Listen To Our Podcast 🎧

Introduction

Community banks face the same security and compliance needs as large banks, but they operate with smaller teams and limited budgets. Competing with large banks is no longer only about offering better rates. Customers today want fast, safe, and seamless banking experiences.

Meeting these expectations requires tools that support real-time operations, smart decision-making, and strong security. Many community banks assume such solutions are only for large institutions. Smart agentic solutions, however, provide the capabilities to modernize operations, delivering enterprise-grade protection without megabank-level budgets.

The Security and Operational Challenges of Community Banks

With smaller teams and limited budgets, community banks face several challenges in maintaining robust security and operational efficiency. Here are some

1.Growing Cybersecurity Risks: Most community banks operate with weak infrastructure and slower response to fraud. Threat actors, using advanced phishing and deepfakes, trick systems and staff to bypass traditional verification and fraud detection controls.

2. Evolving Regulatory Standards: Regulators now demand enterprise-grade protection from all financial institutions. Meeting Federal Financial Institutions Examination Council (FFIEC) and Anti-Money Laundering (AML) guidelines requires continuous data checks and audit reporting, which smaller teams often find difficult to maintain.

3. Limited Security Resources: Security operations in community banks often rely on small IT teams juggling multiple responsibilities. Most lack dedicated Security Operations Centers (SOCs), 24/7 monitoring, or automated alert systems. As a result, incident detection tends to be reactive rather than proactive.

4. Digital Banking Shift: The move to mobile and online banking demands consistent uptime, instant transactions, and seamless customer experiences. With weak infrastructure and a lack of AI tools, maintaining speed and accuracy becomes hard for banks.

5. Staying in Competition: Large banks invest heavily in AI-driven automation to improve efficiency and security. For community banks, the challenge lies in keeping pace with limited budgets, finding smarter tools that deliver the same level of security and efficiency at lower costs.

How Smart AI Agents Address Core Banking Challenges

Traditional banking AI solutions offer reactive fraud detection or process automation support. Smart AI agents, in contrast, go beyond to provide integrated, real-time decision-making across security, compliance, and operational workflows. Under community banks, AI agents:

- Enable Banking Cybersecurity Modernization: Automated threat detection and adaptive response frameworks allow smaller banks to modernize security without expanding IT teams.

- Regulatory Compliance Automation: AI-driven systems manage KYC, AML, and reporting workflows automatically, ensuring audit readiness and consistent compliance.

- Operational Workflow Optimization: Routine manual tasks, such as transaction monitoring or approvals, are automated, freeing staff for higher-value strategic work.

- Cost-Efficient Enterprise-Grade Security: Smart AI agents deliver the same level of protection as larger banks but within the tighter budgets of community institutions.

- Scalable and Adaptive AI Systems: AI agents grow with the institution, adjusting to increasing digital channels, transaction volumes, and regulatory demands without major infrastructure changes.

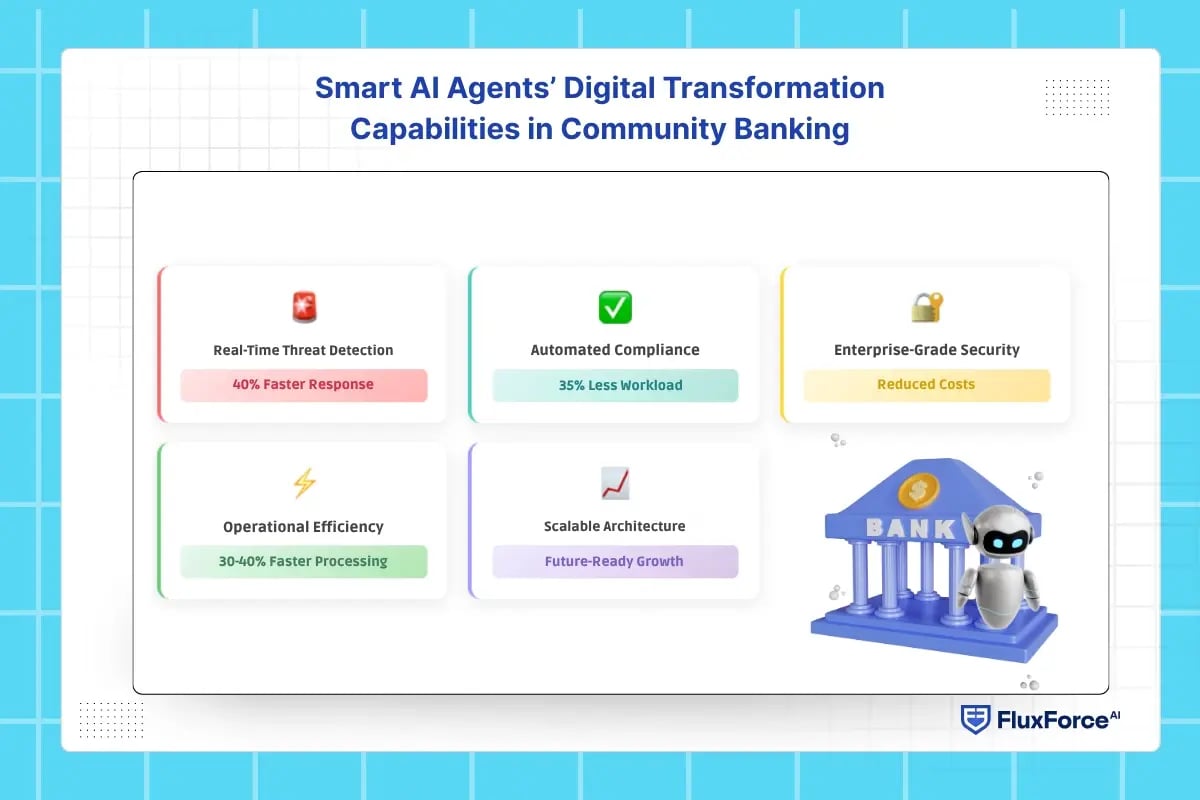

Smart AI Agents’ Digital Transformation Capabilities in Community Banking

With smart agents, the role of AI in community banking doesn’t just limit to simple automation. These agents enable digital transformation in banking environments without requiring megabank budgets.

1. Real-Time Threat Detection and Anomaly Monitoring

Smart AI agents continuously monitor transactions, account activity, and network behaviour to detect unusual patterns as they occur. Community banks often face slower detection due to limited staffing, but AI-driven monitoring reduces response time dramatically.

According to industry data, AI-powered anomaly detection can reduce fraud response times by up to 40%, allowing banks to act before losses escalate. With integrated machine learning models that learn normal behaviour and flag deviations automatically, it supports proactive decision-making in region-specific banks.

2. Automated Compliance and Regulatory Intelligence

Maintaining compliance with FFIEC, AML, and SOC requirements can be resource intensive. Smart AI agents automate routine compliance tasks, including transaction screening, KYC verification, and reporting workflows, ensuring audit readiness.

Automated systems reduce human error and save significant staff hours; some reports suggest up to a 35% reduction in compliance-related operational workload. AI agents also adapt to evolving regulatory updates, allowing community banks to maintain enterprise-level compliance without continuously expanding their teams.

3. Enterprise-Grade Security Without Megabank Costs

Large banks invest millions in security infrastructure, but community banks cannot match those budgets. Smart AI agents deliver enterprise-grade threat protection and access control using cloud-native or hybrid deployment models.

Encryption, continuous monitoring, and automated alerting provide a level of protection typically reserved for larger institutions. By deploying AI in a targeted, modular way, community banks can achieve robust security while maintaining operational cost-efficiency.

4. AI-Driven Operational Efficiency and Decision Support

AI agents automate repetitive processes like transaction review, loan approval checks, and exception handling. This not only reduces human error but also accelerates decision-making.

For example, banks implementing AI-assisted loan workflows report 30–40% faster processing times. Beyond automation, AI agents provide actionable insights through predictive analytics, enabling management to prioritize risk mitigation and optimize resource allocation without expanding staff.

5. Scalable, Future-Ready AI Architecture

Smart AI agents are designed to grow with the institution. As transaction volumes, digital channels, or regulatory requirements increase, AI adapts without requiring major infrastructure changes.

Continuous learning models allow the system to evolve, improving fraud detection, operational efficiency, and compliance over time. This scalability ensures that community banks can maintain competitive performance and operational resilience while controlling costs.

Shaping the Future of AI in Finance

Fluxforce research uncovers how banks and enterprises are adapting to fraud, compliance, and data challenges in 2025.

Effective Strategies for Implementing Smart AI Agents

The adoption of AI pilots in financial markets is expected to grow at a CAGR of 45.8%. For community banks, this growth highlights the strategic opportunity to compete with large, established banks. Below are some effective implementation strategies to get maximum results from these models.

Prioritize High-Impact Use Cases

Identify areas where AI delivers maximum value, such as fraud monitoring, regulatory reporting, or workflow automation. Prioritization ensures measurable ROI without overextending limited budgets.

Leverage Cloud-Native and Modular Solutions

Adopting cloud-based, modular AI platforms allows community banks to scale capabilities gradually, maintain flexibility, and reduce upfront costs while achieving enterprise-grade performance.

Align AI with Regulatory Requirements

Strategically integrating AI with compliance frameworks ensures continuous adherence to FFIEC, AML, and other standards, minimizing risk while supporting operational efficiency.

Focus on Data Quality and Governance

Reliable AI insights depend on high-quality, well-governed data. Establishing robust data practices enhances model accuracy, risk detection, and overall decision-making.

Measure Performance and Adapt Strategy

Continuous monitoring of AI impact, including efficiency gains and cost reduction, enables institutions to refine deployment strategies, maximize value, and maintain competitive parity with larger banks.

Turn Your Data into Real-Time Decisions

Transform your third-party risk management with Agentic AI Agents.

Conclusion

Community banks no longer have to compromise on security, efficiency, or customer experience. Smart AI agents provide enterprise-grade security, automated compliance, and real-time operational support without the high costs typically associated with large banks. These solutions enable smaller institutions to detect threats instantly, maintain regulatory compliance, and streamline operations with minimal staff.

By leveraging scalable, cloud-based AI systems, community banks can compete effectively with larger institutions while offering fast, reliable, and secure services.

.webp)

Share this article