Listen To Our Podcast 🎧

.png)

Introduction

Fraud mitigation is placed as a primary concern for banks and online financial service providers. With rapid digital banking transformation, fraud attempts increased significantly in both frequency and complexity.

To address the challenge of detecting and responding to fraud in real time amid growing volumes, many organizations shifted from on-site administrative checks to autonomous Artificial Intelligence (AI) systems.

However, even with modern AI deployment, complex fraud patterns often remain undetected, costing banks an average of $4.88 million per data breach in 2024.

Under this transition phase, a critical question arises: which detects fraud faster and more accurately; human analysts relying on experience and judgment, or AI modules processing large volumes of data in real time?

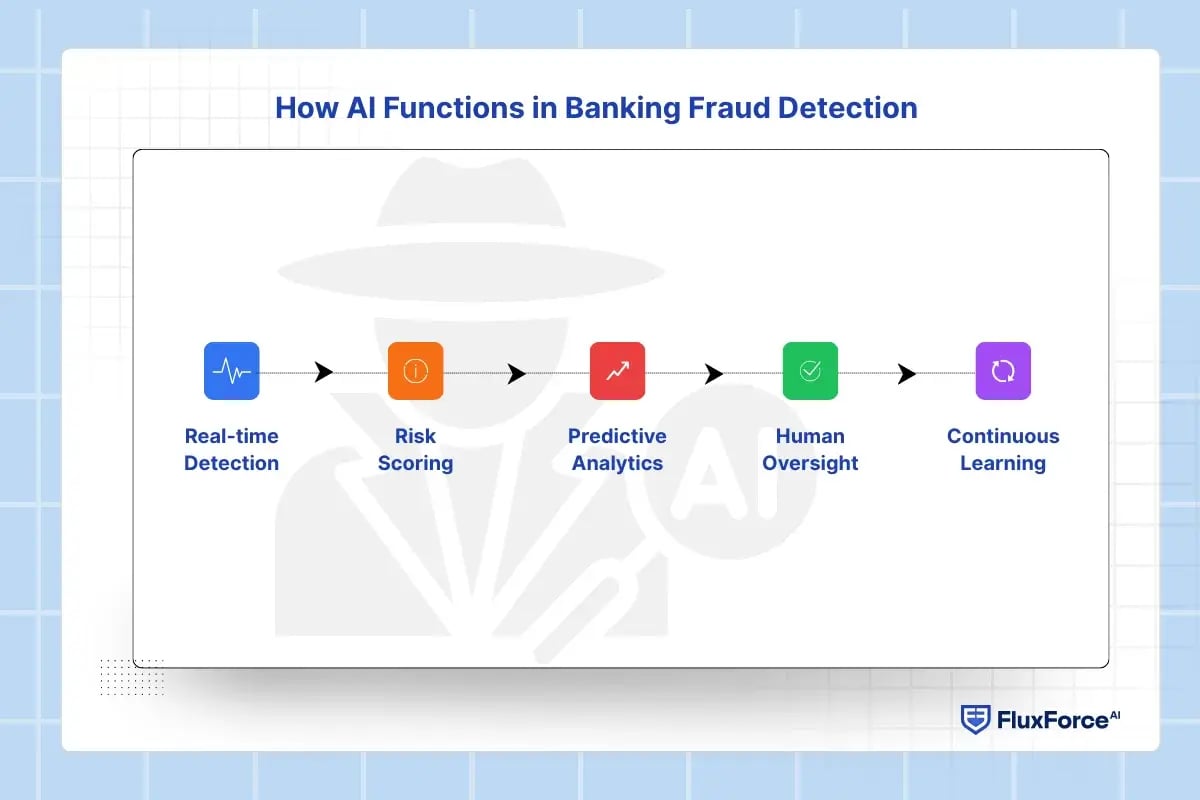

How AI Functions in Banking Fraud Detection

Artificial Intelligence in banking enables advanced analysis of large datasets, recognizing irregular patterns much faster than humans. With evolving fraud patterns making detection complex, AI strengthens fraud prevention through its key functions:

- Real-time Fraud Detection: Automated monitoring systems scan millions of transaction data as it occurs, enabling identification of unusual activities.

- Automated Decision-Making and Alert Prioritization: AI models assign a risk score to each transaction, helping employees focus on high-risk alerts first.

- Predictive analytics for fraud detection: Through historical fraud data analysis, AI systems provide early warning signs of suspicious behaviour, delivering proactive detection to emerging fraud methods.

- Continuous Learning: Each new dataset helps AI models update their understanding of transaction behaviour, improving their ability to detect evolving fraud schemes.

Although AI modules are highly effective at handling large-scale data and rapid analysis, they are not flawless. Leveraging human oversight in AI-driven fraud detection remains essential to ensure accurate judgment in complex cases.

The Role of Human Analysts in Complex Fraud Prevention

The changes brought by AI adoption do not reduce the importance of human analysts. While AI handles up to 90% of routine fraud-related tasks across institutions, complex cases still require contextual judgment and experience. Here’s an overview of how the roles of human analysts have shifted with AI integration:

Fraud Analyst Roles & Responsibilities Before AI

- Manually reviewing transactions for suspicious activity.

- Investigating customer disputes, chargebacks, and identified unusual behaviour.

- Detecting anomalies using experience, intuition, and historical knowledge.

- Preparing reports for compliance and regulatory audits.

- Coordinating with internal teams to resolve confirmed fraud cases.

Fraud Analyst Roles & Responsibilities After AI

- Verifying alerts and cases flagged by AI systems.

- Focusing only on complex or high-risk transactions that require human judgment.

- Providing context-specific insights that AI cannot fully assess.

- Collaborating with AI to improve model accuracy and reduce false positives.

- Ensuring compliance and documenting decision reports for regulatory purposes.

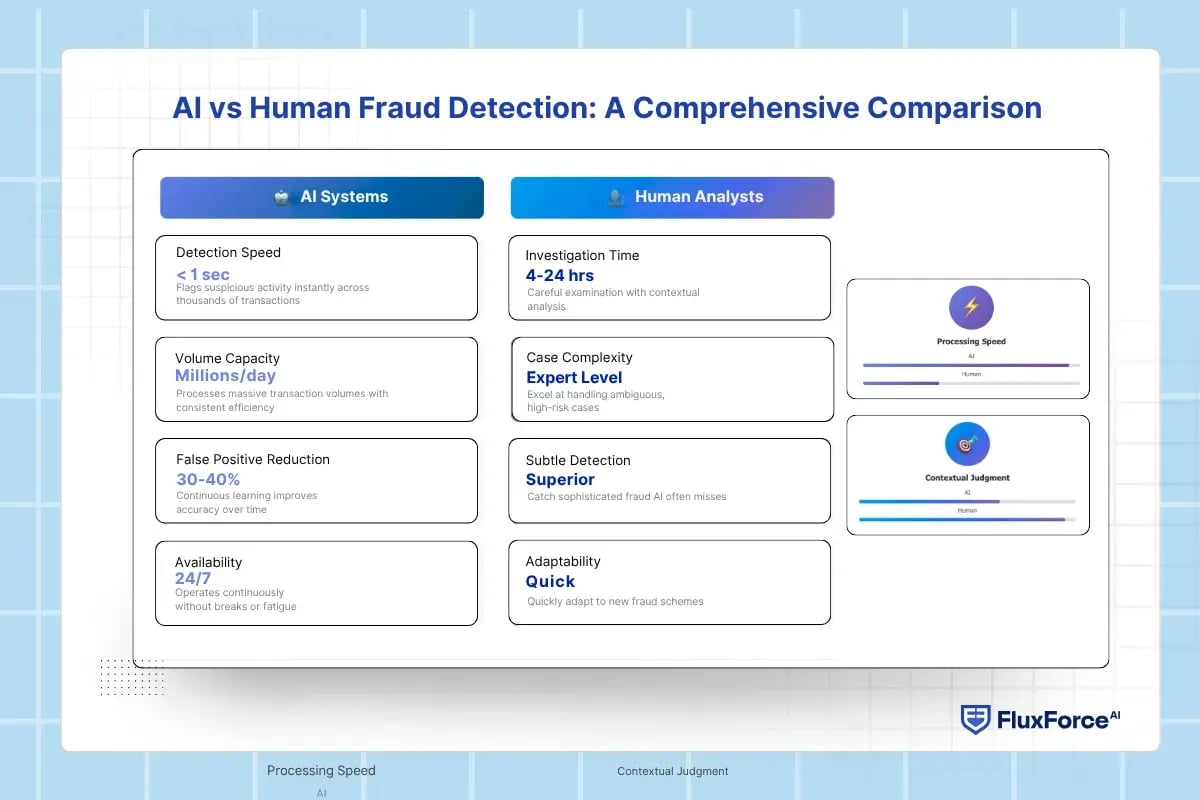

AI vs Human Fraud Detection: A Comprehensive Comparison

AI detects fraud by analysing massive datasets rapidly, spotting irregular patterns instantly. Human analysts investigate complex or ambiguous cases, applying experience and judgment to ensure high accuracy and operational reliability.

1. Detection Speed and Response Time

AI Approach: AI systems monitor thousands of transactions per second. When suspicious activity appears, the system flags it within seconds, enabling immediate alerts for high-risk cases across the banking network.

Human Analyst Approach: Manual investigation consumes time. Cases move through careful examination of transaction histories, account behaviour, and contextual details. Average resolution typically ranges from 4 to 24 hours, depending on the complexity involved.

2. Handling Volume and Complexity

AI Approach: Millions of transactions flow through these systems daily. Abnormal patterns get detected across countless accounts with consistent efficiency. Performance remains stable regardless of volume or the number of simultaneous fraud attempts.

Human Analyst Approach: Analysts excel at handling complex, high-risk cases that demand careful investigation. However, their capacity naturally limits them to smaller transaction sets. Even with experienced teams, it becomes difficult to scale human analysis across millions of daily transactions.

3. Detection Accuracy and Reliability

AI Approach: Continuous learning drives improvement over time. Modern systems have shown a 30–40% reduction in false positives compared to earlier models.

Human Analyst Approach: Manual review brings an irreplaceable advantage. They detect subtle fraud that AI often misses. Their contextual judgment proves essential in ambiguous, high-risk cases where the data alone isn’t enough.

4. Operational Effectiveness

AI Approach: AI systems operate continuously without breaks, maintaining consistent performance across 24/7 monitoring cycles. Processing costs decrease as transaction volumes increase, making large-scale fraud detection more economically viable.

Human Analyst Approach: Human teams require shift rotations, training investments, and scaling challenges as workloads grow. While this increases operational costs, analysts adapt quickly to new fraud schemes without system reconfiguration.

Shaping the Future of AI in Finance

Fluxforce research uncovers how banks and enterprises are adapting to fraud, compliance, and data challenges in 2025.

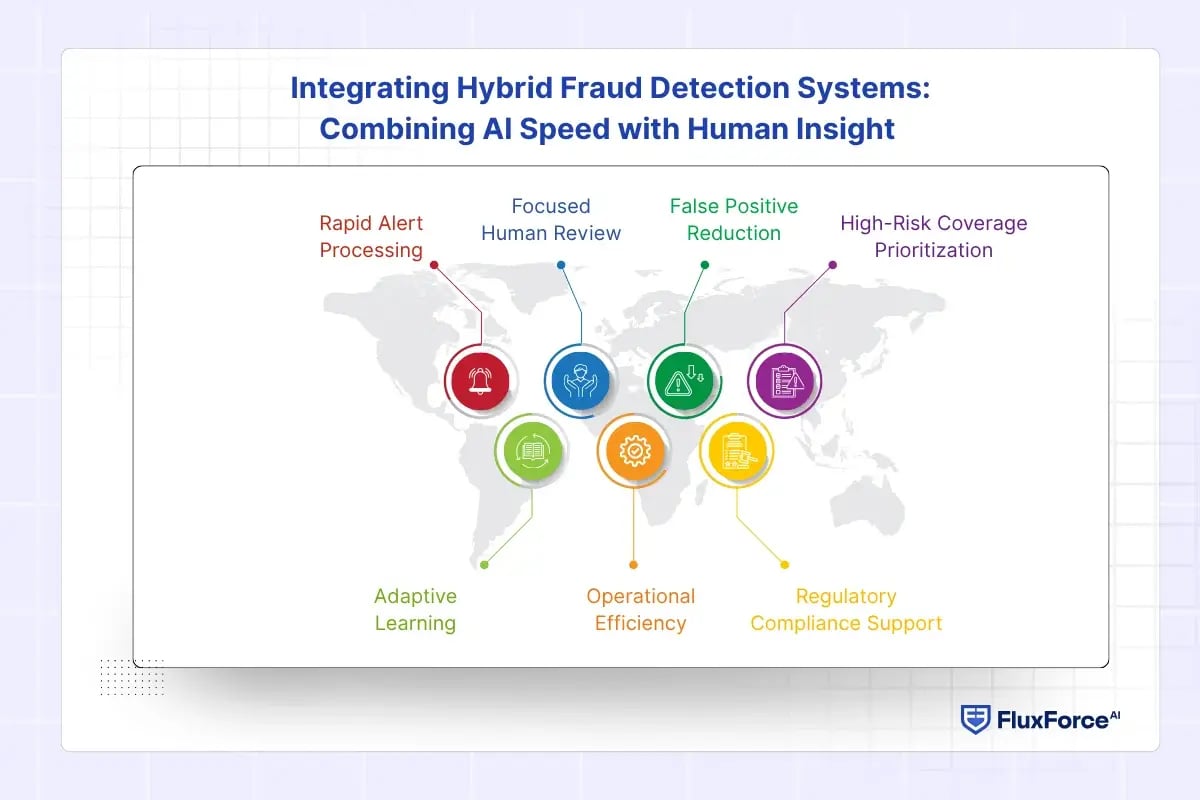

Integrating Hybrid Fraud Detection Systems: Combining AI Speed with Human Insight

Hybrid fraud detection leverages AI speed and human expertise to handle large-scale transactions efficiently while maintaining high accuracy. Key capabilities include:

- Rapid Alert Processing: AI scans millions of transactions daily, flagging suspicious activity within seconds, enabling analysts to focus immediately on the highest-risk alerts.

- Focused Human Review: Analysts handle ambiguous or complex cases, applying contextual judgment to confirm or reject alerts that AI cannot fully resolve.

- False Positive Reduction: Continuous human feedback retrains AI models, cutting false positives by 25–35%, improving the overall efficiency of monitoring systems.

- High-Risk Coverage Prioritization: Analysts concentrate on the top 5–10% of high-risk alerts, while AI handles routine patterns, ensuring no critical case is overlooked.

- Adaptive Learning: Each analyst-reviewed alert updates AI models, enabling the system to detect emerging fraud tactics and evolving transaction behaviours.

- Operational Efficiency: Institutions using hybrid systems report 20–40% improvement in fraud detection rates and faster case resolution, reducing financial exposure.

- Regulatory Compliance Support: Hybrid models generate structured reports for auditors while maintaining accuracy, streamlining regulatory oversight in real-time monitoring environments.

Turn Your Data into Real-Time Decisions

Transform your third-party risk management with Agentic AI Agents.

Conclusion

Neither AI nor human analysts alone provide complete fraud detection. AI excels at speed and volume, processing millions of transactions with consistent accuracy and reducing false positives significantly. However, human judgment remains irreplaceable for complex cases requiring contextual understanding and regulatory compliance.

The evidence suggests that optimal fraud detection relies on integration of hybrid approaches—AI handles large-scale monitoring and flags suspicious activity, while analysts investigate nuanced cases and validate critical alerts.

Banks achieving the strongest fraud prevention combine both methods, leveraging AI's computational power alongside human expertise. As fraud tactics continue evolving, this hybrid model offers the most effective defence, balancing operational efficiency with the adaptability and accountability that only human oversight provides.

.webp)

Share this article