.

Tool and Data Integration: Verifies Data Across Multiple Sources

Agentic AI integrates seamlessly with internal systems and broader external databases, such as credit bureaus, public registries, and historical claim records. It runs real-time cross-validation and pattern correlation, detecting mismatched or suspicious information within seconds.

Reasoning and Planning: Assigning Dynamic Risk Scores

The AI evaluates high to low-risk customers instantly based on comprehensive data. Using reasoning algorithms, it prioritizes cases, identifies high-risk claims, and plans escalation workflows automatically. This allows underwriters to focus only on cases that require human judgment.

Adaptability: Learns from New Fraud Patterns

Agentic AI continuously retrains on new fraud cases and evolving tactics. Its adaptive machine learning models update detection logic automatically, helping insurers anticipate emerging fraud strategies instead of reacting after losses occur. Over time, the system improves predictive accuracy and reduces repeat fraud.

Goal-Oriented: Supports Human Decision-Making

Agentic AI performs every action with insurers’ objectives: whether it’s reducing fraud, improving accuracy, or protecting revenue. The system generates explainable alerts with evidence, audit trails, and regulatory-ready reports, enabling underwriters and compliance teams to make informed decisions quickly.

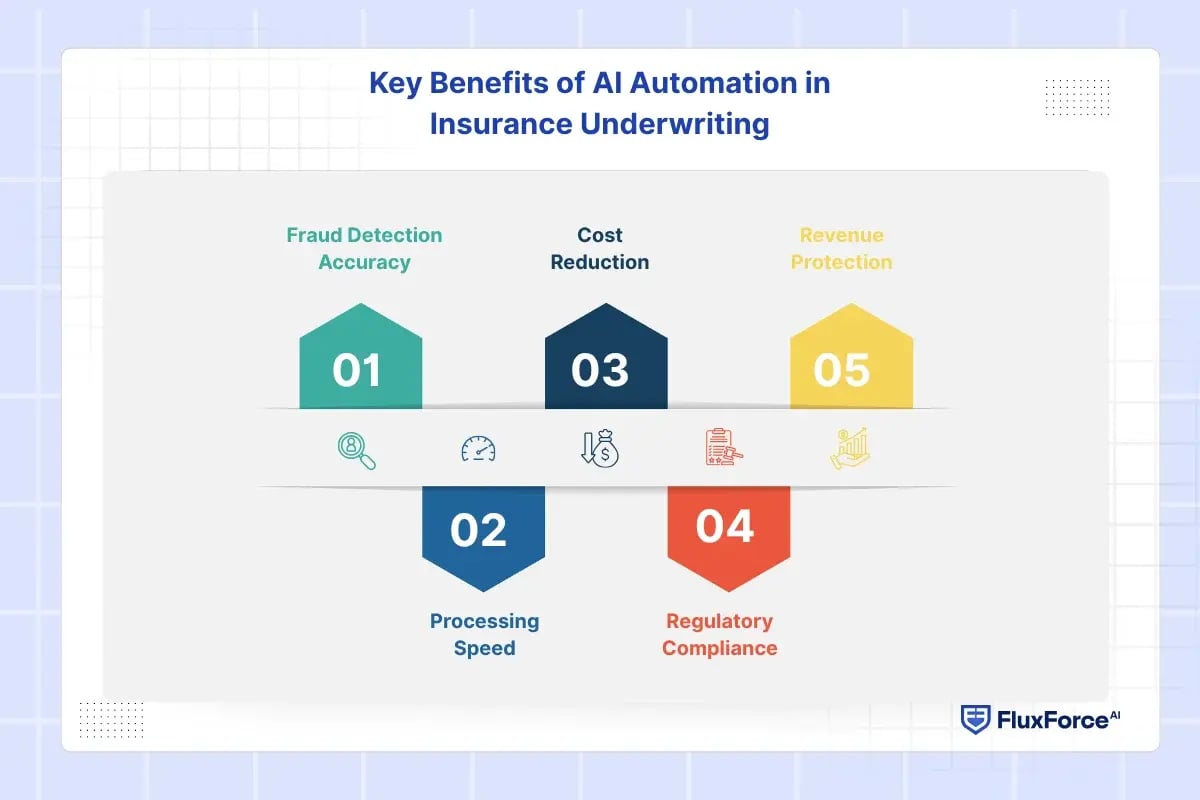

Key Benefits of AI Automation in Insurance Underwriting

Beyond fraud detection, Agentic AI transforms underwriting operations into competitive advantages. These include:

- Fraud Detection Accuracy: Agentic AI systems show 85–92% accuracy in spotting fraudulent applications. Traditional rule-based systems, in contrast, detect only 30% of fraud cases.

- Processing Speed: Application processing times drop significantly. Standard cases move from an average of 4.5 days to under 2 hours, while fully automated approvals for low-risk applications can be completed in just minutes.

- Cost Reduction: Operational costs decrease by 35–45% as automated systems manage routine verification tasks. Human underwriters can then focus on complex cases that require their expertise and judgment.

- Regulatory Compliance: Automated documentation and audit trails cut compliance preparation time by 60%. Real-time monitoring also ensures continuous adherence to frameworks such as DORA’s ICT risk management requirements.

- Revenue Protection: By catching fraud before policies are issued, insurers avoid losses estimated at $12–18 per policy. Across a large portfolio, this translates into millions in protected revenue.

Shaping the Future of AI in Finance

Fluxforce research uncovers how banks and enterprises are adapting to fraud, compliance, and data challenges in 2025.

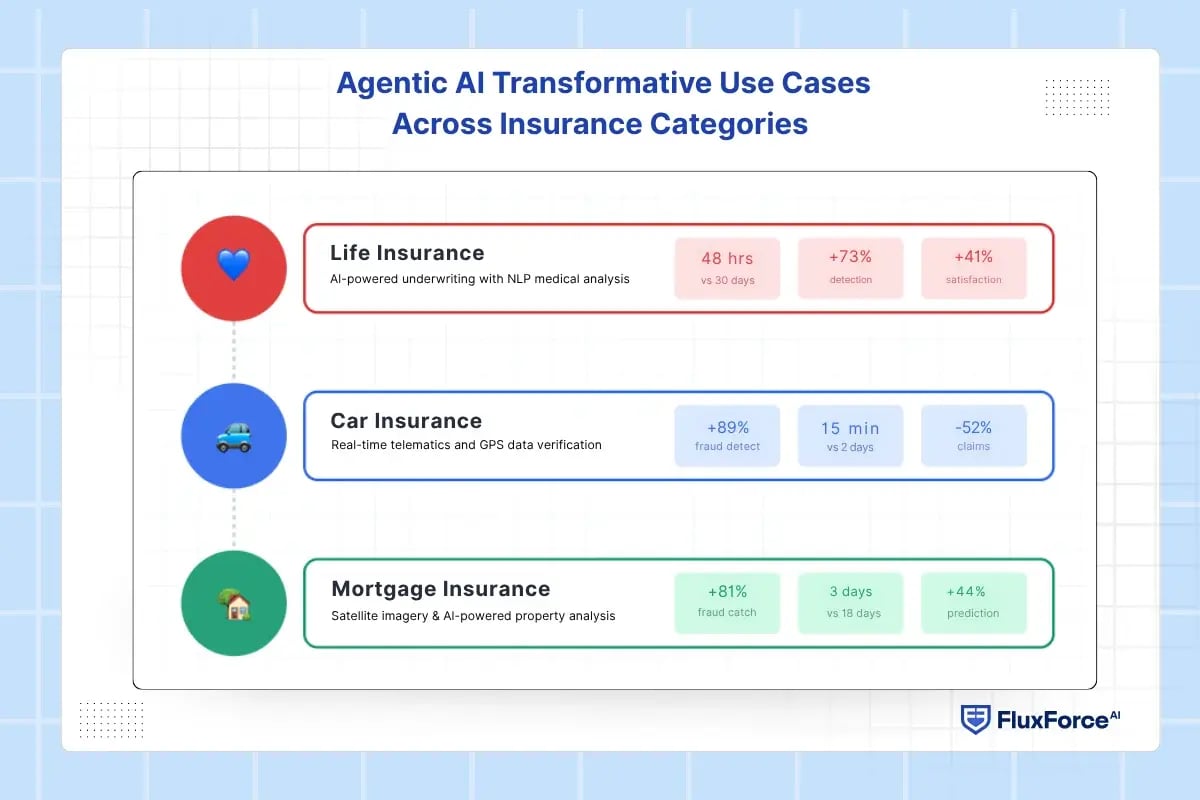

Agentic AI Transformative Use Cases Across Insurance Categories

The impact of Agentic AI varies across insurance categories, with each domain presenting unique fraud patterns and operational requirements.

Life Insurance

Old Method: Manual review of medical histories and prescriptions took weeks. Underwriters often missed undisclosed conditions, resulting in inaccurate policies and delayed decisions.

Agentic AI Approach: AI scans medical records, prescription databases, and documents using Natural Language Processing (NLP) and predictive models. It flags inconsistencies and evaluates risk instantly, speeding up accurate underwriting.

Results

- Underwriting time: 30 days → 48 hours

- Detection of undisclosed conditions: +73%

- Premium accuracy: +28%

- Customer satisfaction: +41%

Car Insurance

Old Method: Traditional checks of driving history and vehicle condition took days. Fraudsters understated accidents or mileage, leaving insurers exposed to inaccurate pricing and higher risk.

Agentic AI Approach: With Agentic AI, insurers use telematics, GPS data, and vehicle images to verify driving behaviour and vehicle condition in real time. This ensures accurate risk scoring and prevents costly mistakes before policy issuance.

Results

- Mileage fraud detection: +89%

- Premium accuracy: +34%

- High-risk claims frequency: -52%

- Quote-to-policy time: 2 days → 15 minutes

Mortgage Insurance

Old Method: With traditional methods, property appraisals, income checks, and historical loan reviews were slow and sometimes inaccurate. Fraudsters could inflate values or hide defects, leaving insurers exposed to risk.

Agentic AI Approach: Agentic AI aggregates property listings, public records, satellite imagery, and financial data to verify values, detect anomalies, and predict default risk accurately. Decisions happen in real time, with fewer errors and faster approvals.

Results

- Appraisal fraud detection: +81%

- Property valuation accuracy: +29%

- Default prediction accuracy: +44%

- Underwriting cycle: 18 days → 3 days

Turn Your Data into Real-Time Decisions

Transform your third-party risk management with Agentic AI Agents.

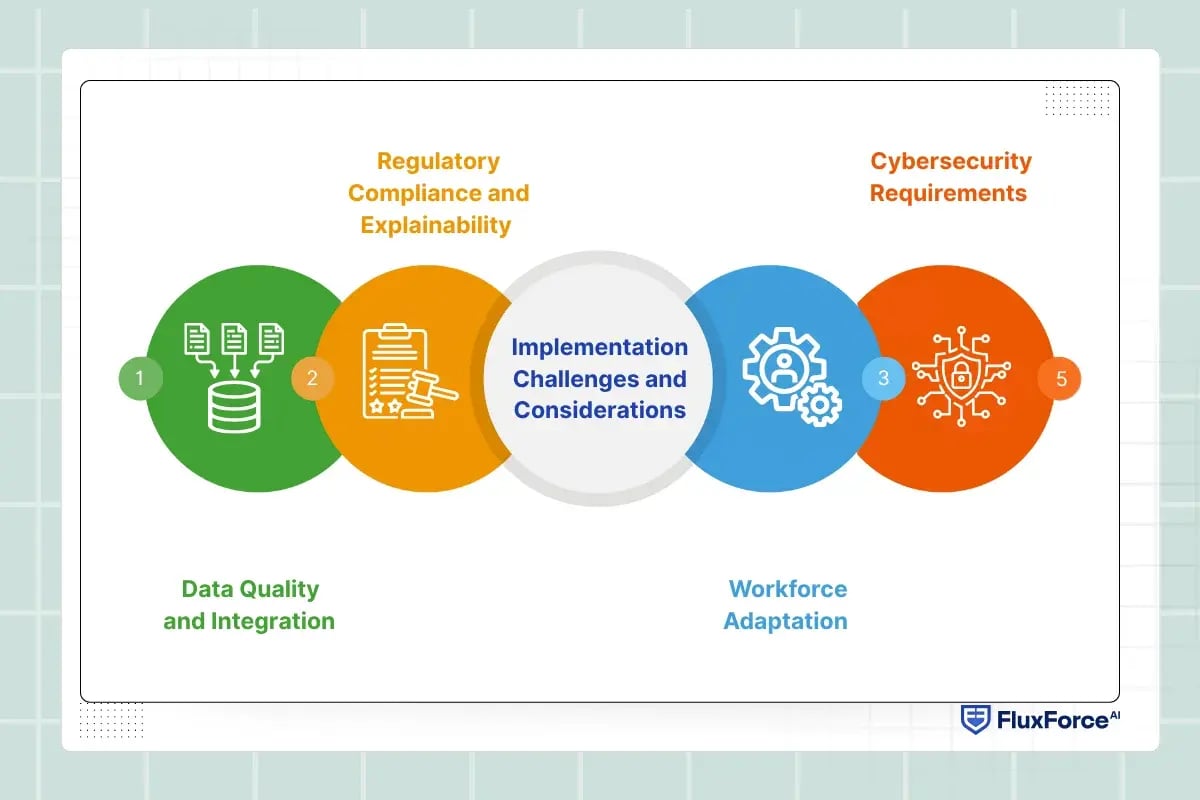

Implementation Challenges and Considerations

Implementing Agentic AI is a strategic investment. However, insurers must address several operational and technical challenges that determine the model’s success or failure.

Data Quality and Integration

Agentic AI needs comprehensive, accurate data from diverse sources. Successful implementation requires data infrastructure investment—data lakes, API integrations, and governance frameworks. Plan 6-12 months just for data preparation.

Regulatory Compliance and Explainability

Regulations require insurers to explain automated decisions that affect customers. Insurers must implement explainable AI frameworks that document how models reach conclusions.

Workforce Adaptation

Agentic AI changes underwriter roles from primary decision-makers to monitoring specialists. This creates anxiety and potential resistance. Successful implementation requires retraining programs, clear communication about role evolution, and incentive structures that reward collaboration with AI systems.

Cybersecurity Requirements

Agentic AI systems that integrate multiple data sources create expanded attack surfaces for cyber threats. Insurers must implement robust security—encryption, multi-factor authentication, and regular testing to mitigate AI system compromises.

Conclusion: The Future of Agentic AI in Insurance Underwriting

The next wave of insurance underwriting will transform significantly with intelligent, autonomous systems that can anticipate and respond to evolving fraud threats. Agentic AI moves insurers from reactive processes to real-time decision-making, continuously learning from emerging patterns and integrating diverse data sources.

As technologies like blockchain, federated learning, and advanced analytics mature, AI will provide even stronger protection, transparency, and operational efficiency.

Share this article